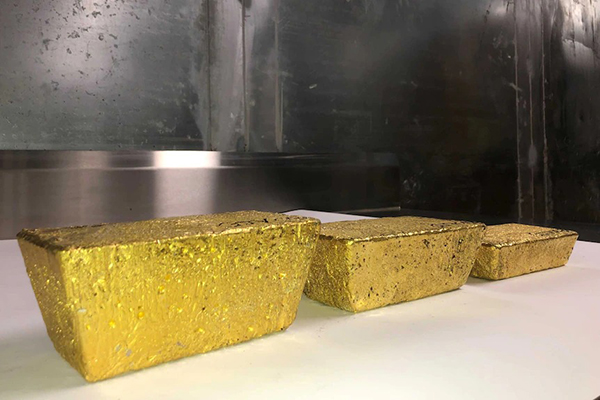

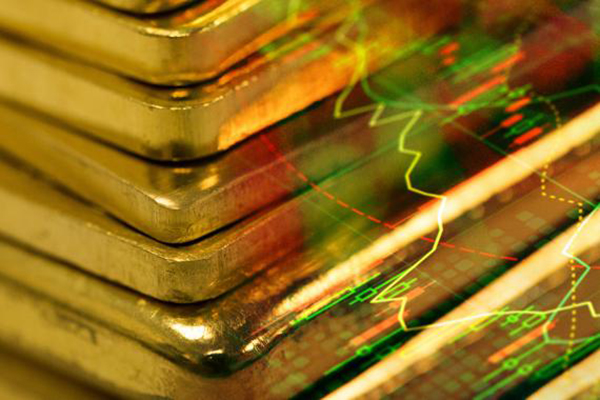

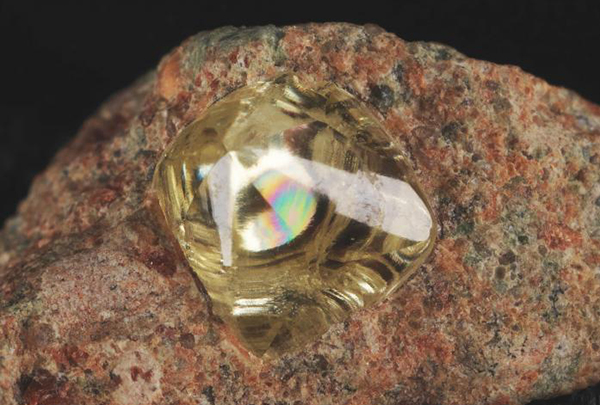

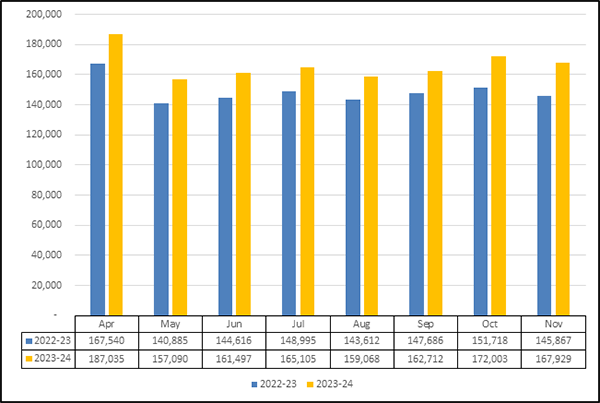

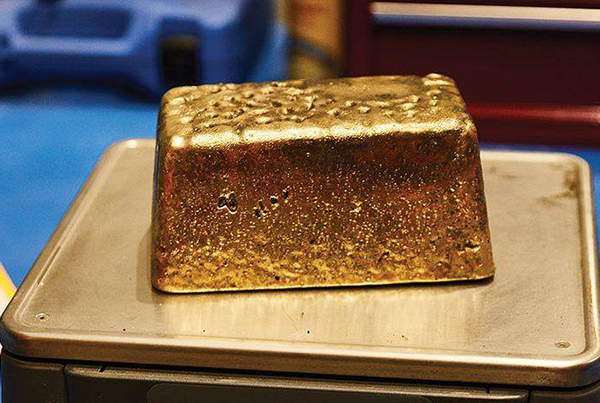

At the December 2023 overview, World Gold Council presented that, Global physically backed gold ETFs witnessed net outflows of US$1bn in December, marking their seventh consecutive monthly loss. Collective holdings stood at 3,225t at the end of 2023, a 10t decrease in December. Benefiting from continued strength in the gold price (+2% m/m), total AUM rose by 1% during the month, to US$214bn.

