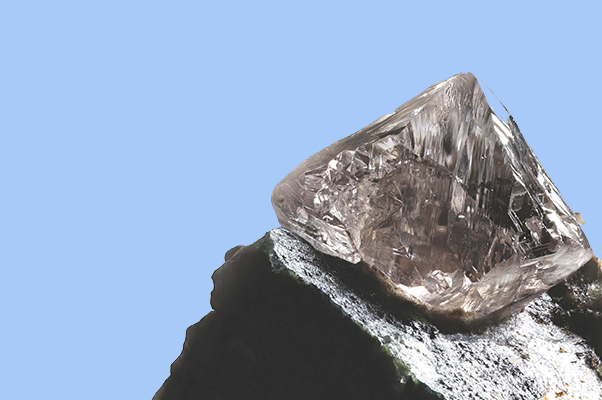

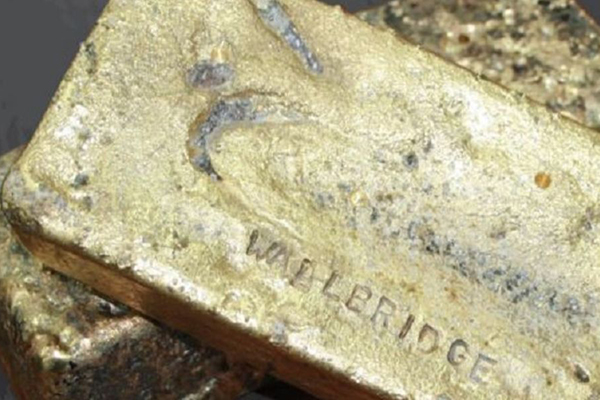

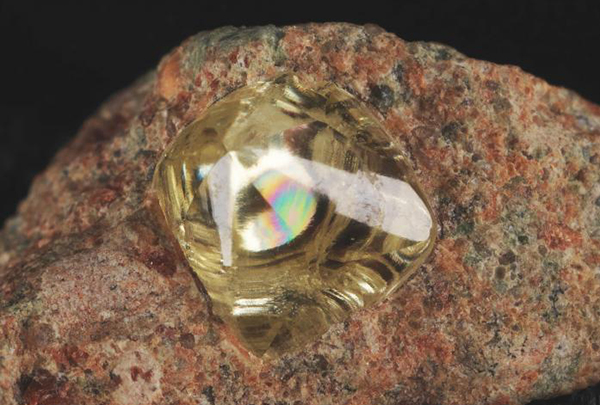

Cost savings target increased to more than US$30m per annum and entry into definitive transaction agreement for the sale of Koffiefontein! In line with its approach to building business resilience, Petra announces additional steps to reduce costs and provides an update of the sale of its interest in the Koffiefontein Diamond Mine (KDM).

Cost savings target increased to more than US$30m per annum and entry into definitive transaction agreement for the sale of Koffiefontein! In line with its approach to building business resilience, Petra announces additional steps to reduce costs and provides an update of the sale of its interest in the Koffiefontein Diamond Mine (KDM).

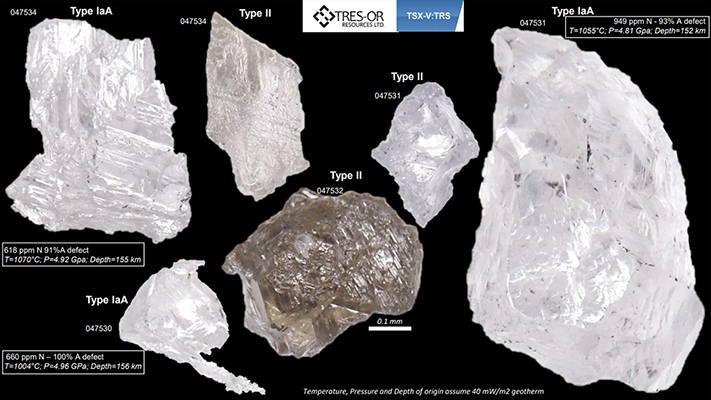

Richard Duffy, Petra’s Chief Executive Officer, said: “We remain on track to deliver the US$75 million of cash savings in FY 2024 as a result of capital deferrals and cost savings of circa US$10 million. The Company has further increased its cost savings target for FY 2025 to more than US$30 million per annum, on a sustainable basis going forward, across its South African operations, centralised services and overheads.

This cost rebase will align our group support structures with our more streamlined operational requirements and transition Petra to a more smoothed capital profile to enable sustainable net free cash flow generation, notwithstanding the continued slower recovery of the diamond market as a result of ongoing economic uncertainty and weakness in China.

Regular updates on the Company’s delivery against the US$30 million plus annualised cost savings target will be provided and an update on our revised Life of Mine Plans, incorporating our transition to a more smoothed capital profile, will be shared at the end of June 2024.

