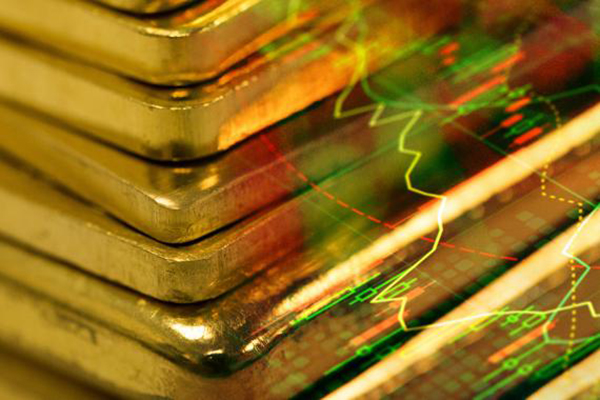

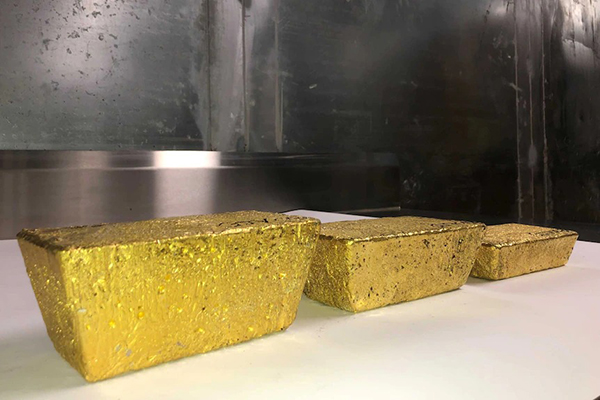

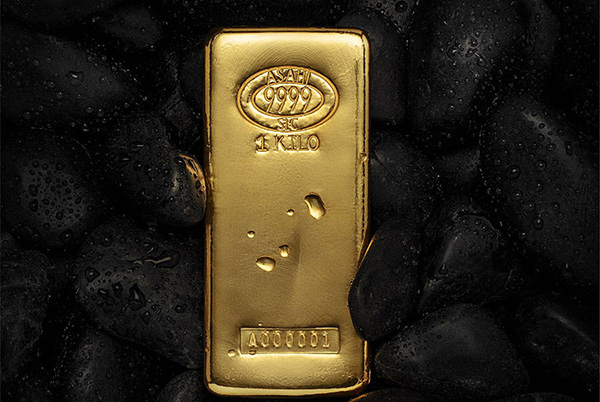

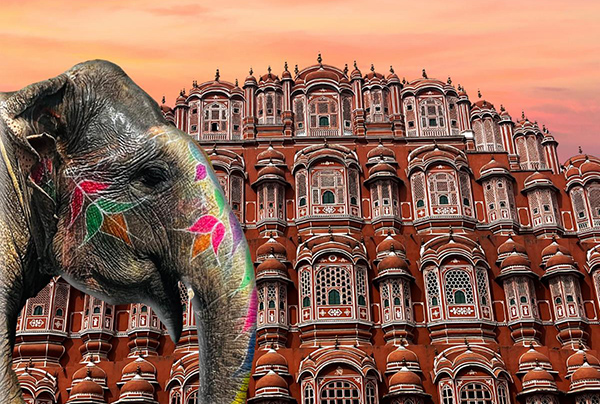

With India’s deep affinity for gold, Indians have historically turned to this asset as a means of preserving their wealth – and increasing its value over time. Now, however, attitudes are changing. Consumer spending on other goods has increased, growing financial inclusion has encouraged more people to put their savings in the bank and greater financial literacy has boosted interest in other assets, such as equities. Focussing here just a two points.

With India’s deep affinity for gold, Indians have historically turned to this asset as a means of preserving their wealth – and increasing its value over time. Now, however, attitudes are changing. Consumer spending on other goods has increased, growing financial inclusion has encouraged more people to put their savings in the bank and greater financial literacy has boosted interest in other assets, such as equities. Focussing here just a two points.

1: Savings and spending: India has a long tradition of saving. From the 1960s until 2010, for example, the Indian savings rate climbed from 6% to 34.3%.25 Since that time, however, savings as a percentage of GDP have declined, dipping below 30% in 2018 and continuing to inch lower to this day. Rather than hoarding their money, Indian consumers have begun to spend more on goods and services, such as smartphones, designer clothes and travel.

2: Growing financial inclusion: Even as consumer spending has risen, the government has taken steps to clamp down on unaccounted money and increase financial inclusion. These measures have met with considerable success. Between 2011 and 2017, for example, the share of adults with a bank account more than doubled to 80%.

The growth in micro finance companies and payment banks has helped to boost financial inclusion in villages and small towns. At the same time, soaring smartphone use has allowed Indians to access financial services swiftly and efficiently. Many Indian banks now have smartphone apps, access to high speed internet is inexpensive in many parts of the country and take-up has been enthusiastic. As of the end of 2020, India had the second largest number of internet users in the world, with almost 750mn Indians actively accessing the internet each month.

