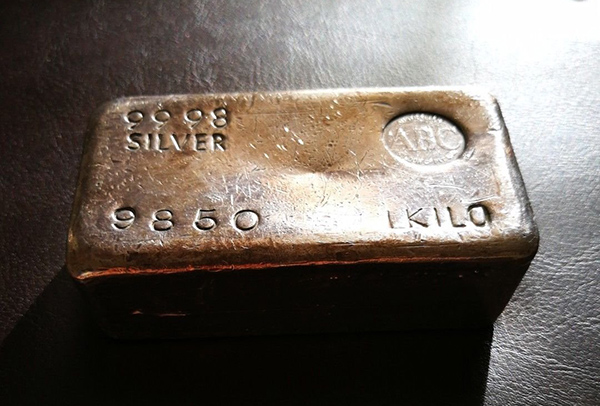

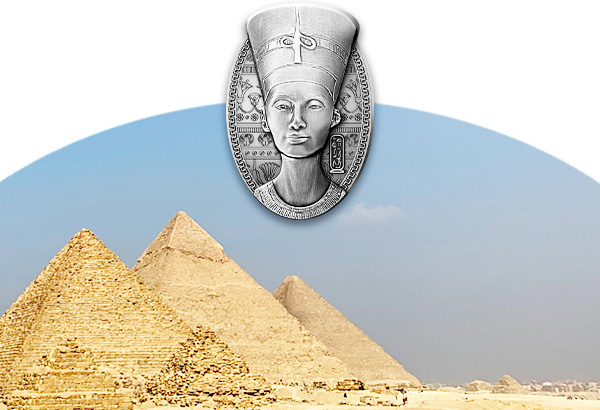

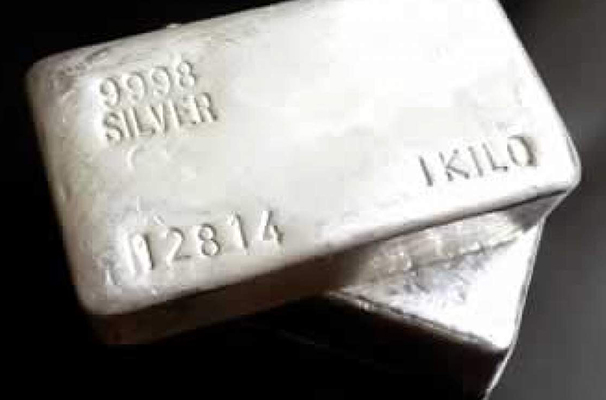

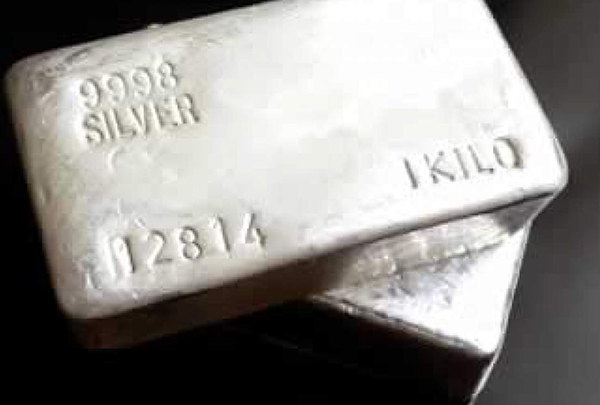

Recently the Silver Institute published their outlook 2023 for Silver. The Outlook said, silver Industrial demand is expected to grow 8% to a record 632 million ounces (Moz) this year. Key drivers behind this performance include investment in photovoltaics, power grid and 5G networks, growth in consumer electronics, and rising vehicle output.

Recently the Silver Institute published their outlook 2023 for Silver. The Outlook said, silver Industrial demand is expected to grow 8% to a record 632 million ounces (Moz) this year. Key drivers behind this performance include investment in photovoltaics, power grid and 5G networks, growth in consumer electronics, and rising vehicle output.