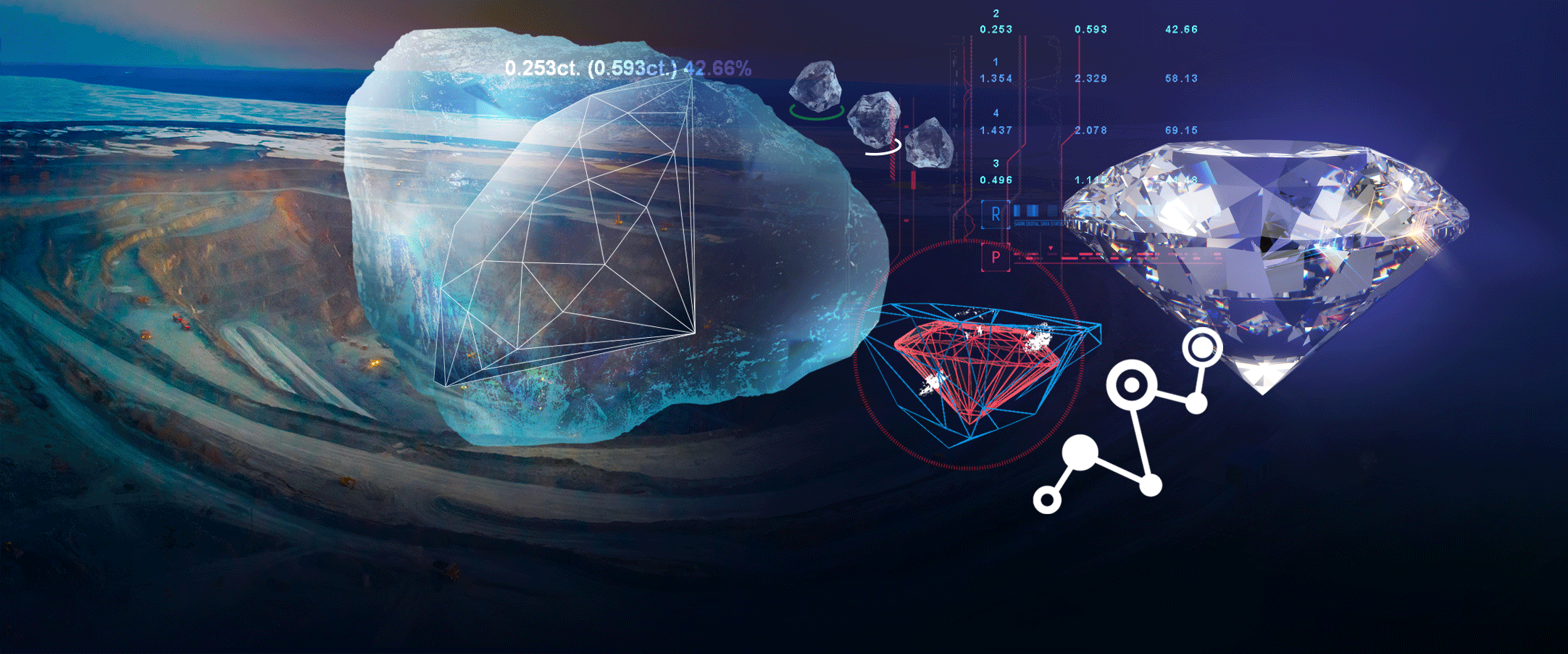

Since taking the decision to close Koffiefontein, Petra has remained committed to also exploring a responsible exit in consultation with its stakeholders. I am pleased that the sale agreement reached with Stargems will, once completed, provide ongoing economic activity in the region.

We believe Stargems has the technical and financial capability to conduct operations in a responsible manner for all stakeholders. We look forward to working closely with the DMRE, employees, community representatives and other key stakeholders in completing the sale. As a result of this transaction, Petra will avoid incurring closure-related costs of US$15-18 million included in the Company’s 31 December 2023 balance sheet provisions.ʺ