At the December 2023 overview, World Gold Council presented that, Global physically backed gold ETFs witnessed net outflows of US$1bn in December, marking their seventh consecutive monthly loss. Collective holdings stood at 3,225t at the end of 2023, a 10t decrease in December. Benefiting from continued strength in the gold price (+2% m/m), total AUM rose by 1% during the month, to US$214bn.

At the Regional overview front, North American funds attracted US$717mn in December; the second successive month of inflows. The US Fed kept rates unchanged for the third straight meeting and signalled rate cuts of 75bps in 2024, more dovish than previously projected. As a result, opportunity costs of holding gold, proxied by the 10-year US Treasury yield (-45bps) and the dollar (-2%), fell in the month, pushing up the gold price and attracting gold ETF inflows.

The gold price reached a record high in December 4, and this, together with continued geopolitical concerns, also lifted investor interest – in the US, Google Trends saw rocketing searches on gold price related topics. Major gold ETF options that expired on 15 December also contributed positively as the price jump ahead of the expiry date triggered exercises of in-the-money calls and created inflows.

European funds witnessed outflows of US$2bn, extending their losing streak to seven months. Although the European Central Bank and the Bank of England continued to leave rates unchanged, they maintained their hawkish attitude and pushed back expectations of rate cuts in the near future. Consequently, local investors remained cautious about gold investment amid elevated interest rates, still-hawkish central banks and strengthening currencies.

And other factors such as softer local gold price performances relative to their US peer and rallies in equities may have further dimmed investor interest during the month. The largest outflows came from funds listed in the UK and Germany. Asian funds attracted inflows of US$208mn in December for the ninth consecutive month.

These were led by China (+US$140mn) and Japan (+US$64mn). Economic and geopolitical uncertainties, as well as local gold prices refreshing all-time highs, increased gold’s allure in these markets. The Other region also ended the month positively (+US$33mn) as Turkish inflows, which reached a seven month high, outweighed outflows from Australia.