These key findings were reported by Philip Newman, Managing Director at Metals Focus, and Sarah Tomlinson, Director of Mine Supply, during the Silver Institute’s Annual Silver Industry Dinner in New York tonight, featuring historical supply and demand statistics and estimates for 2023. Other key highlights from their presentation include:

Globally, total silver demand is forecast to ease by 10% to reach 1.14 billion ounces in 2023. Gains in industrial applications will be offset by losses in all other key segments. Despite the fall, total demand remains elevated by historical standards, making the 2023 figure the second highest in Metals Focus’ data series.

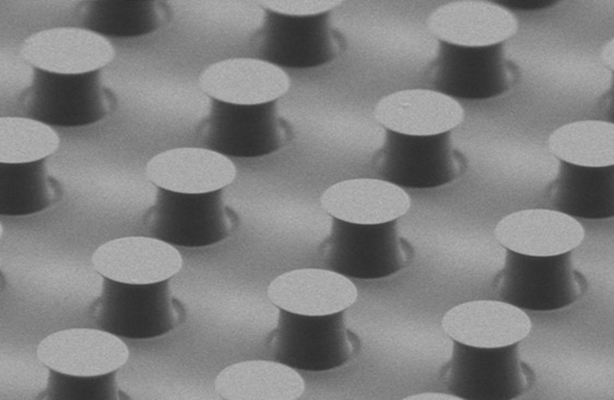

Industrial demand in 2023 will achieve a new annual high. As noted above, key drivers in this growth are being driven by a strong green economy, including investment in photovoltaics (PV), power grids and 5G networks, as well as increased use of automotive electronics and supporting infrastructure. Improvements in (PV) were particularly noticeable as the increase in cell production exceeded silver thrifting, which helped drive electronics and electrical demand higher.

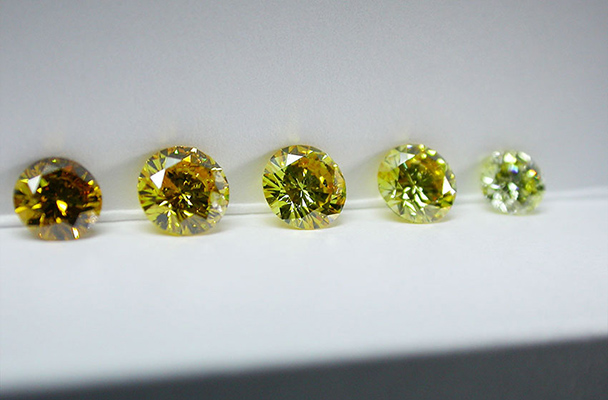

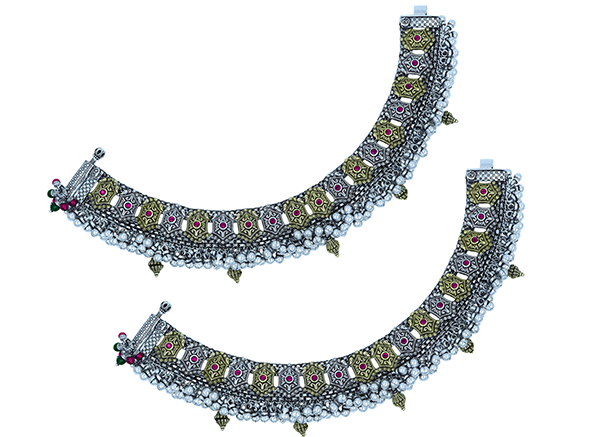

Silver jewelry and silverware demand is set to fall by 22% and 47%, respectively, to 182 Moz and 39 Moz this year. For both, losses are led by India, where full-year demand is expected to normalize after a surge in 2022. Excluding India, global jewelry demand is expected to edge slightly higher in 2023, while silverware will fall by a notably smaller 12%.