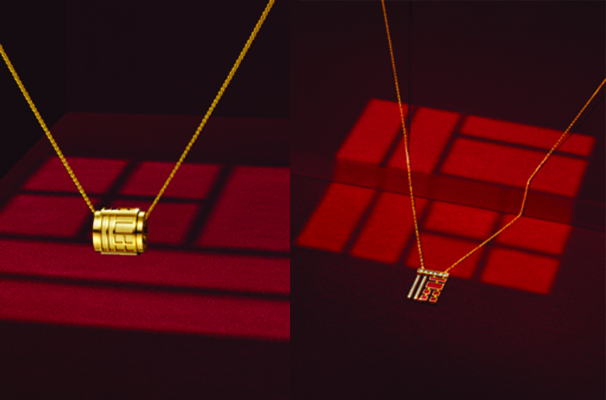

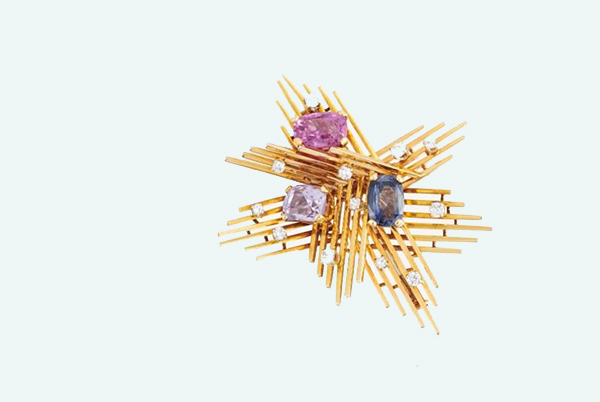

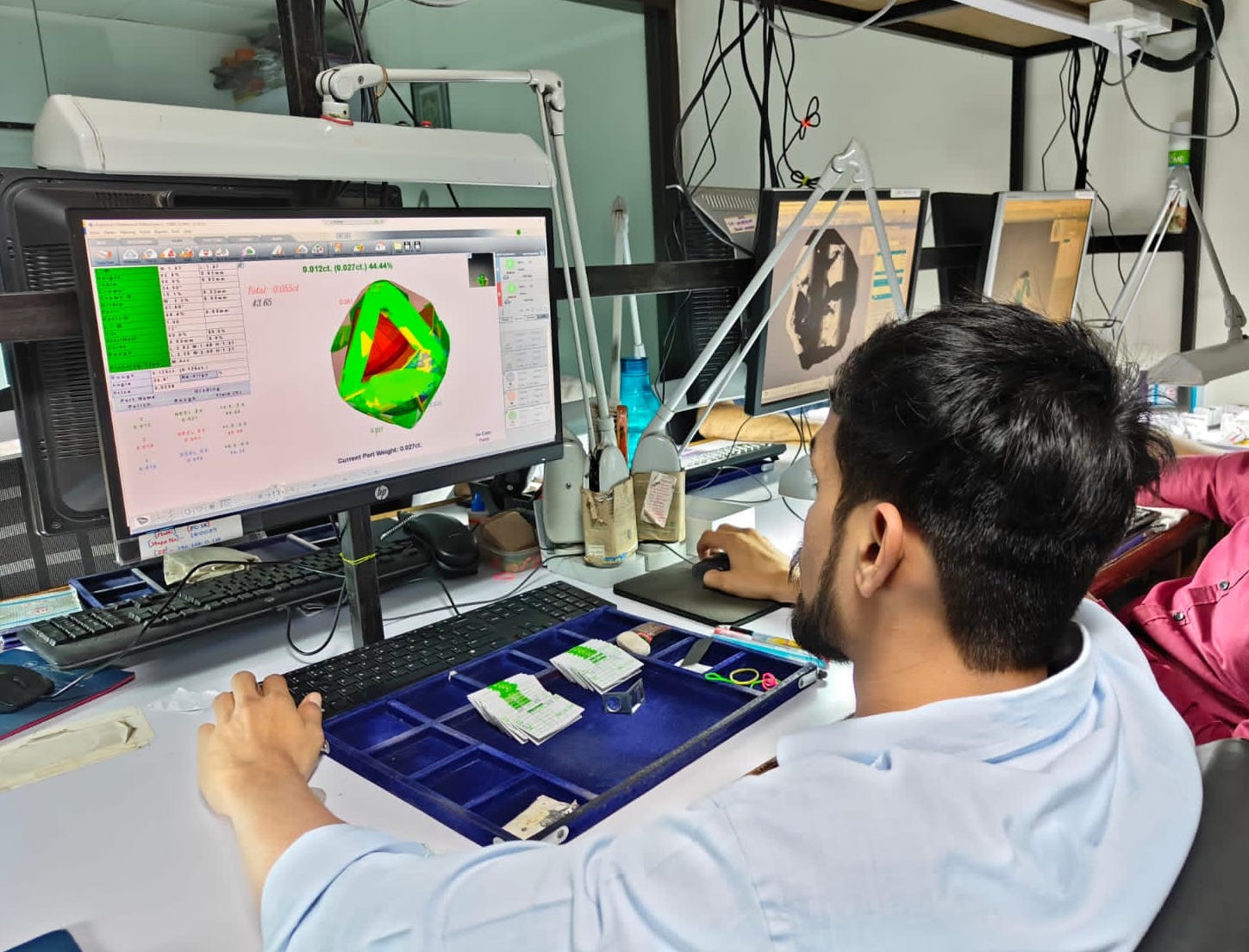

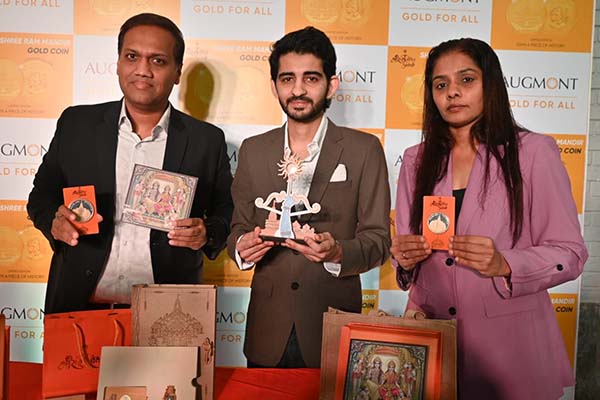

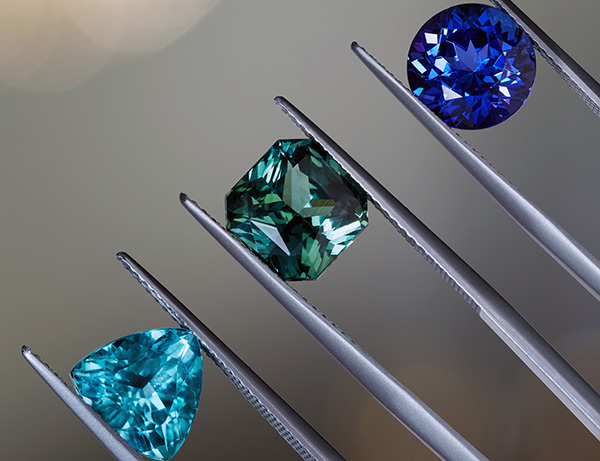

