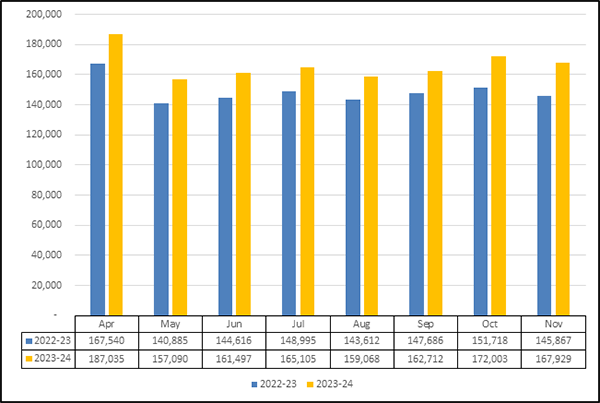

World Gold Council (WGC) publishes the report, Gold Market Primer Market size and structure! Gold is an attractive means of helping investors diversify their portfolios. Its relative scarcity supports its long-term investment appeal. But its market size is large enough to make it relevant for a wide variety of investors, from individuals to institutions and central banks.

This Primer gives an overview of the available above-ground stock of gold, the relative size of the financial gold market, and the composition of demand and supply that supports gold’s investment credentials. The report said:

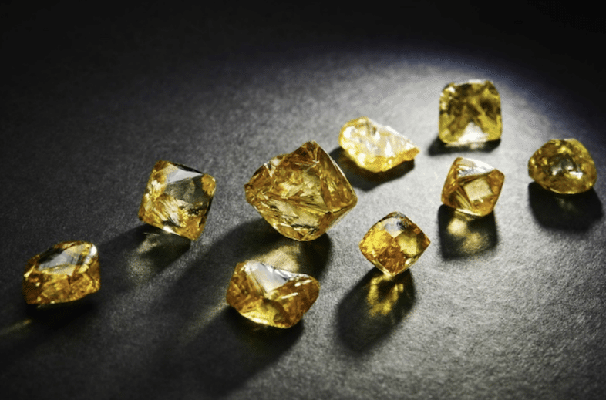

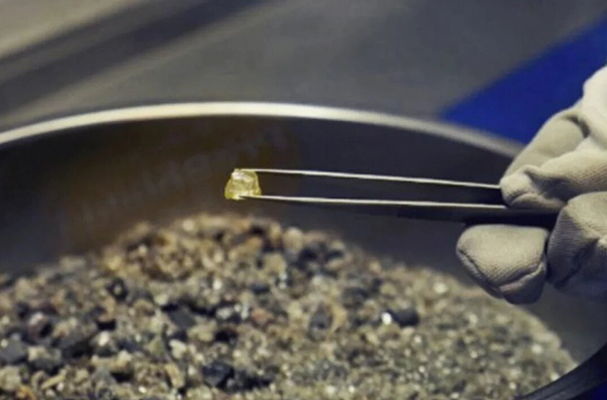