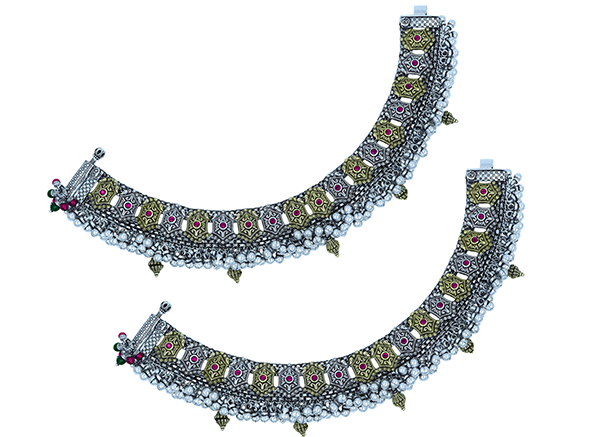

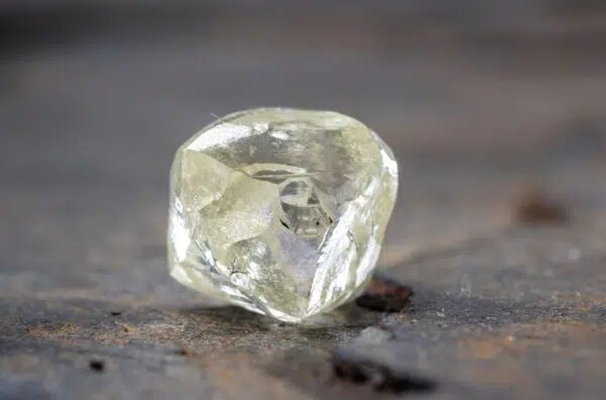

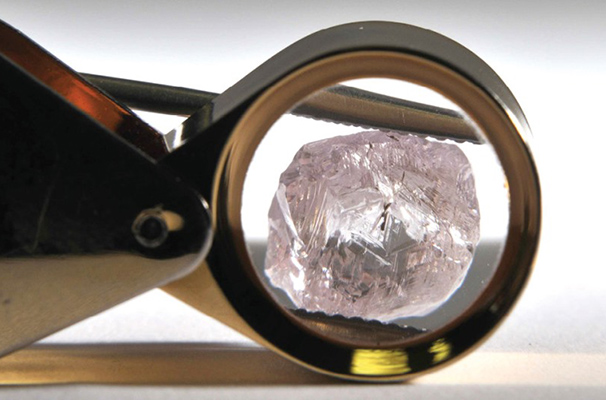

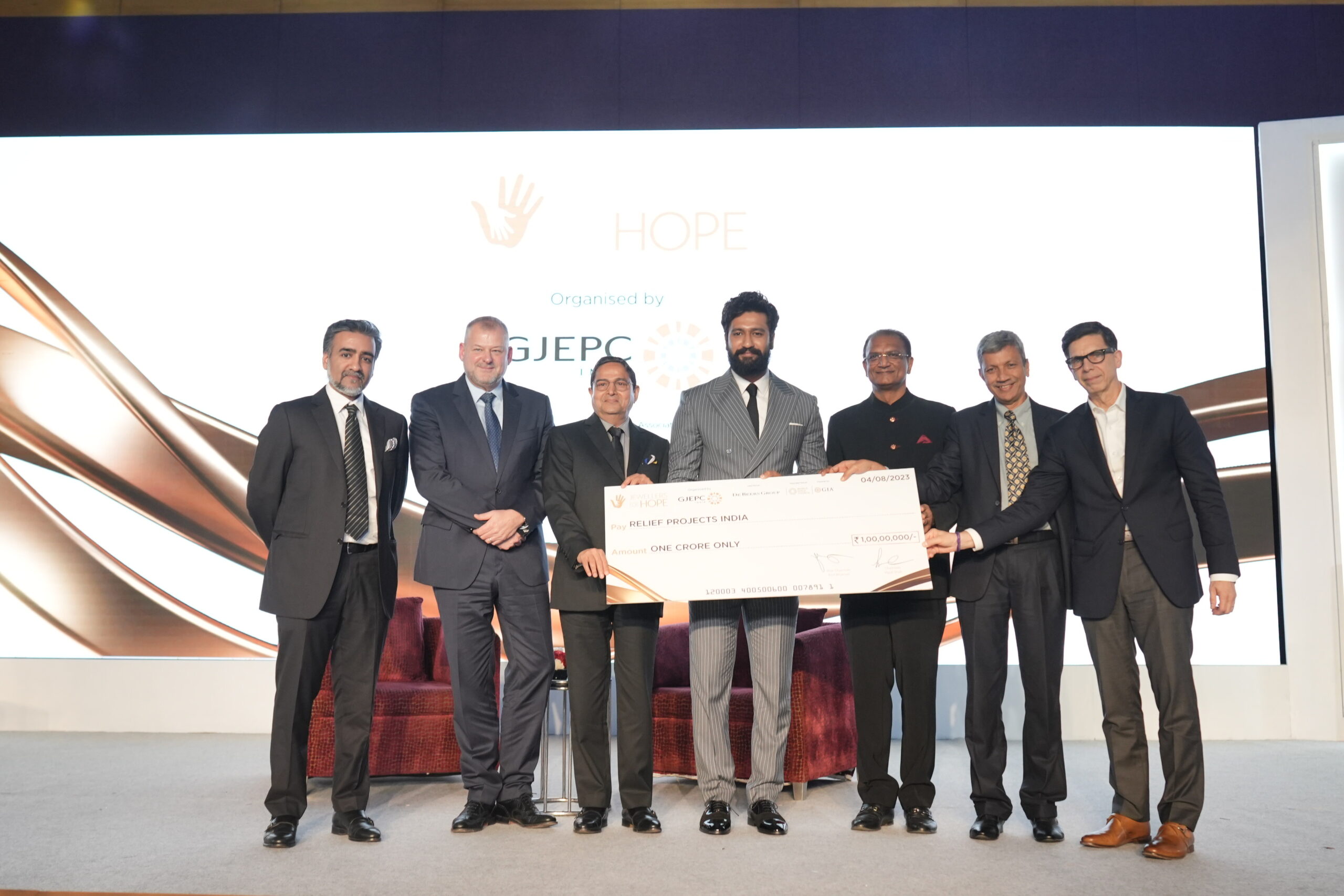

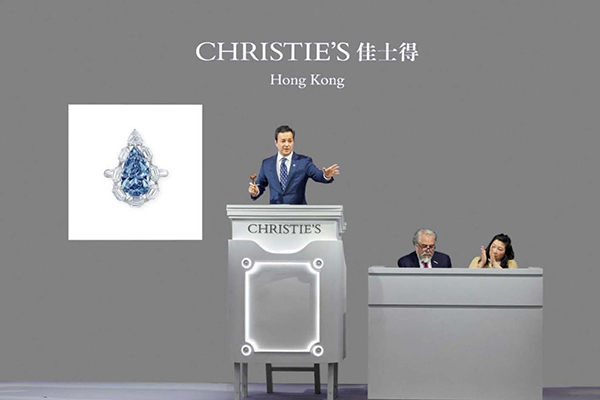

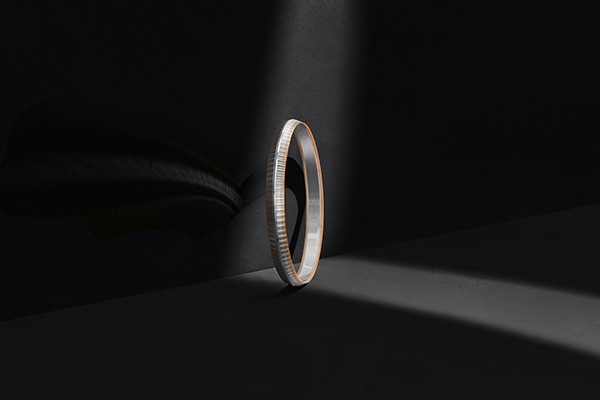

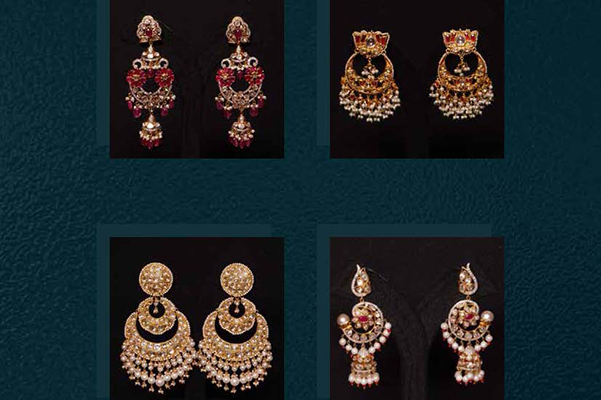

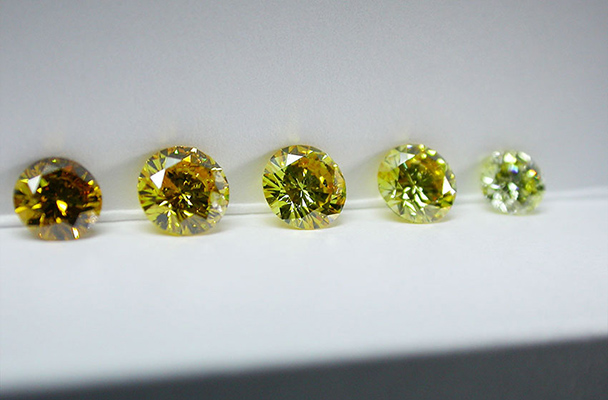