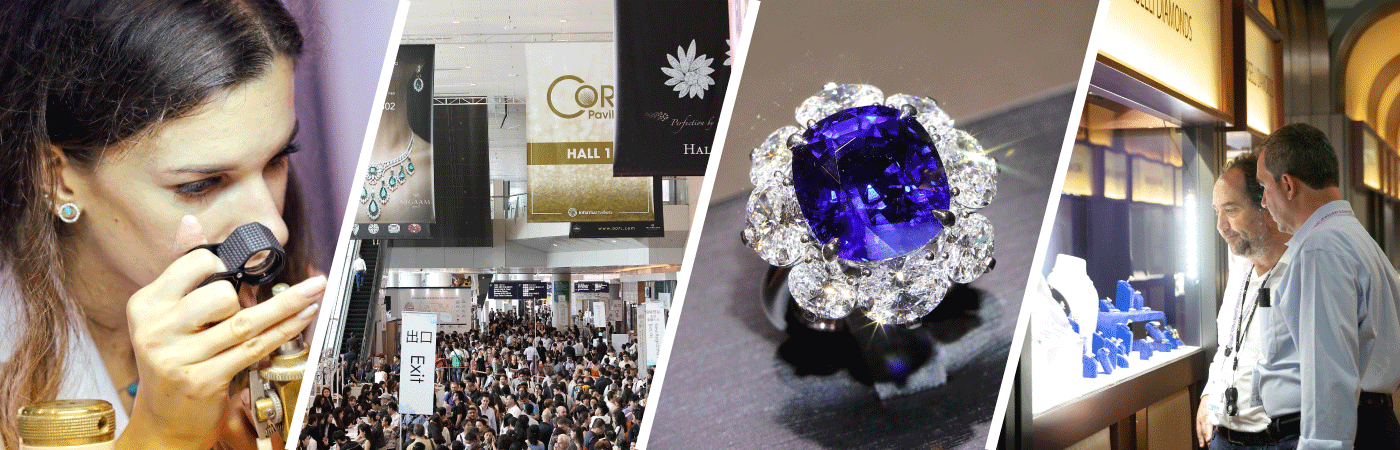

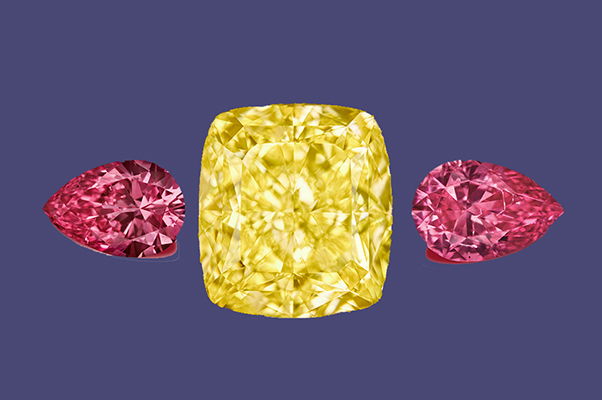

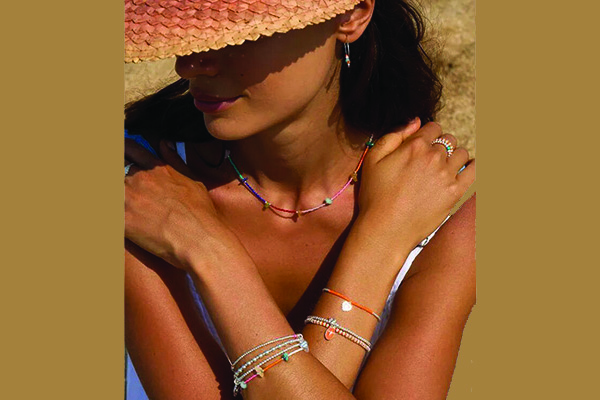

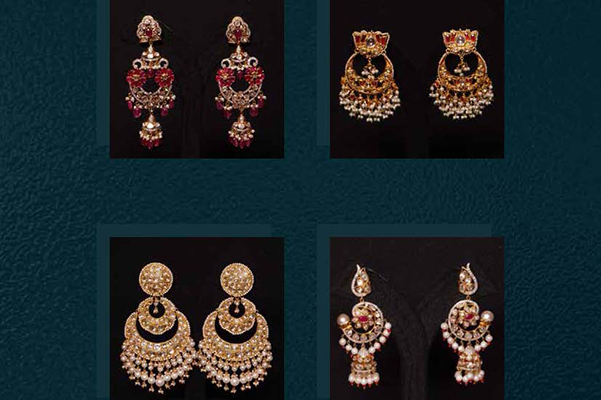

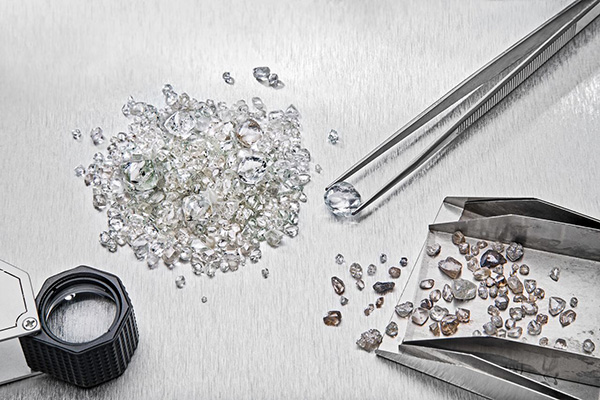

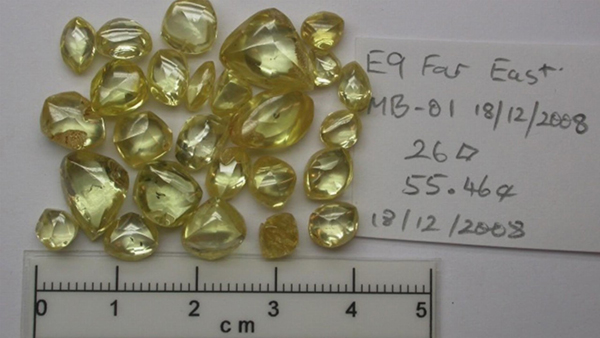

