After a slump in the late 2010’s, the Indian silver futures market is once again on the rise. With the introduction of new investment products, Indian investors now have greater opportunities for silver investing beyond holding physical silver, which has traditionally been their favored way for investing in the white metal, according to a recently-published Silver Institute Market Trend Report, “Trends in Indian Investment Demand.” With the introduction of new options, including silver exchange-traded products (ETPs) and digital silver, Indian investors have opportunities to invest in liquid investments without the need to worry about storage of the physical silver.

As the world’s sixth-largest economy and foremost silver fabricator, India also plays an essential role in silver and gold investment demand, historically recognized in that market as savings and investment assets, a reflection of the low penetration of banking and other financial products. Today, with new investment products available to Indian investors, India’s role in silver investment has the potential to grow.

Since 2010, India’s physical silver investment (bars and coins) has accounted for one-third of overall Indian silver demand. During this time, Indian retail investors bought around 730 million ounces (Moz) of silver, representing 90 percent of 2022’s global silver mine production.

However, the report notes that since 2014, some notable policy and regulatory changes in India have structurally altered investment in precious metals, potentially limiting physical investment. These changes have included the government’s push to provide banking services to the entire population and the crackdown on tax evasion and cash transactions. These changes, however, have served to spur new options for investing in silver.

In India today investors can currently choose amongst seven ETPs and five silver ETP Fund-of-Funds (FoFs invest in ETPs). “As of end 2022, silver ETP holdings in India stood at an estimated 8 million ounces, a good start given the fact that these products were only released in late 2021,” the report noted.

Another new area of investment in India is ‘digital silver,’ which allows investors to buy silver for a low price point, depending on the platform. The silver is then stored in insured vaults by the seller on behalf of the customer, who can either sell it back on the same platform or take physical delivery in the form of coins or bullion (after paying delivery and minting charges). Digital silver represents another new chapter of silver investment in India, and already nine companies offer these products.

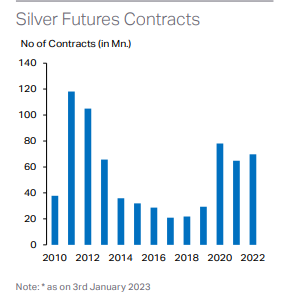

Still another new potential arena for silver investment is futures at the India International Bullion Exchange (IIBX), which launched in August 2022. The report stated: “The IIBX allows Indian jewelers and bullion dealers to import gold directly from foreign suppliers through the exchange by trading Bullion Depository Receipts (BDRs). While the exchange only permits gold imports and trading of gold through spot contracts, officials expect the importation and trading of silver to eventually be allowed.”

Although these new silver investments are expected to increase with growing awareness by investors, Indians still favor holding the physical product in the form of bars, coins and jewelry. According to Silver Institute data, since 2010, India’s physical silver investment (bars and coins) has accounted for one-third of overall Indian silver demand.

During this time, Indian retail investors bought around 730 million ounces of silver. Last year saw Indian physical investment jump to 79.4 million ounces, the highest total since 2015. This represents a record high for Indian silver imports, which surged last year to 304 million ounces, easily surpassing the 2015 record of 260 million ounces.