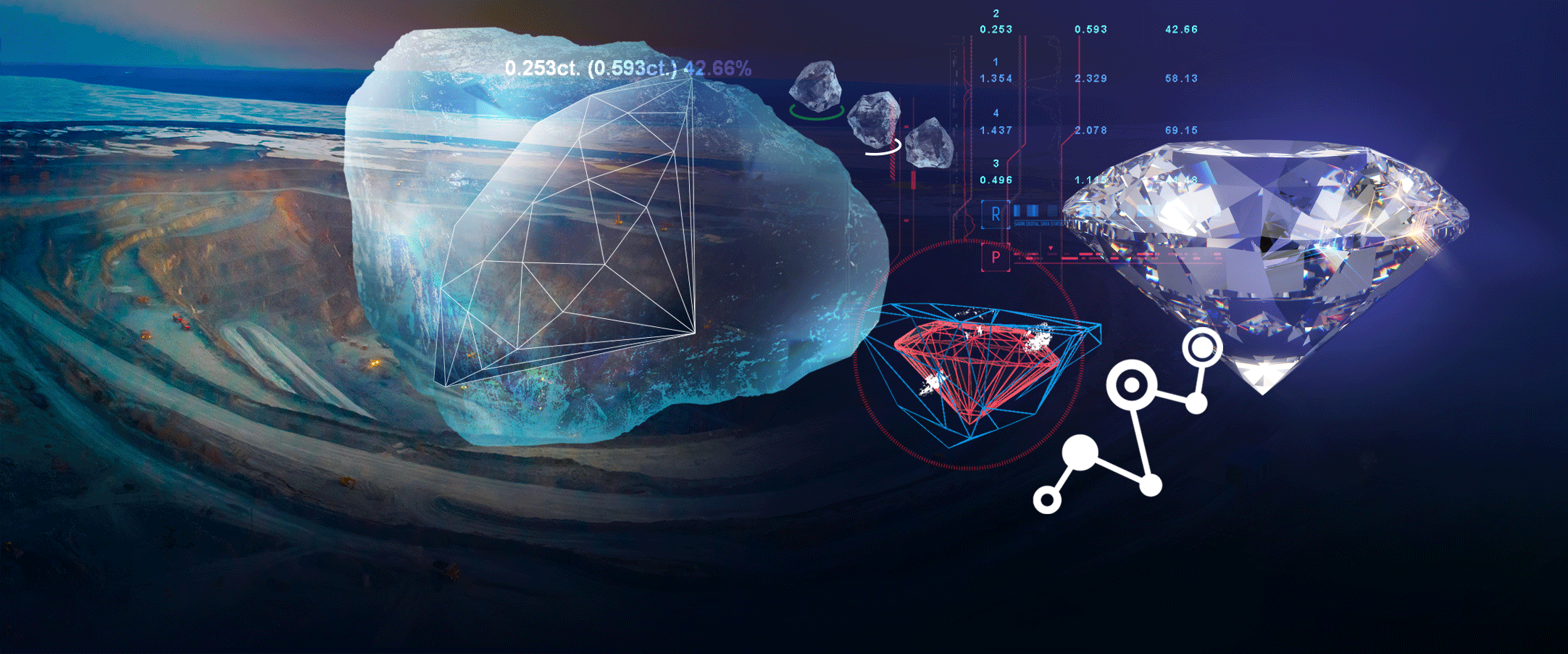

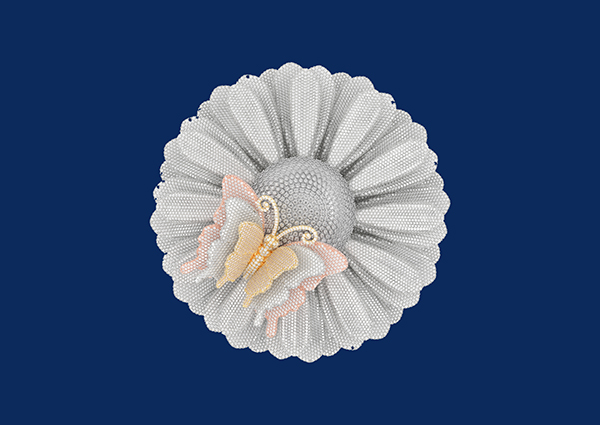

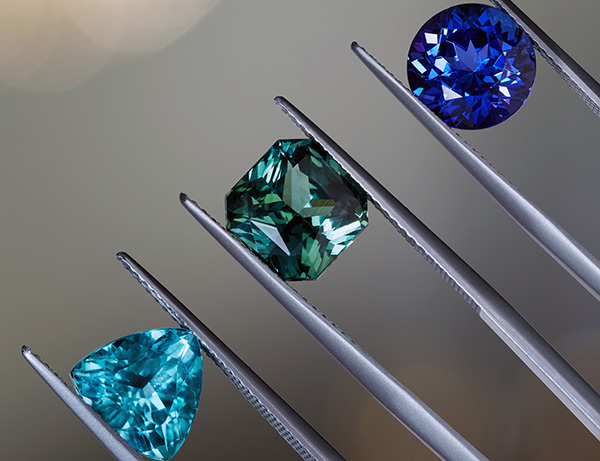

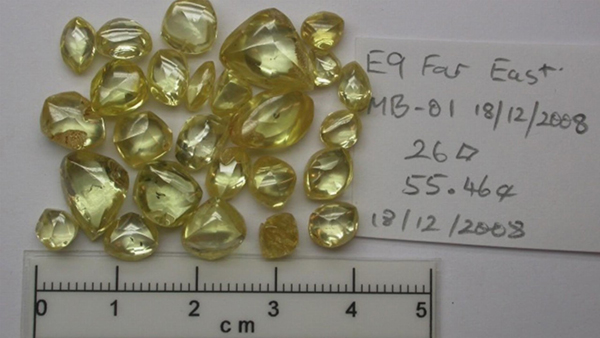

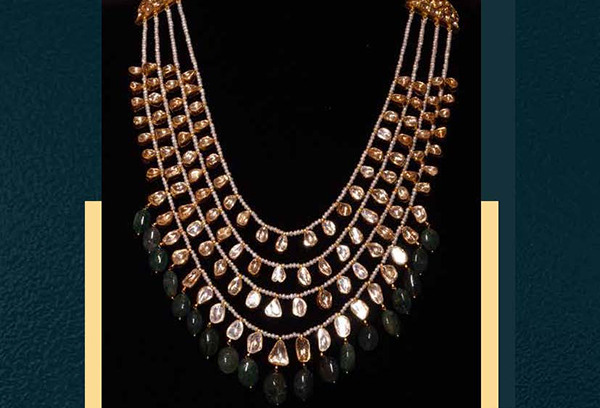

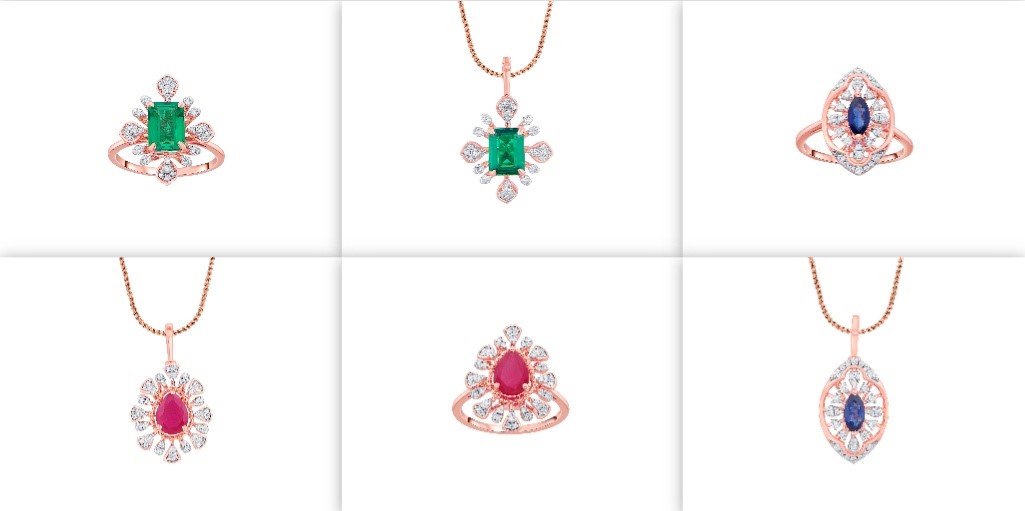

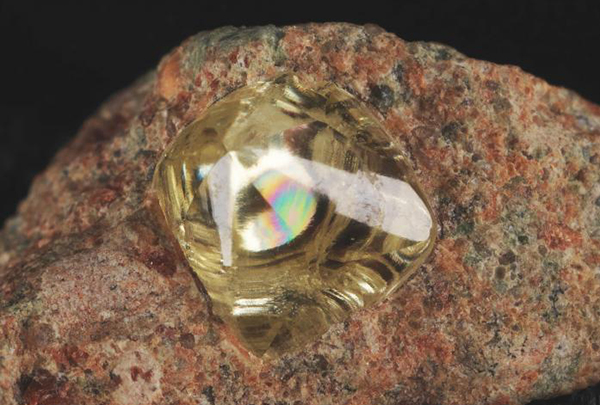

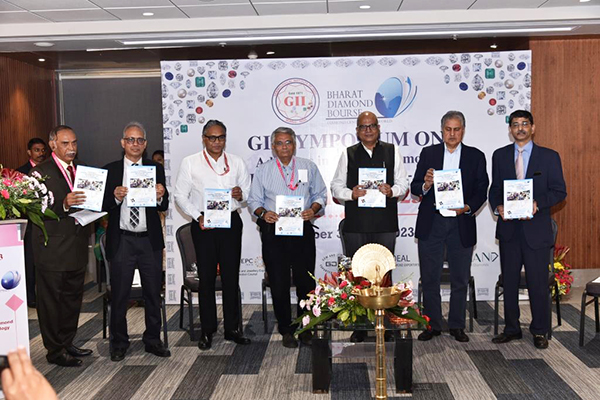