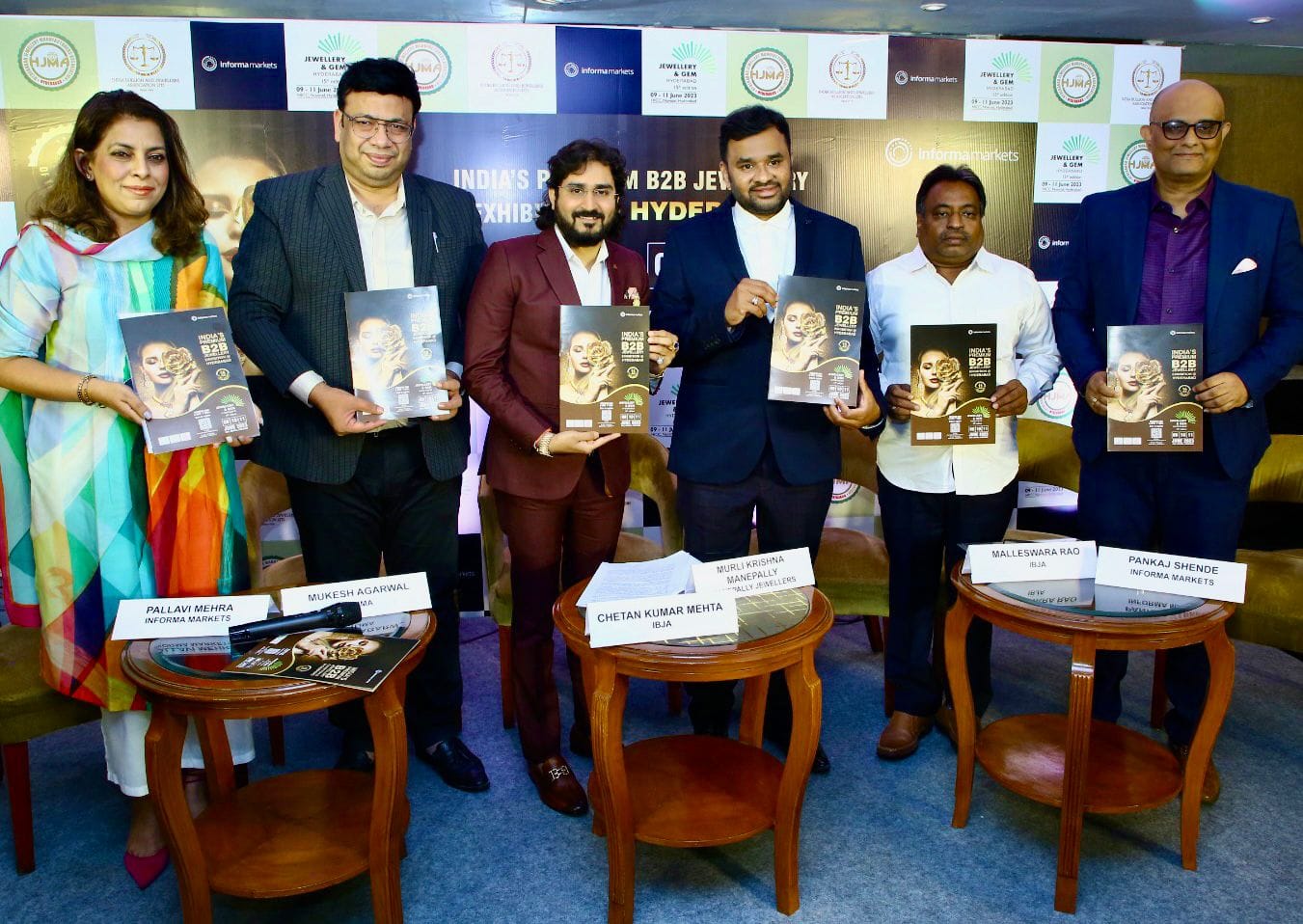

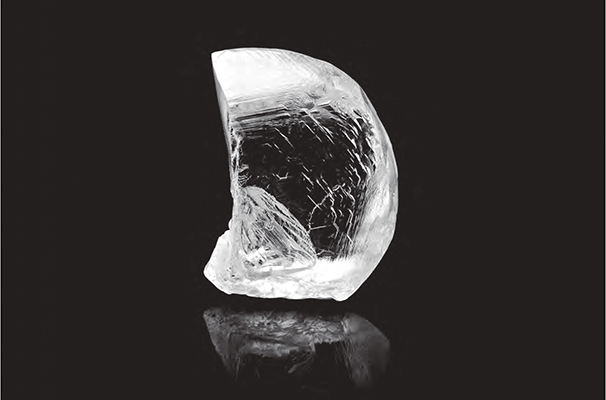

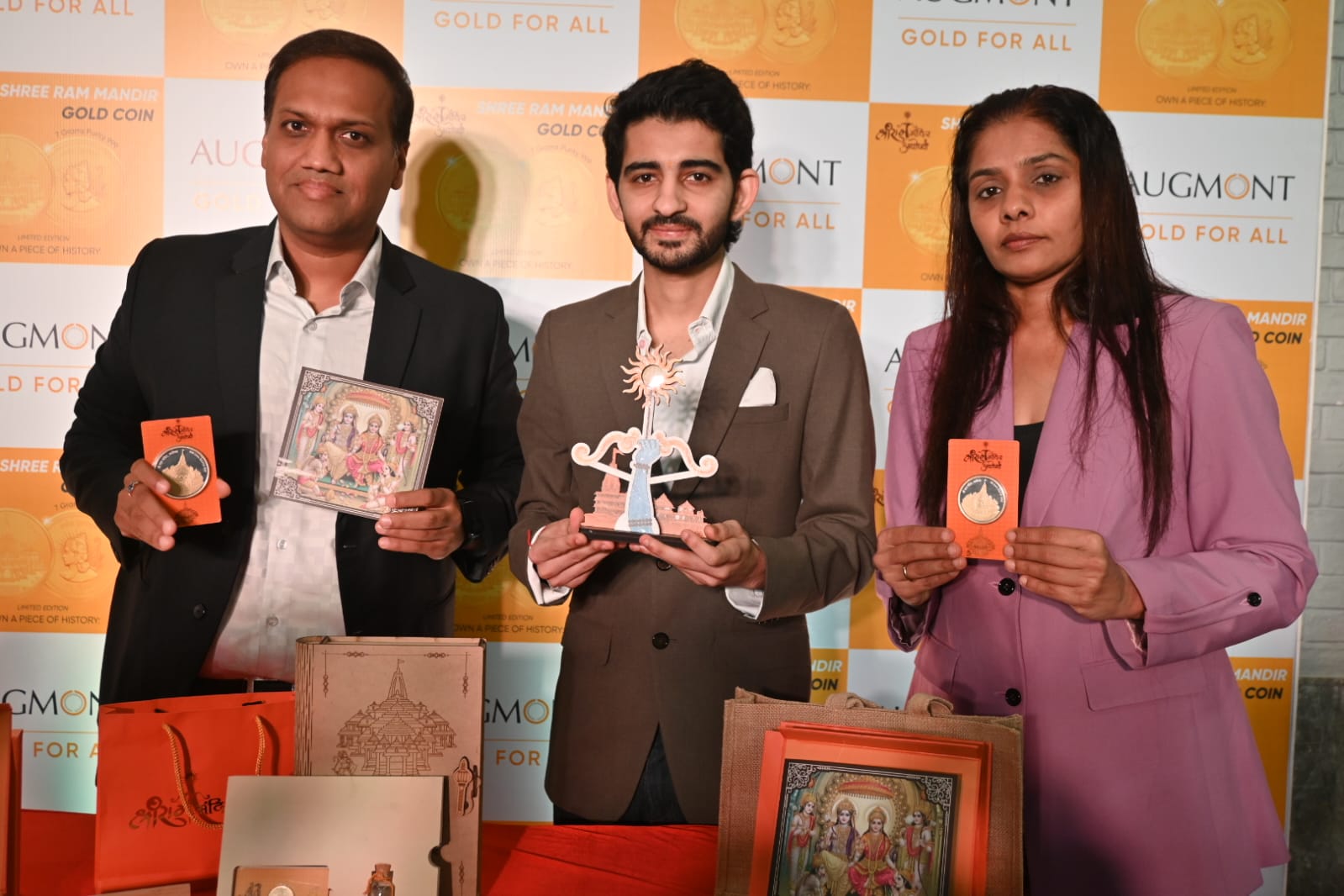

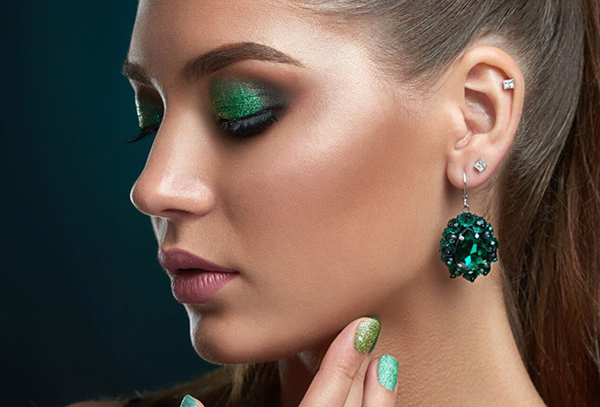

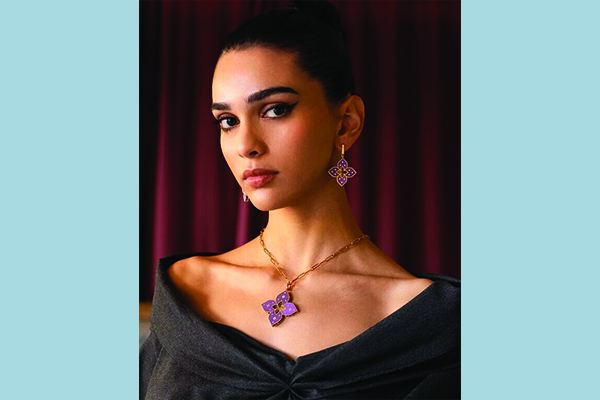