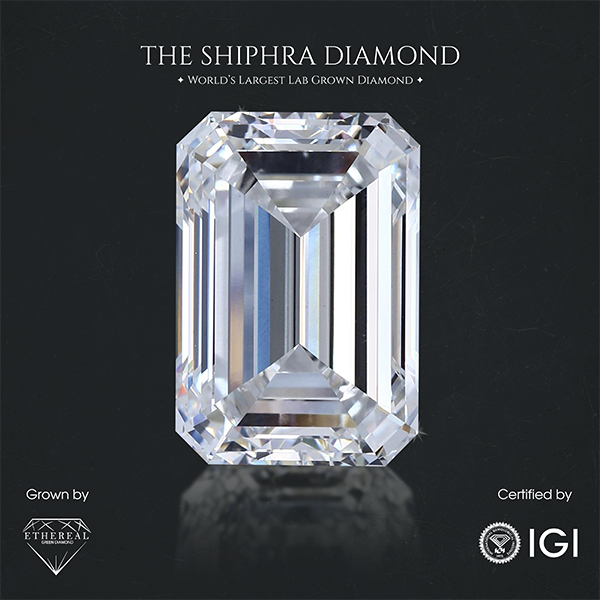

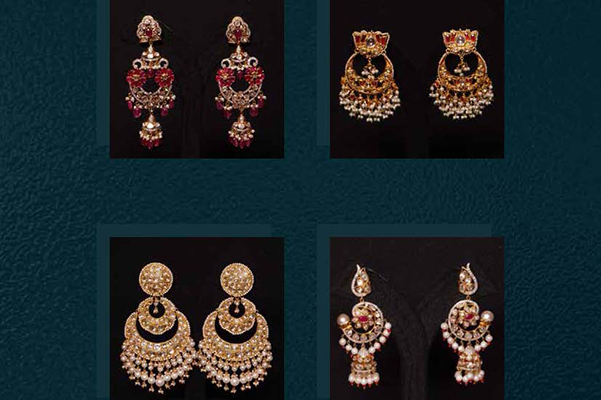

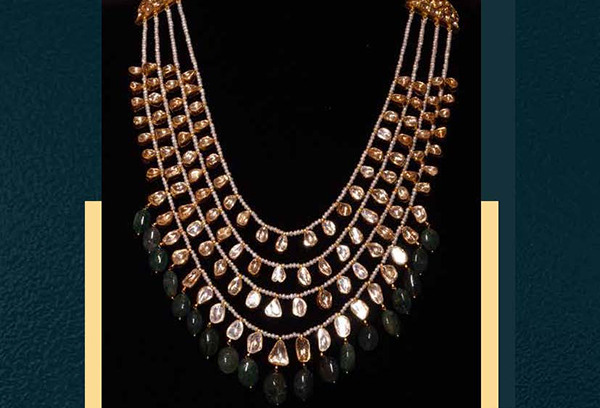

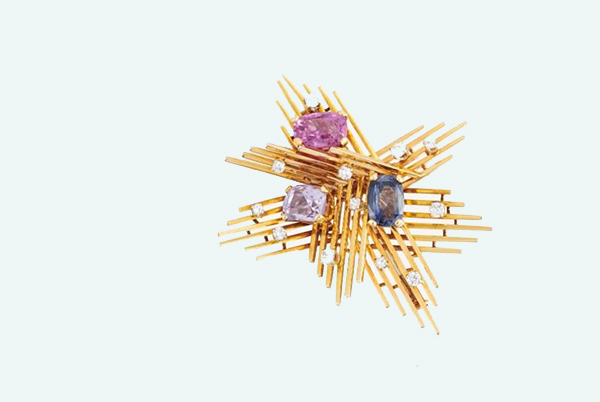

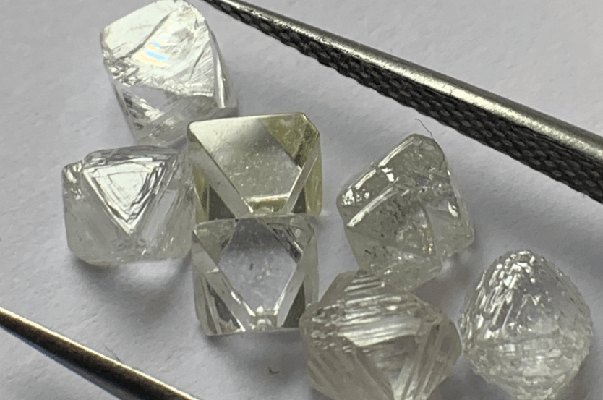

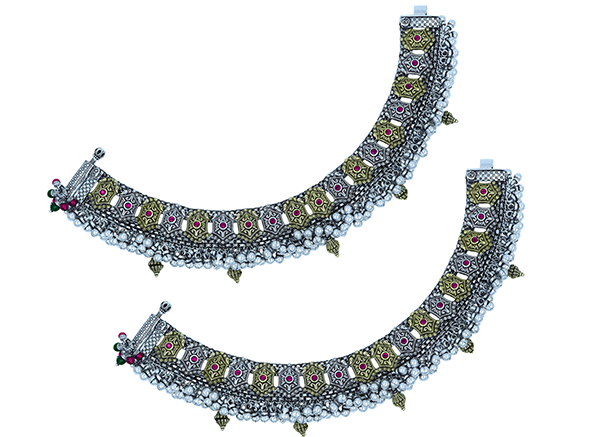

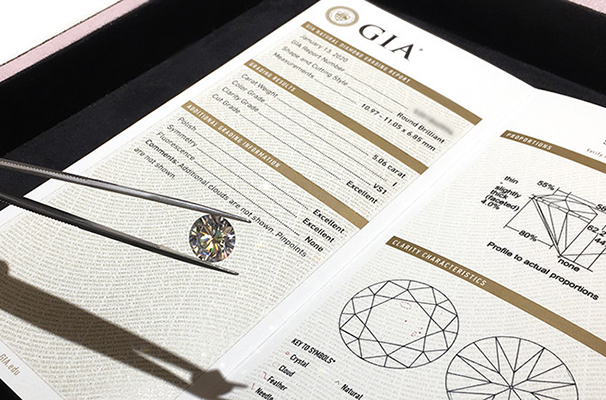