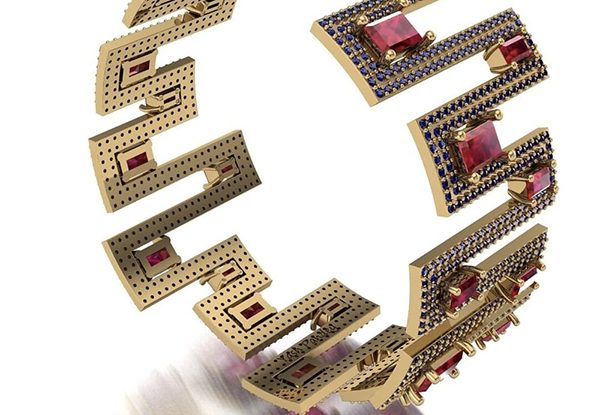

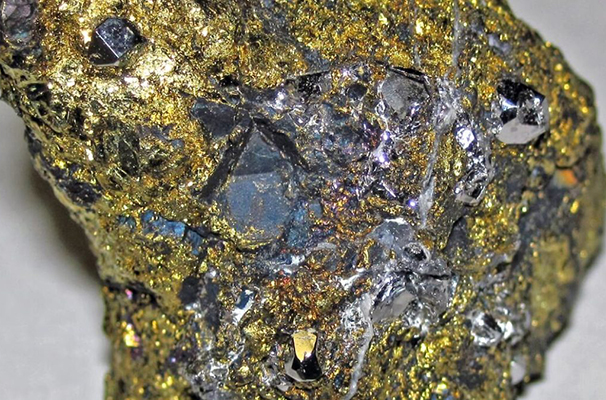

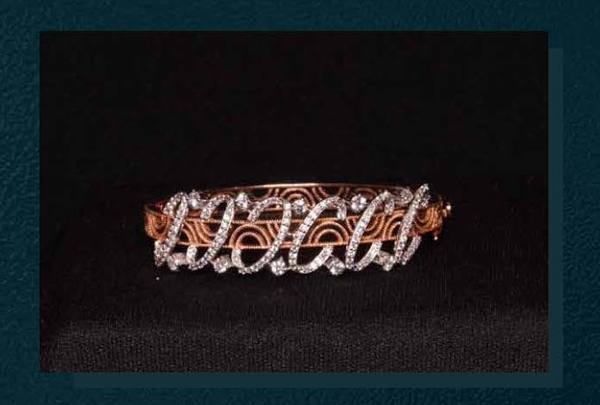

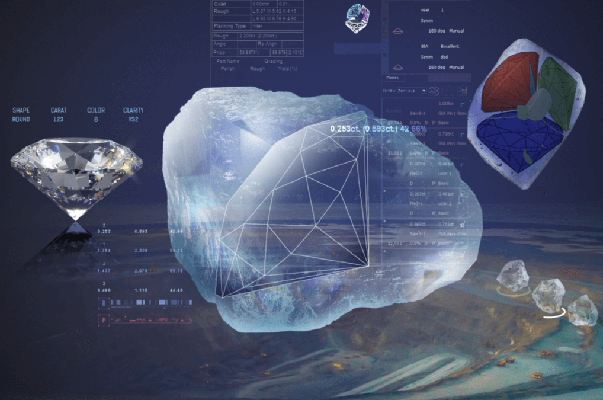

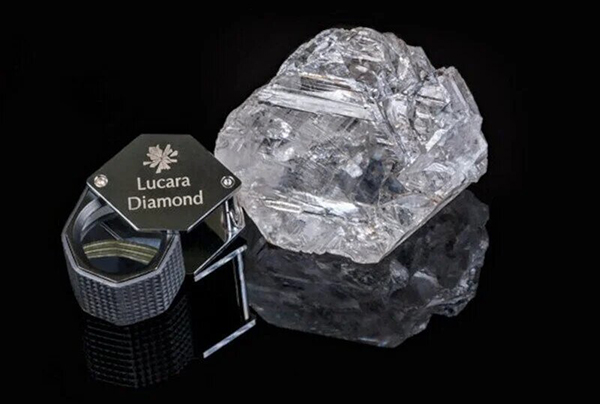

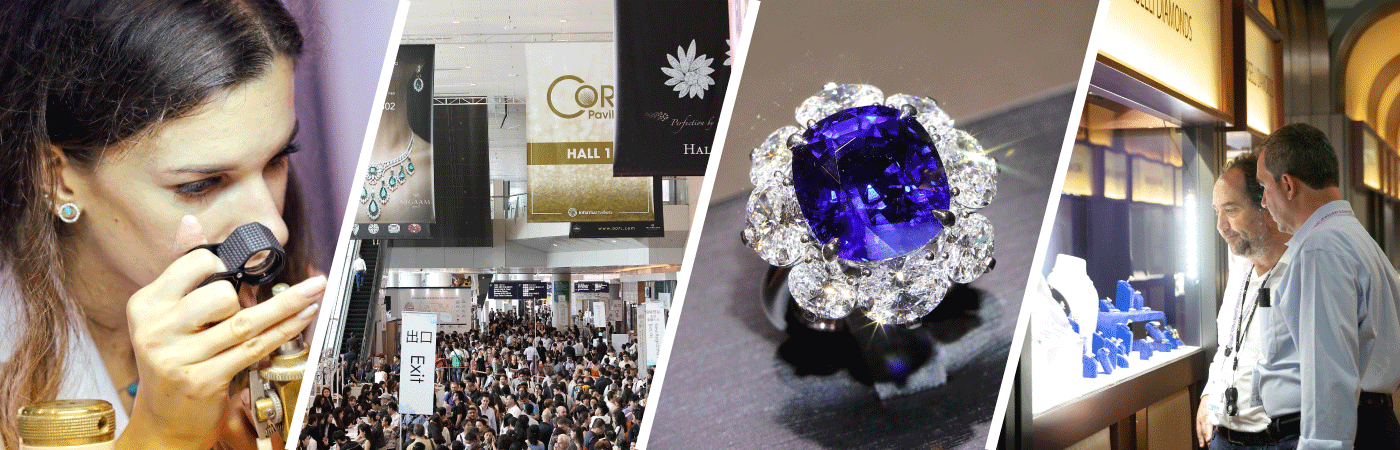

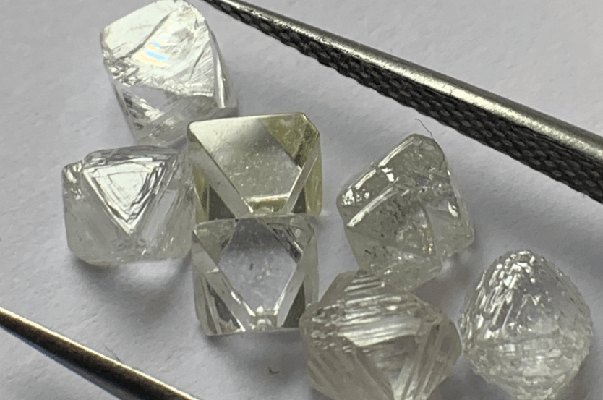