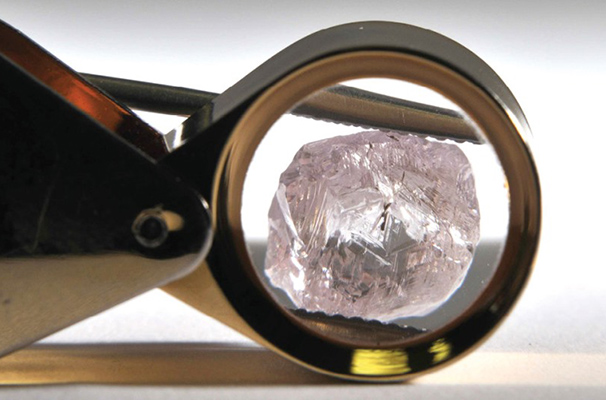

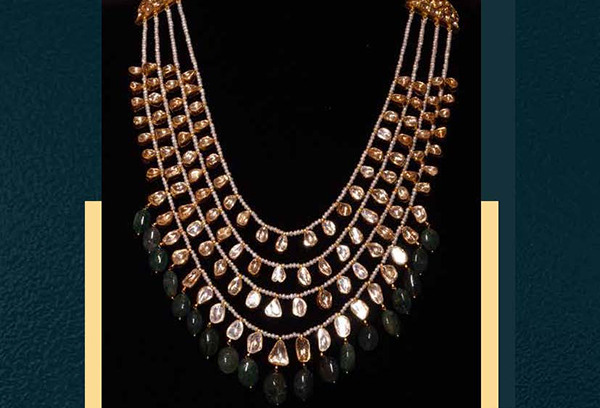

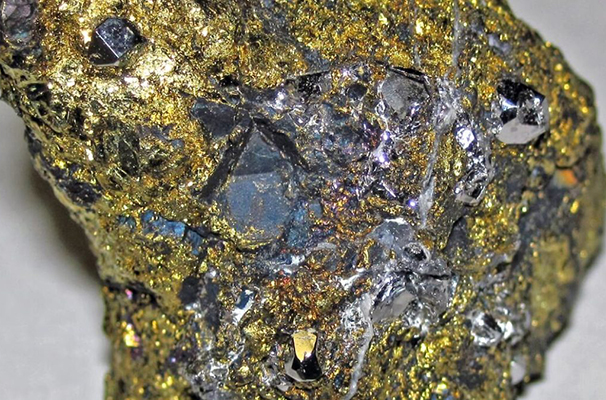

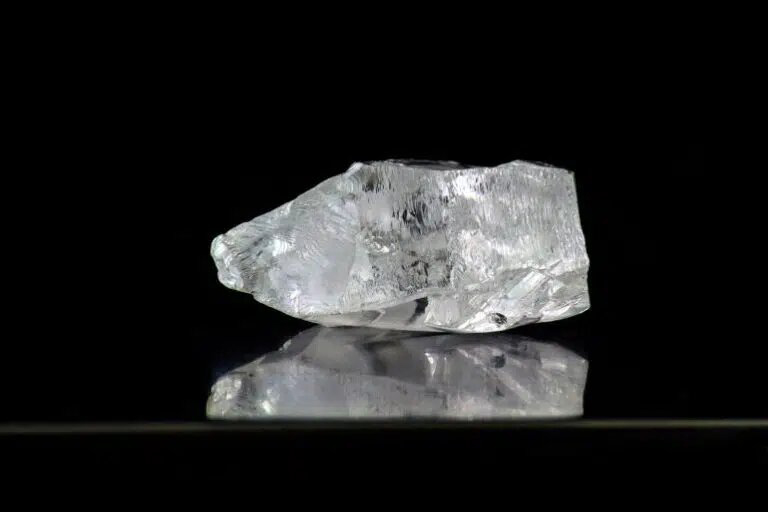

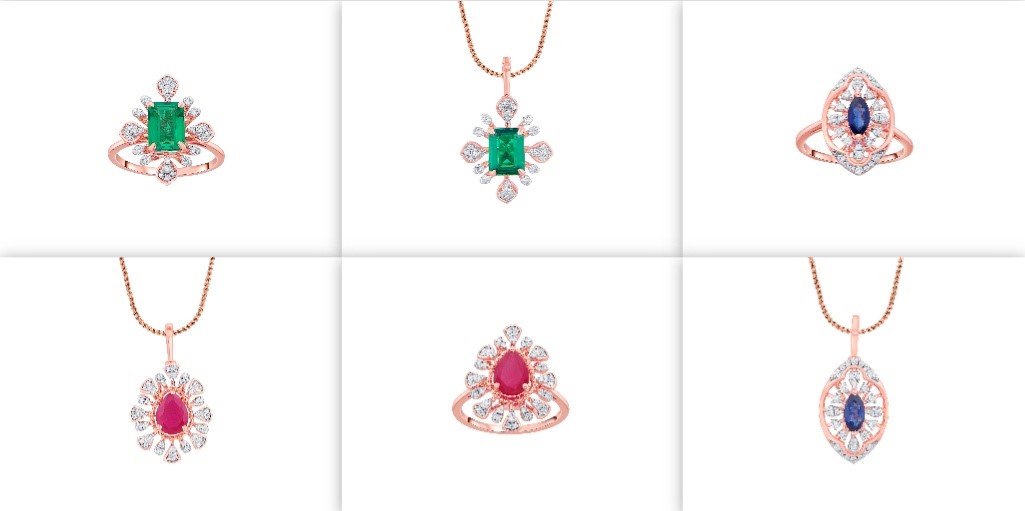

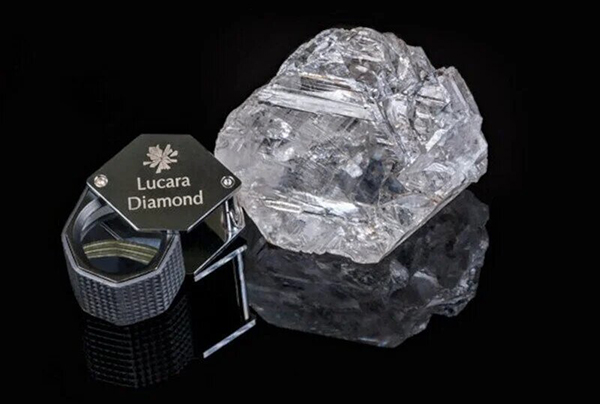