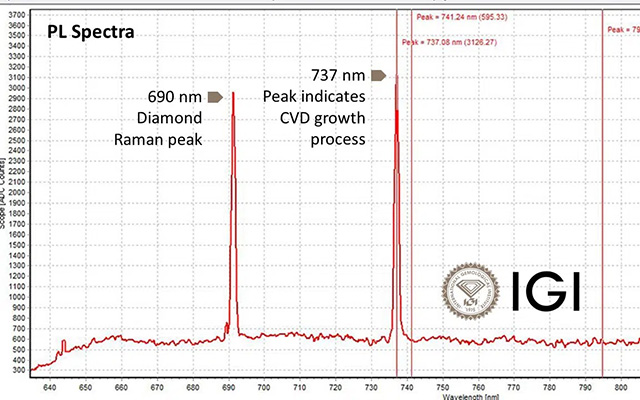

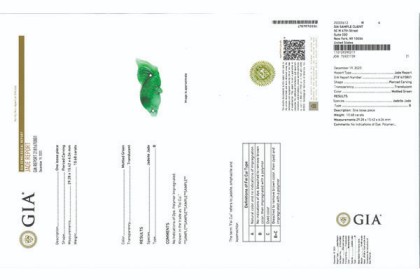

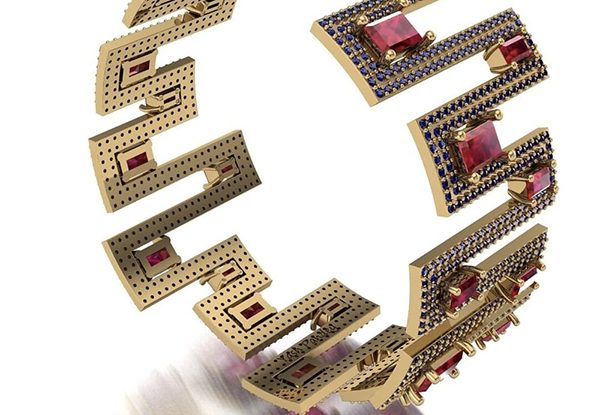

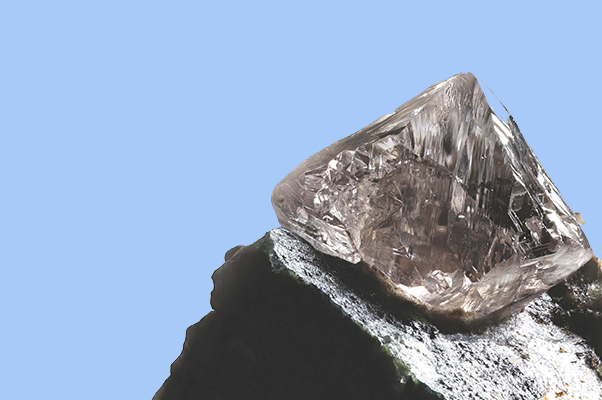

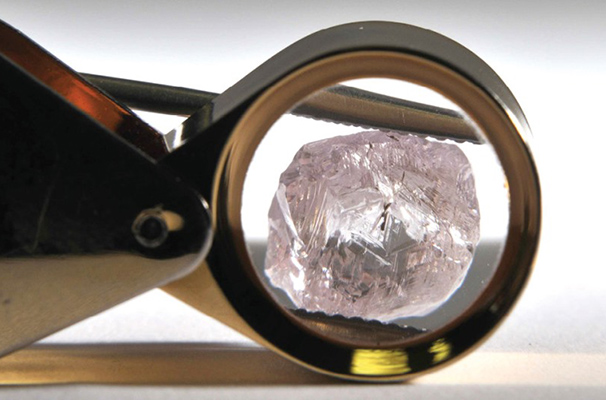

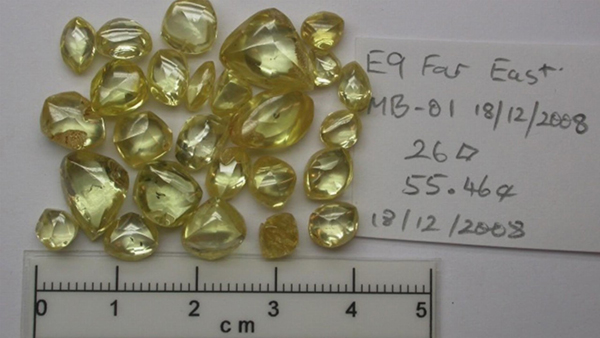

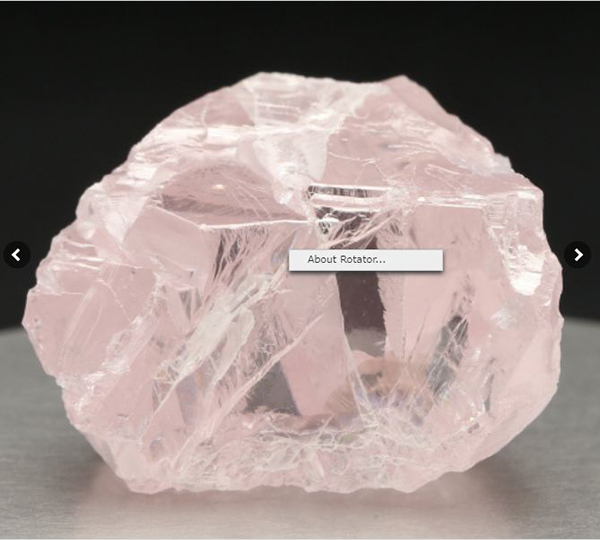

