Gold loan NBFCs face stiff competition!

Gold loan NBFCs face stiff competition!

Gold prices, a key driver for gold loan NBFCs

India Ratings and Research (Ind-Ra) believes gold prices have been a key growth driver for gold loan non-bank finance companies (NBFCs) over the years. Gold loan NBFCs face stiff competition from the unorganised market of moneylenders, which remains quite prominent looking at the muted tonnage addition seen across large gold loan NBFCs.

Gold loan NBFCs are also facing heavy competition from traditional banks and large NBFCs in the high ticket segment, leading to loan growth challenges. There has also been a rise in operating cost for gold financers with rising competition and challenges in building asset under management (AUM) per branch. Small entities are still better placed than large players due to their agility to expand through new branches driving customer additions.

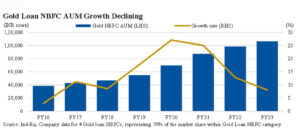

Gold loan AUM growth is a function of three factors – gold price, net customer addition and loan to value (LTV) ratio. Assuming LTV ratio remaining the same, gold prices itself have increased by 16% in the 12 months ended May 2023.

This makes it an attractive borrowing avenue for retail customers as they can borrow a higher amount against the quantity of the gold used as a pledge. Consequently, even with 8.1% yoy growth in gold loan AUM for gold loan NBFCs in FY23, the corresponding tonnage declined 1.8% during same period. Also, customer additions at large gold financers have been muted over the years, compared to small players who have benefitted with branch expansion.

Gold loans continue to be operationally heavy compared to other loan products, as it involves a small ticket size, importance of quick turnaround time, and high reliance on cash collections. Also, a gold loan branch caters to an area of 2-3km in its vicinity, which limits the scope of building AUM at branch level with rising competition, thereby pressuring profitability.

Gold loans continue to be operationally heavy compared to other loan products, as it involves a small ticket size, importance of quick turnaround time, and high reliance on cash collections. Also, a gold loan branch caters to an area of 2-3km in its vicinity, which limits the scope of building AUM at branch level with rising competition, thereby pressuring profitability.

Operating cost are also involved to ensure safety of the collateral for security systems of storage & surveillance of gold as it is prone to the risk of burglary and fraud which can lead to unwanted losses. Companies have to incur cost to adequately cover the risk of losing collateral and cash through insurance along with rising employee cost for those having higher vintage.

Rising competition from banks and fintechs implies that gold loan NBFCs have to improve the presence in the interiors and also improve the visibility of their products with aggressive marketing efforts which further adds to the operating cost.

As per Ind-Ra, large gold loan NBFCs have faced sharper pressure on yields in geographies where they are directly exposed to competition from banks and fintechs. The competitive landscape remains aggressive, especially from banks, leaving limited scope for net interest margin improvement in the near term.

On the contrary, Ind-Ra observes that NBFCs, especially the ones with a large portfolio, had adopted aggressive strategies to maintain and expand their gold loan franchise. Some of this is reflected in margin compression while offering lower yield loans, especially in large ticket size loans, incurring higher operating expenditure, and selectively providing flexible loan terms to ensure customer retention.

Hence, banks (which have low cost of fund advantage) have been the large beneficiary of the rising trend in gold prices, leading gold NBFCs to enter into co-lending arrangements with them for high-ticket gold loans to drive customer retention.