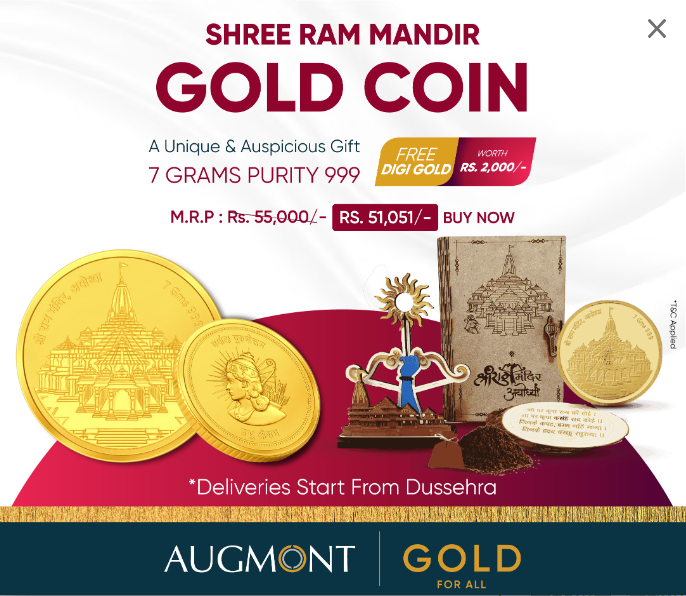

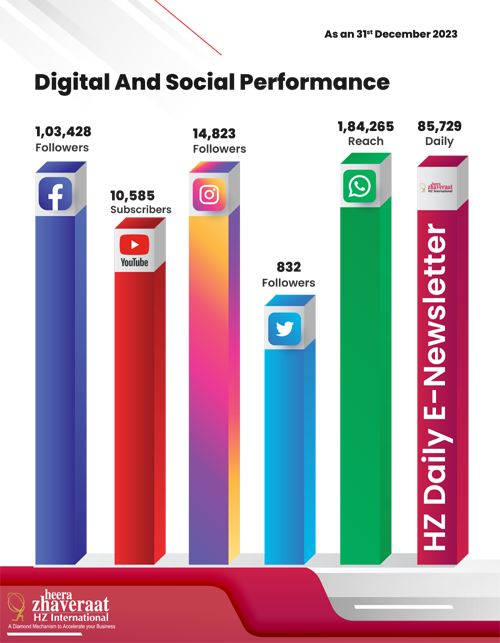

Heera Zhaveraat (HZ International) A Diamond, Watch and Jewellery Trade Promotion Magazine provide dealers and manufactures with the key analytical information they need to succeed in the luxury industry. Pricing, availability and market information in the Magazine provides a critical edge.

All right reserved @HeeraZhaveraat.com

Design and developed by 24x7online.in