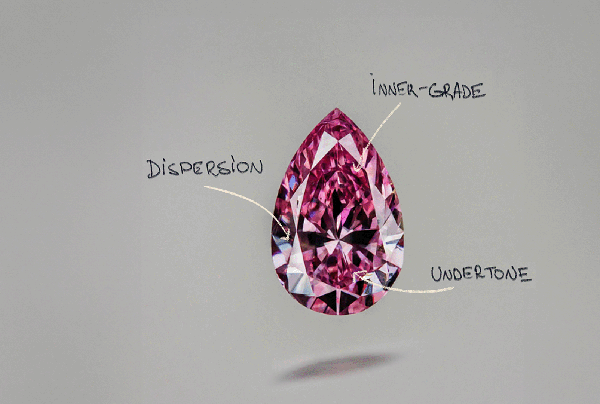

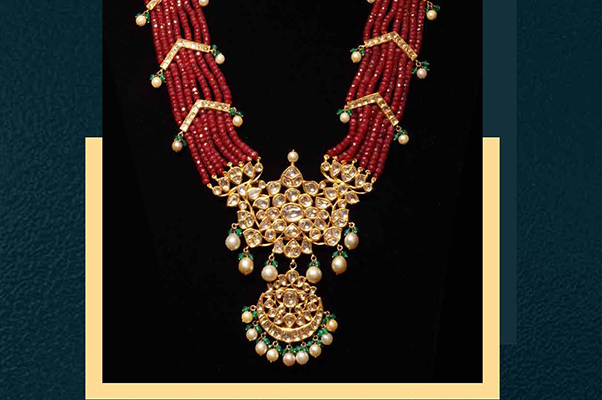

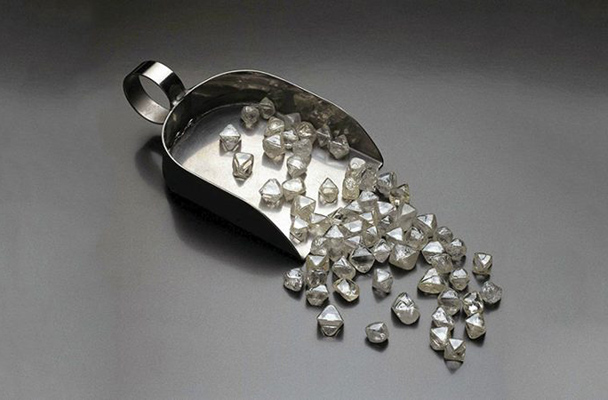

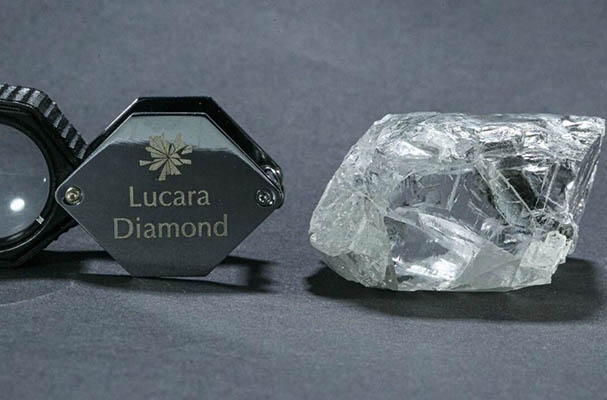

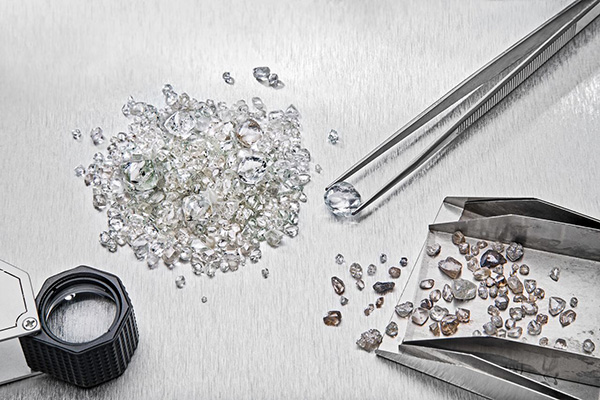

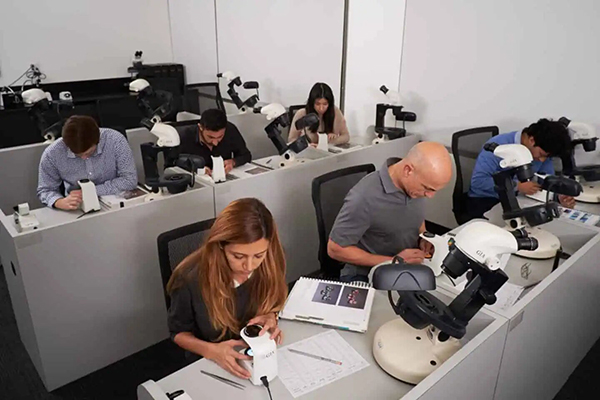