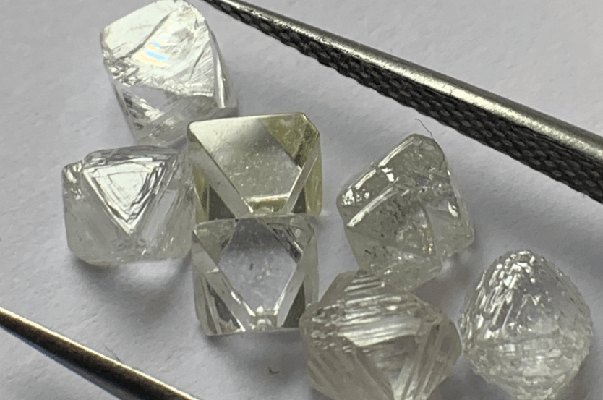

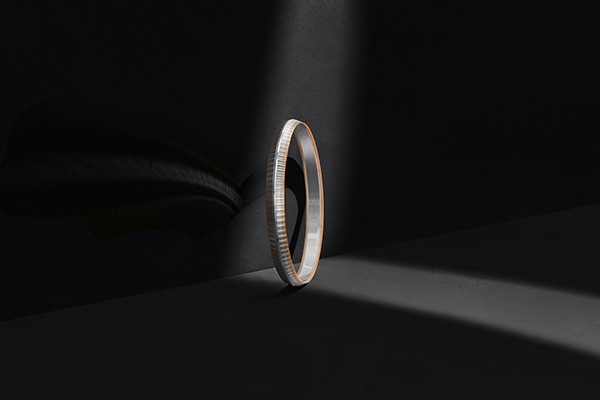

Physical investment in 2023 is projected to fall by 21% to a three-year low of 263 Moz. While most markets have seen weaker volumes, losses have been concentrated in India and Germany. In India, record high local prices both deterred new investor purchases and led to profit taking, resulting in a 46% decline.

In Germany, investor sentiment was hit hard by the VAT hike to some silver coins at the start of 2023. US investment has also turned lower, but only modestly, thanks to buoyant safe haven demand following the regional banking crisis. The resilience of the US market helps explain why the global total stays historically high.