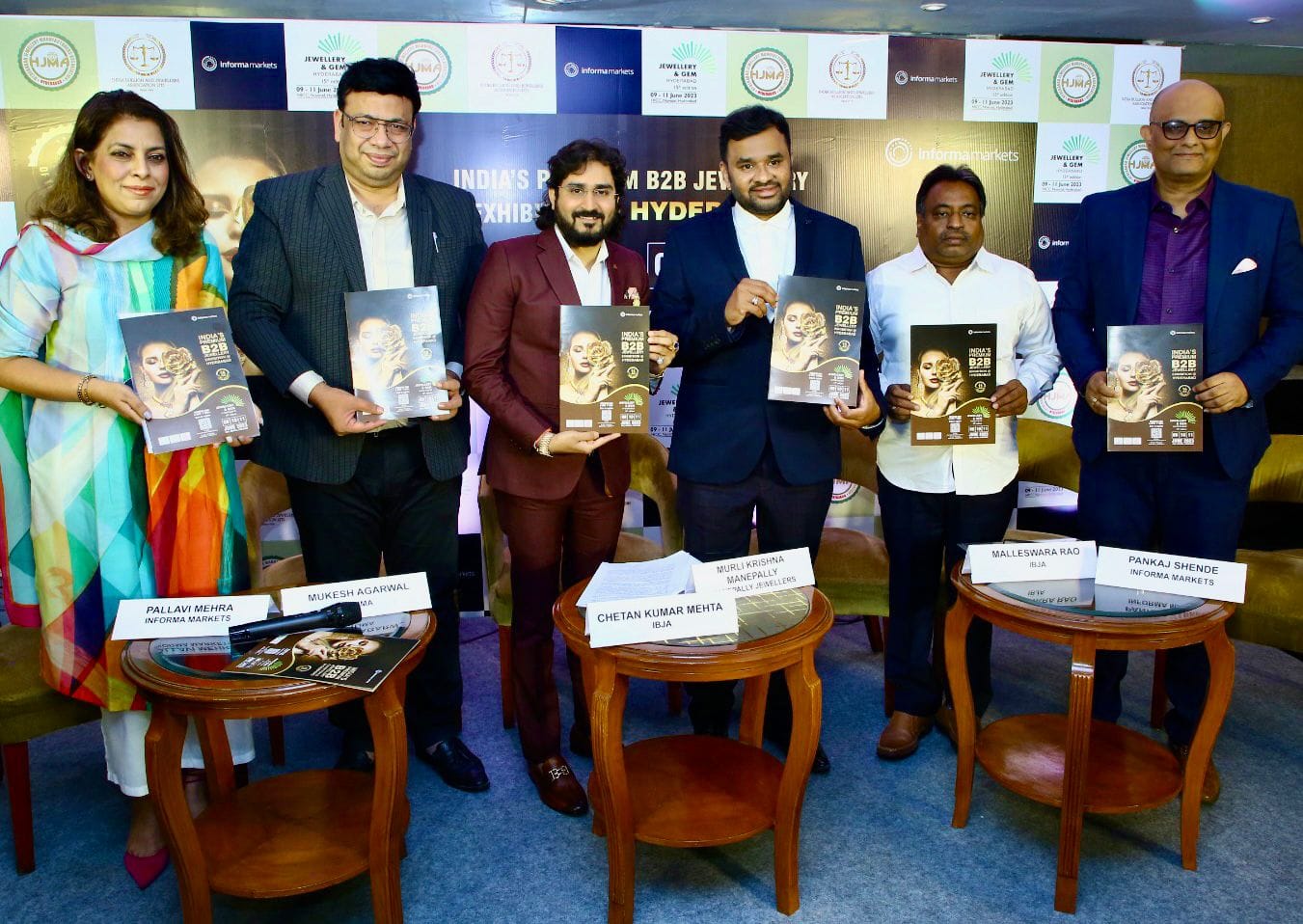

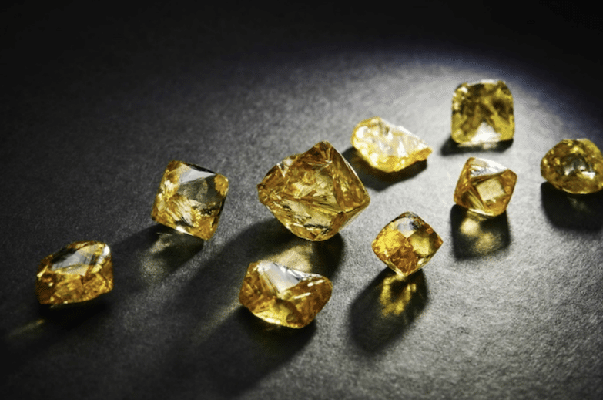

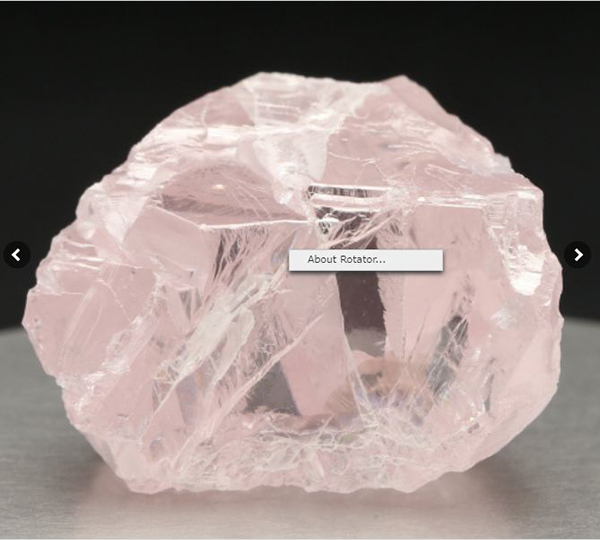

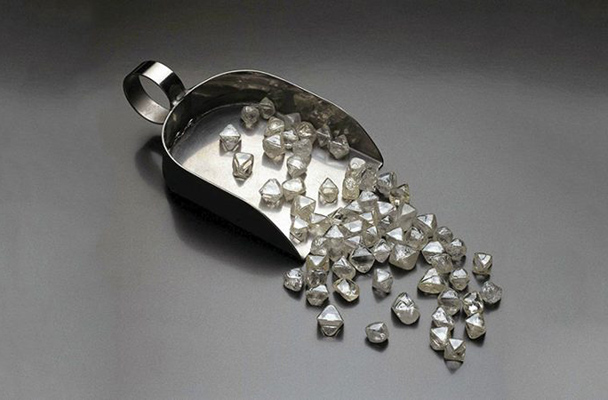

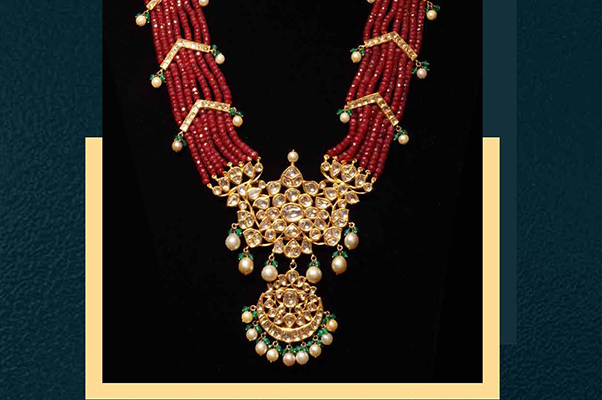

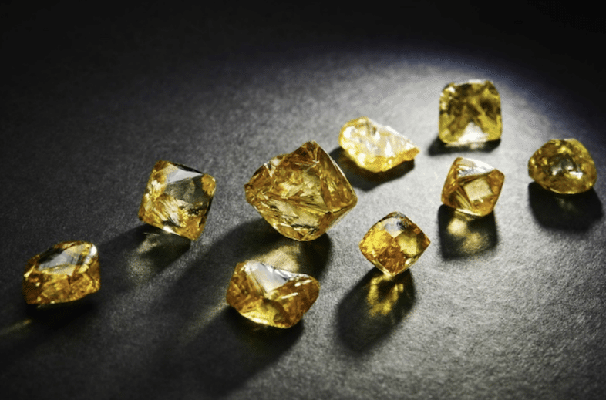

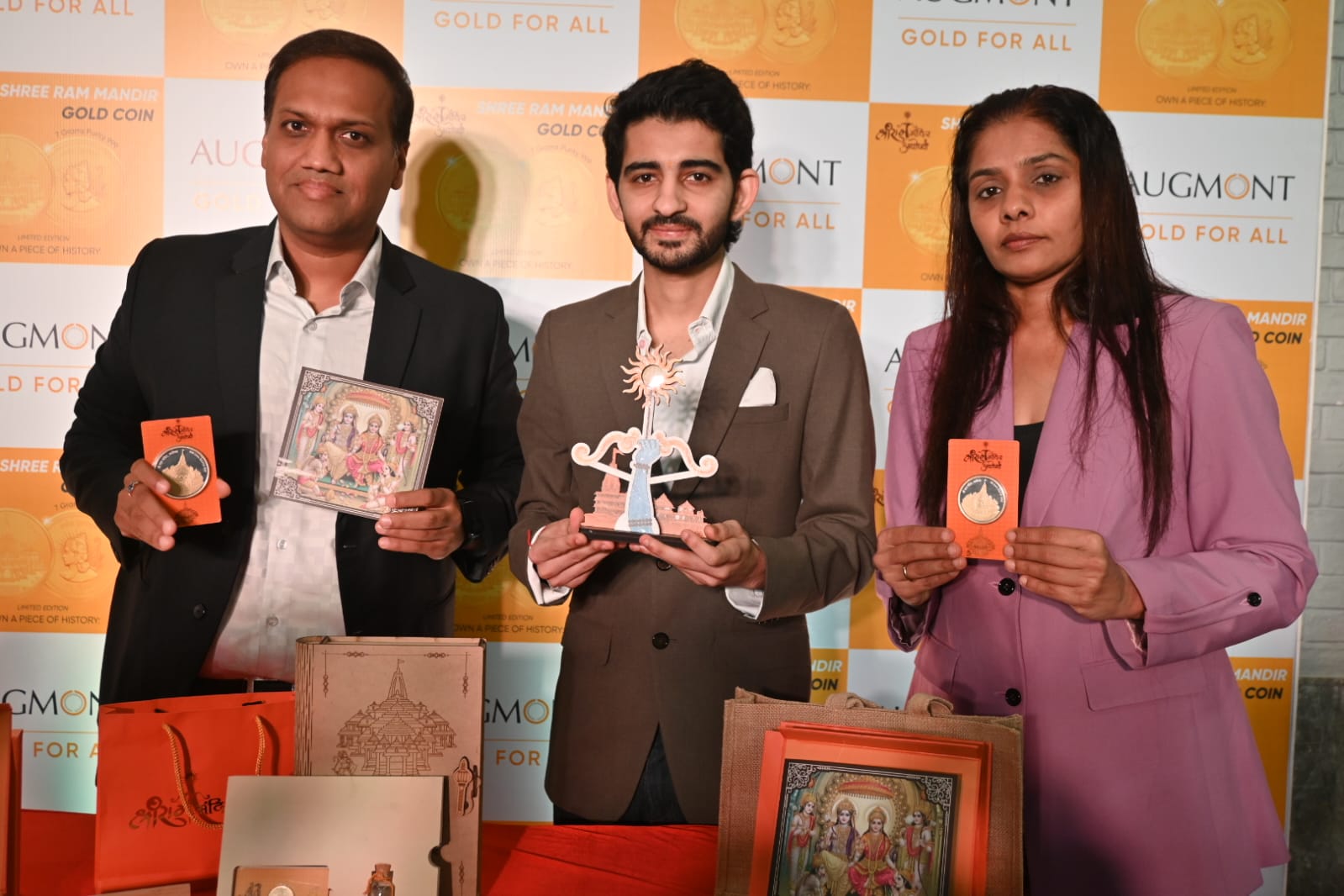

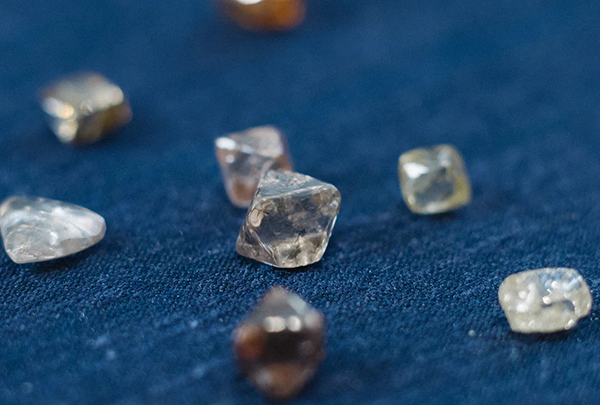