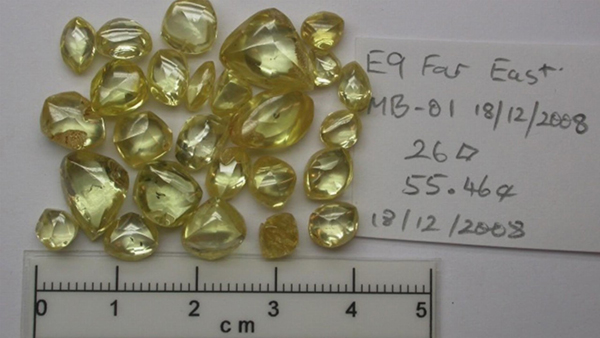

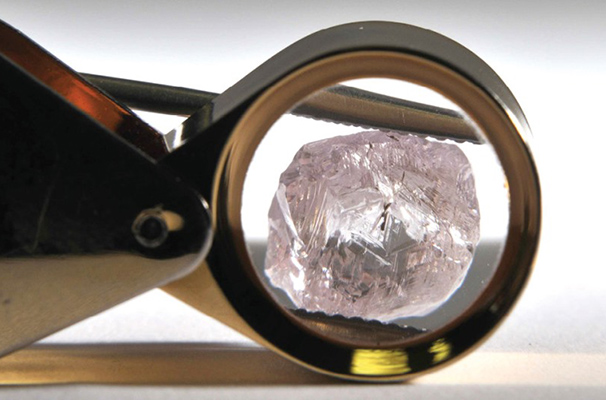

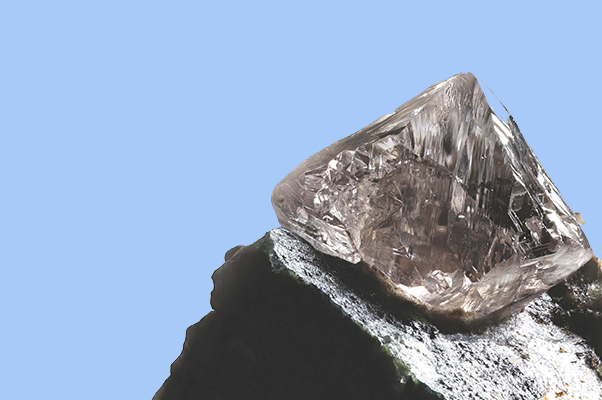

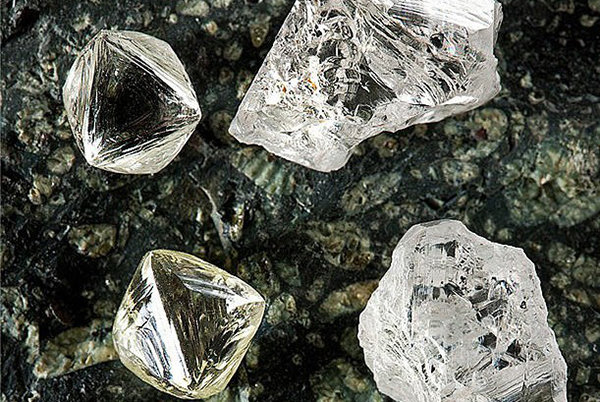

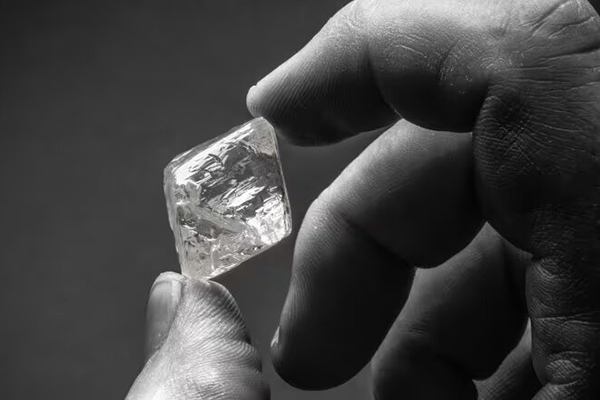

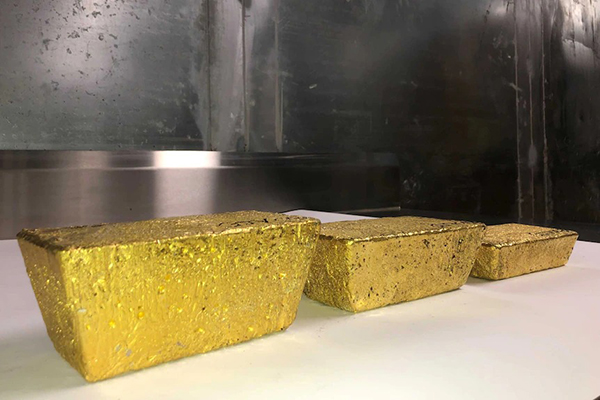

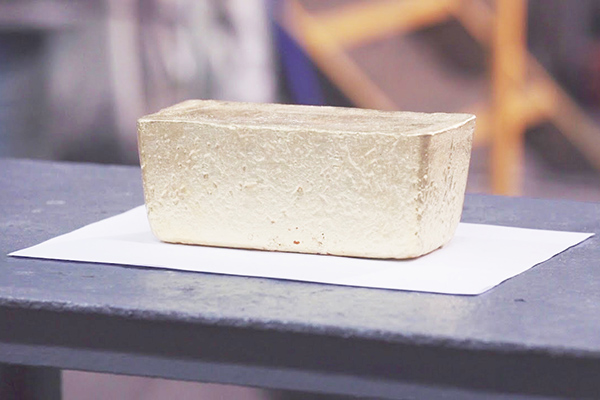

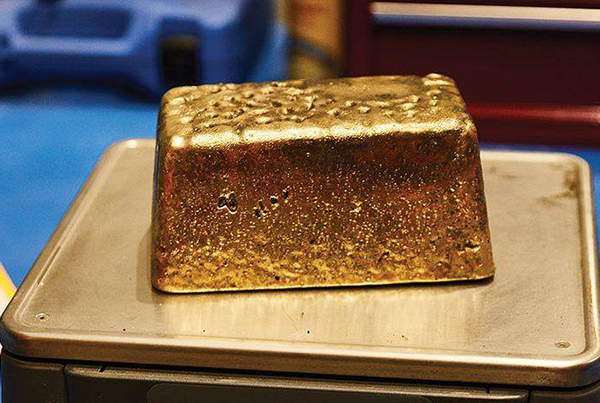