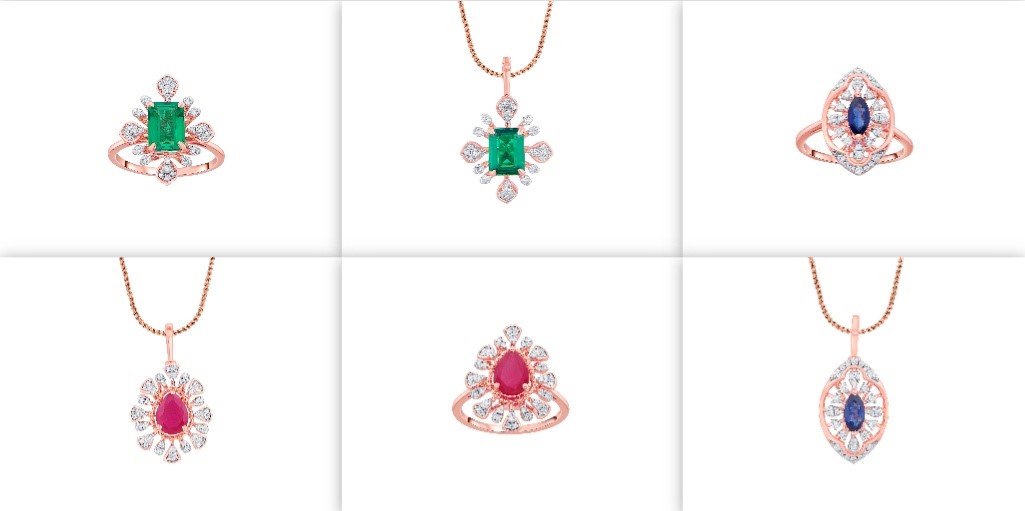

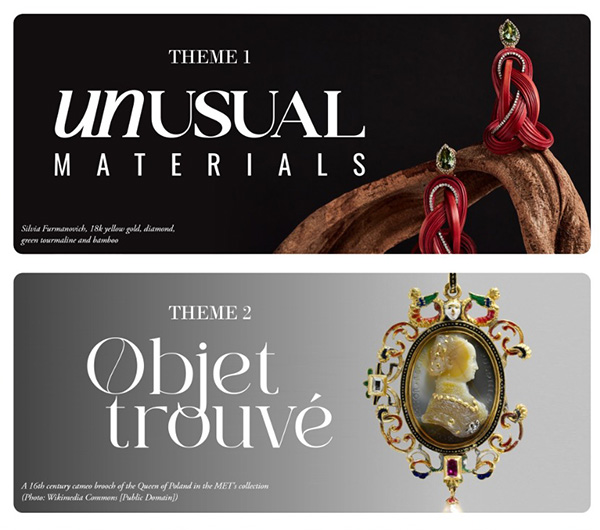

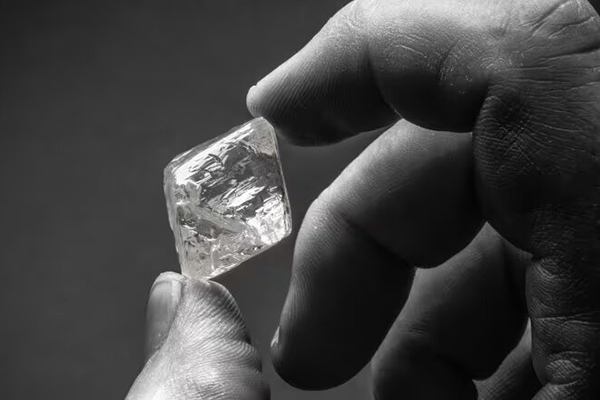

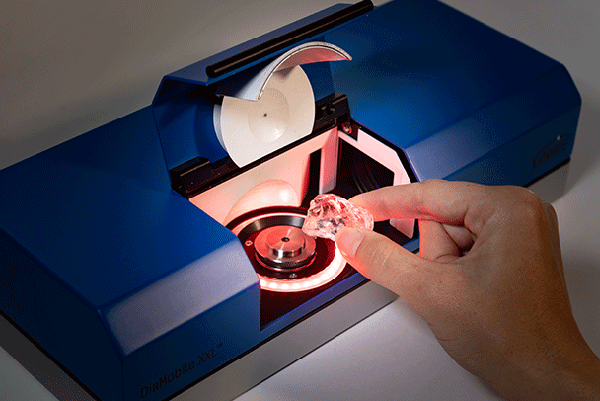

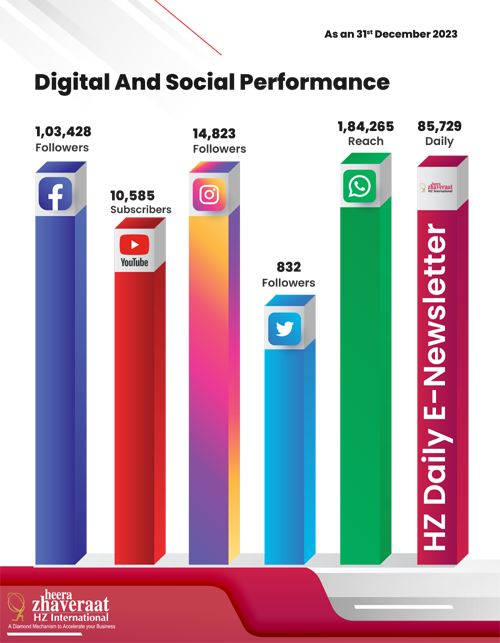

Heera Zhaveraat (HZ International) A Diamond, Watch and Jewellery Trade Promotion Magazine provide dealers and manufactures with the key analytical information they need to succeed in the luxury industry. Pricing, availability and market information in the Magazine provides a critical edge.

All right reserved @HeeraZhaveraat.com

Design and developed by 24x7online.in