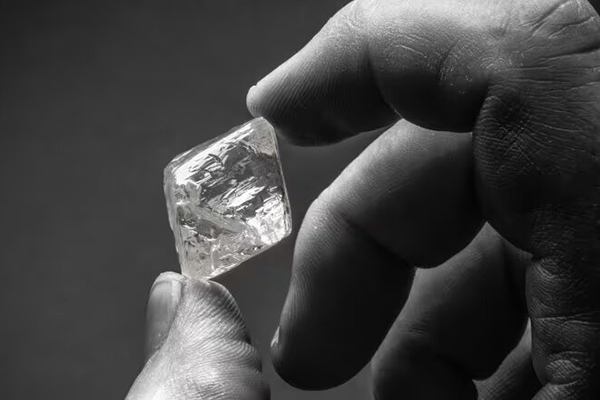

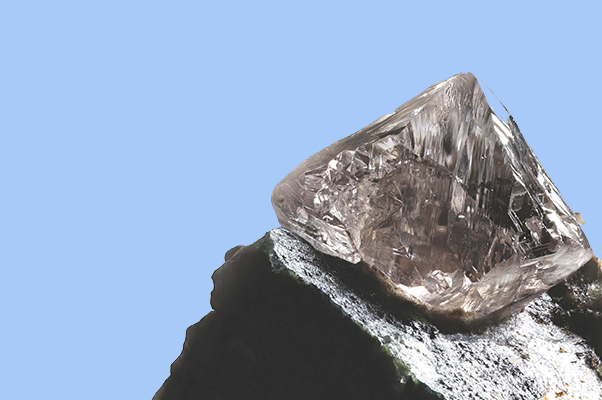

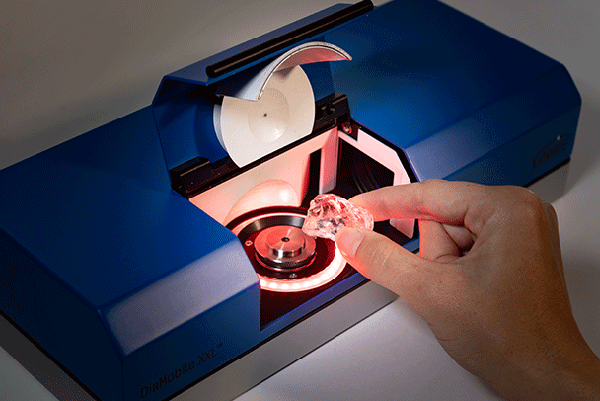

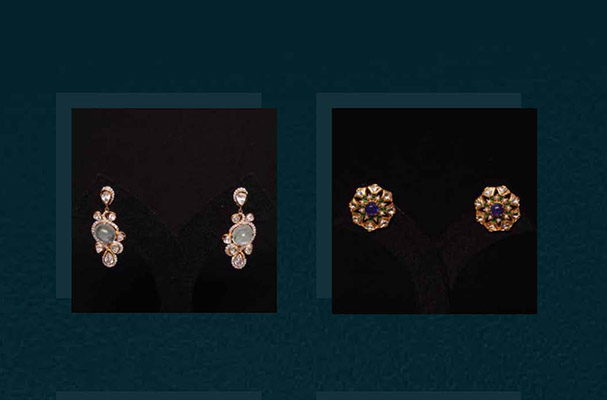

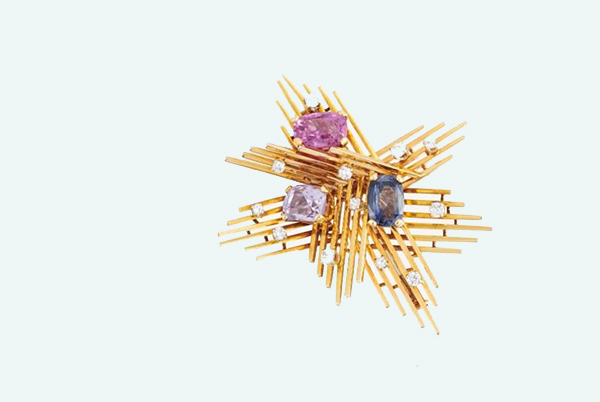

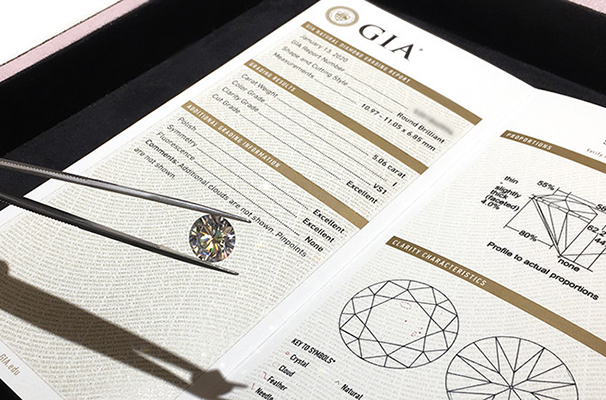

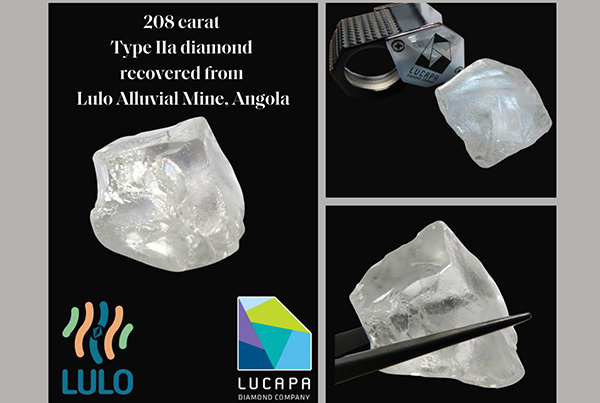

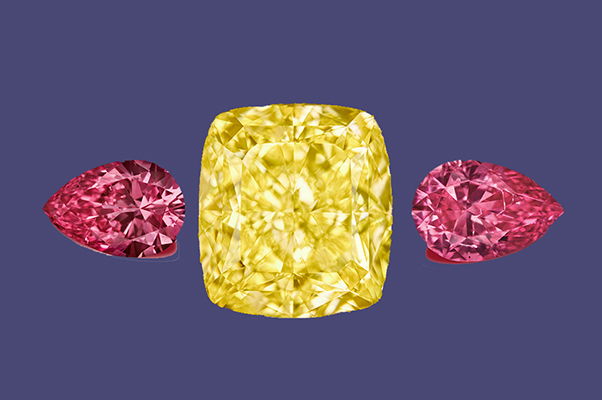

