Gold ETF Flows May 2023

Gold ETF Flows May 2023

Gold ETF Flows: May 2023

Gold ETF commentary: May inflows turn y-t-d gold ETF demand positive

Published: 7 June, 2023

Highlights

Another month of inflows (+US$1.7bn, +19t) in May flipped global gold ETF y-t-d demand positive (+US$1bn, +6t)

North American funds continued to dominate global inflows by attracting US$1.4bn

SPDR® Gold Shares from the US and Invesco Physical Gold ETC from the UK led global inflows.

Gold ETFs continued to see positive in May

May gold ETF demand positive!

Recently, the World Gold Council published their Gold ETF commentary and said, May inflows turn y-t-d gold ETF demand positive! Strong price momentum earlier in the month incited investors’ interests in gold ETFs before giving some back towards the end of May as the gold price pulled back. In addition, we believe that US debt ceiling negotiations and looming banking industry concerns also led investors to seek safe-haven assets, contributing to the positive trend in May.

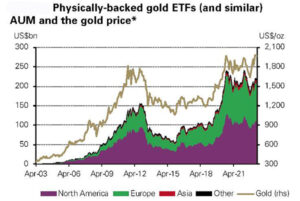

Collective holdings of global gold ETFs reached 3,478t by the end of May, 19t higher m/m. However, total assets under management (AUM) fell slightly by 0.4% to US$220bn due to a lower gold price in the month compared to April. Nonetheless, May took y-t-d global gold ETF flows to positive territory at US$1bn, equivalent to a 6t increase in holdings.

Almost all regions saw positive tonnage demand in May except for Europe. But fund flows in Europe remained above zero due mainly to the mechanics of the region’s FX-hedge products.

North American gold ETFs have now experienced net inflows for three consecutive months, adding US$1.4bn in May. In addition to the aforementioned drivers, a notable price rebound before the expiry date of major gold ETFs’ options might have also contributed, as sizable inflows occurred that day. Between January and May funds in North America accumulated net inflows of US$3.2bn (+47t), dominating global inflows.

North American gold ETFs have now experienced net inflows for three consecutive months, adding US$1.4bn in May. In addition to the aforementioned drivers, a notable price rebound before the expiry date of major gold ETFs’ options might have also contributed, as sizable inflows occurred that day. Between January and May funds in North America accumulated net inflows of US$3.2bn (+47t), dominating global inflows.

European funds ended May with positive fund flows (+US$228mn) but a reduction in gold holdings (-2t). This difference was mostly due to the mechanics of FX-hedged products in Switzerland and Germany, especially amid currency fluctuations related to US debt ceiling uncertainty. Positive fund flows during the month were concentrated in the UK and France.

But stubbornly high inflationary pressure was a stark reminder to investors that central banks in the region are not yet done with hiking. The latter has been a vital factor supressing gold ETF demand in Europe so far in 2023. Y-t-d European funds have led global outflows, losing US$2.4bn, with UK and Germany funds suffering the most.

Asia saw mild net inflows last month (+US$9mn, +0.1t). Outflows from Chinese funds were offset by Japanese and Indian inflows. Y-t-d Asian fund flows remained slightly negative at US$27mn, chiefly due to China.

Demand for funds listed in the other region remained positive (+US25mn, +0.04t).

Turkey, Australia and South Africa all contributed to the positive flow. Y-t-d sizable inflows into Turkish funds, driven by local political and economic uncertainty, pushed the other region’s flows positive to US$197mn.

Daily trading volumes in the global gold market rose by 3% to US$175bn in May, despite a mild decline in the gold price. This was mainly driven by a 26% m/m surge in trading volumes of exchange-traded derivatives. Meanwhile, trading activities in the OTC physical gold market and in gold ETFs fell by 9% and 11%, respectively.

Comex gold futures total net longs stood at 537t at the end of May, an 18% fall on April. The weaker gold price performance has led to tactical and shorter-term investors adjusting their futures positioning, contradicting trends in the physically-backed gold ETF market which often represents investors’ strategic moves. Even so, they remain 2% above the 2022 average of 527t.