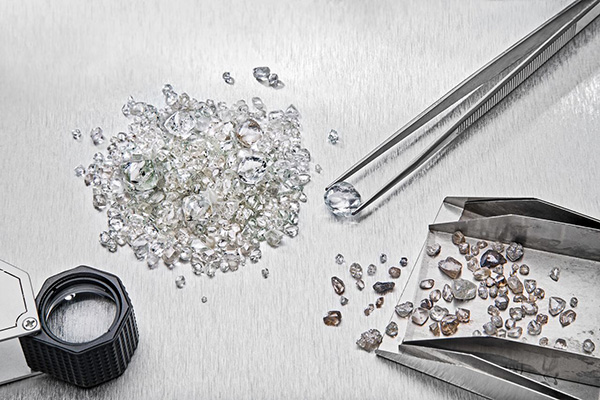

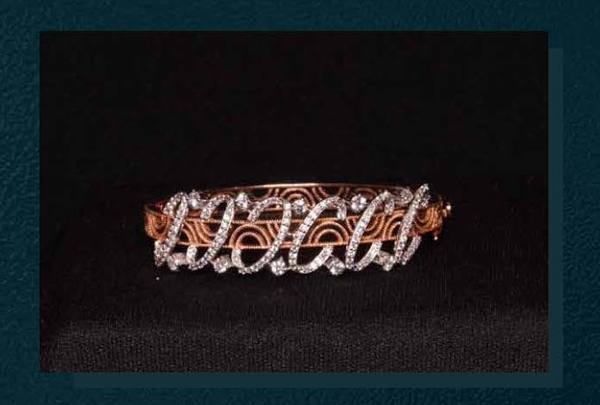

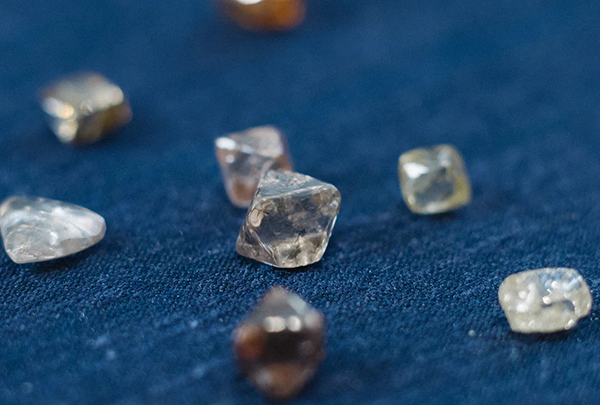

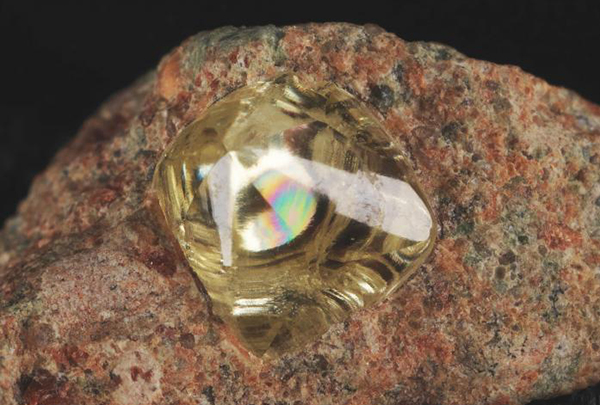

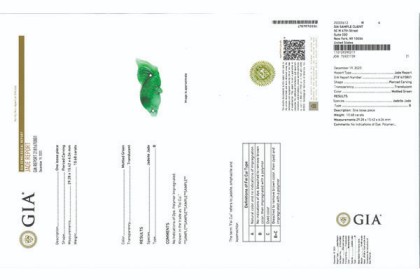

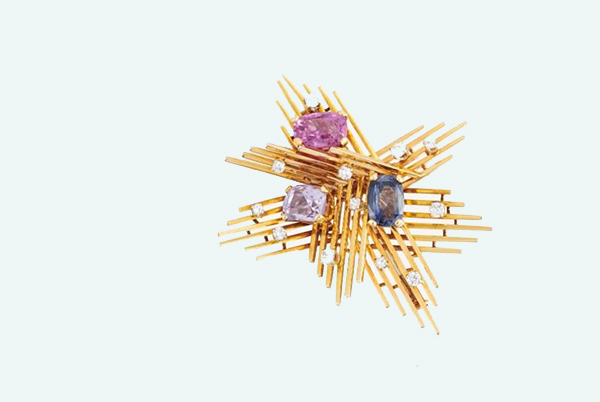

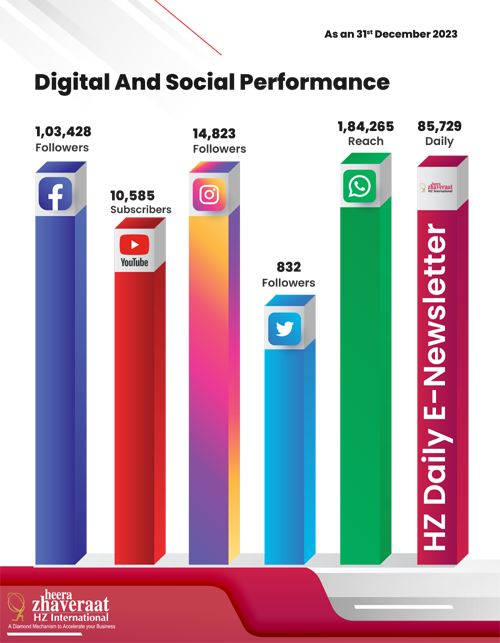

Heera Zhaveraat (HZ International) A Diamond, Watch and Jewellery Trade Promotion Magazine provide dealers and manufactures with the key analytical information they need to succeed in the luxury industry. Pricing, availability and market information in the Magazine provides a critical edge.

All right reserved @HeeraZhaveraat.com

Design and developed by 24x7online.in