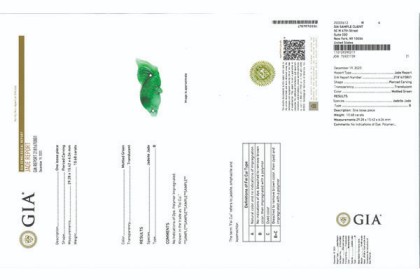

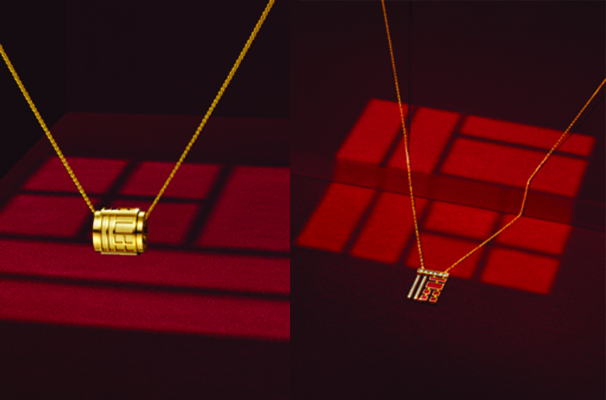

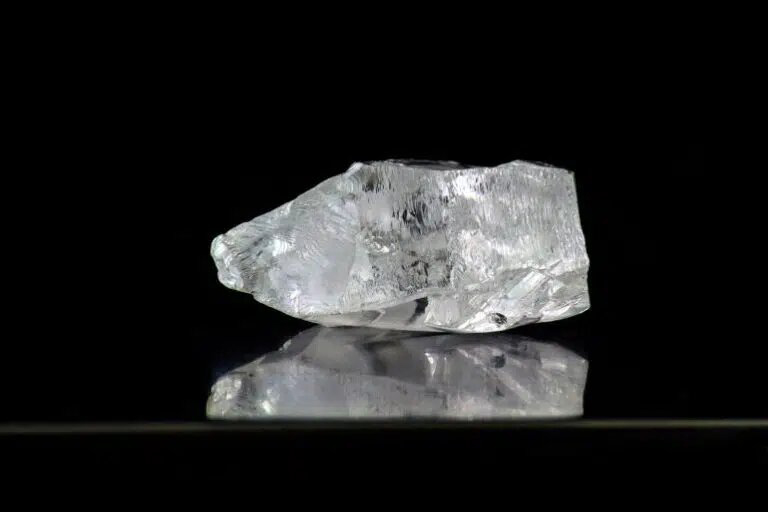

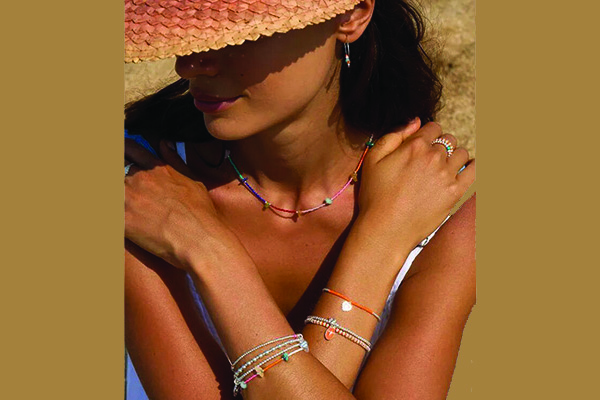

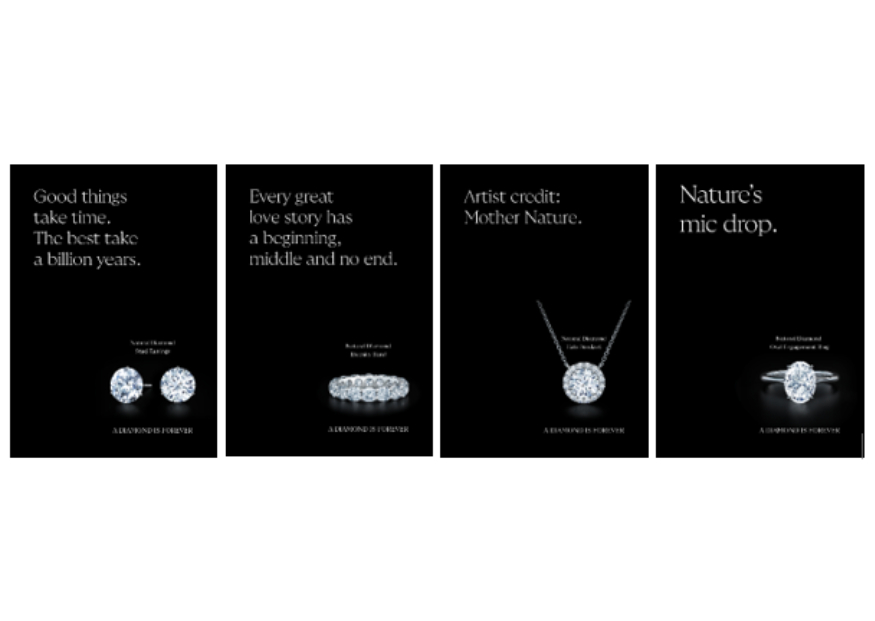

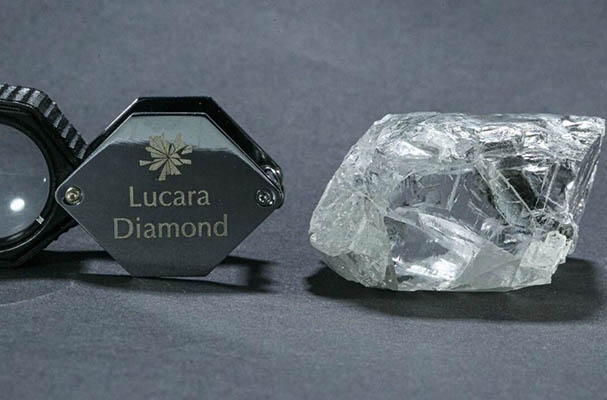

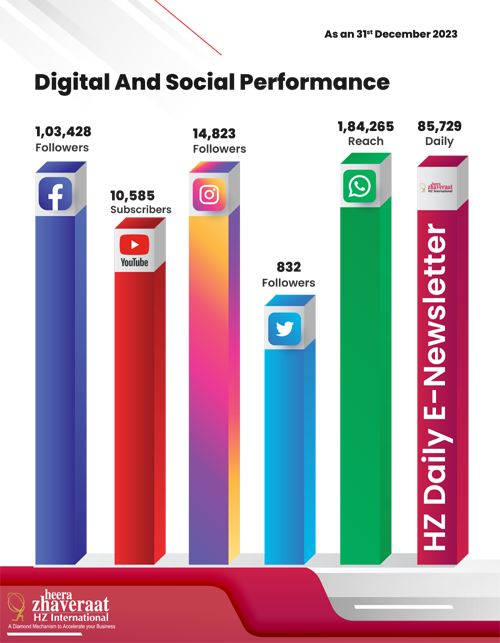

Heera Zhaveraat (HZ International) A Diamond, Watch and Jewellery Trade Promotion Magazine provide dealers and manufactures with the key analytical information they need to succeed in the luxury industry. Pricing, availability and market information in the Magazine provides a critical edge.

All right reserved @HeeraZhaveraat.com

Design and developed by 24x7online.in