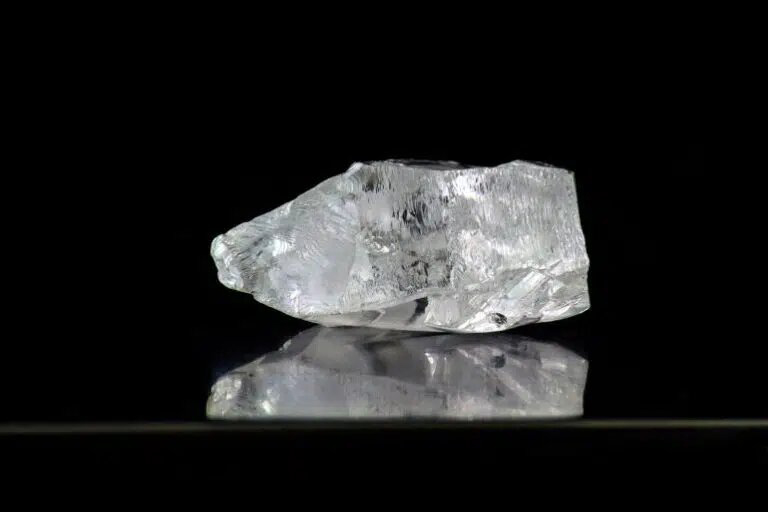

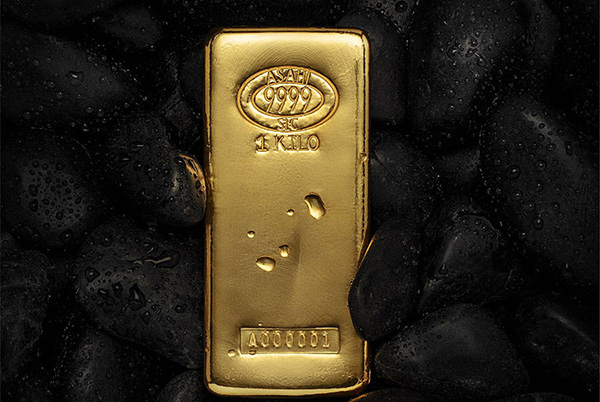

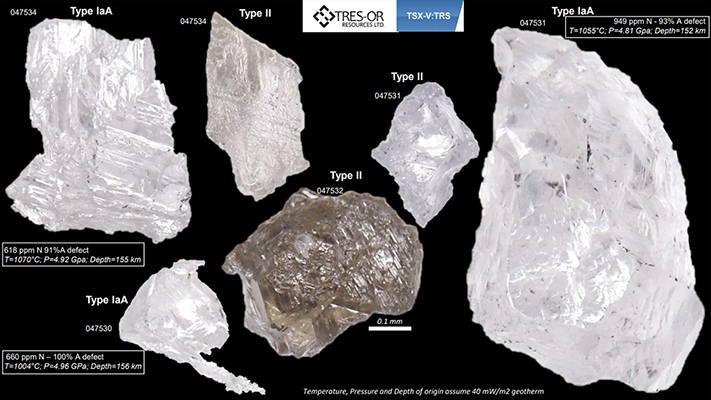

1: We estimate that approximately 209,000 tonnes of gold – worth US$12tn – have been mined throughout history.

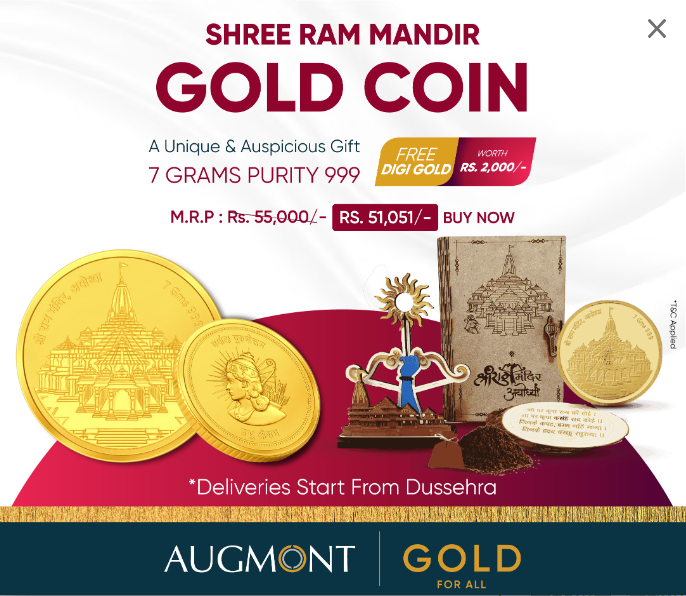

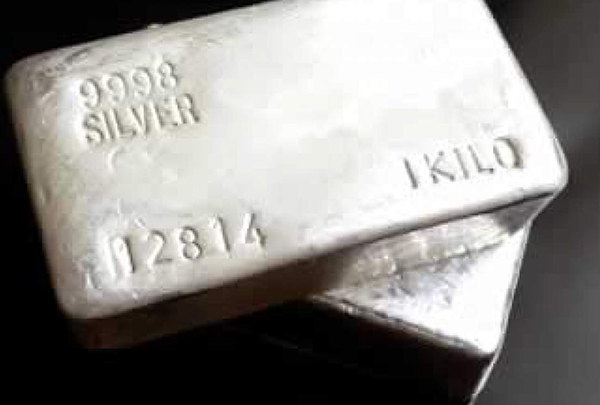

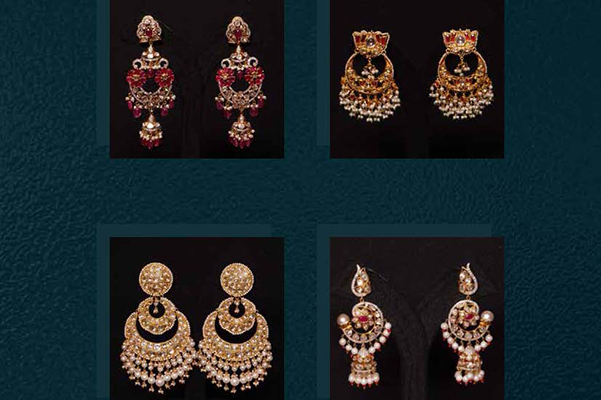

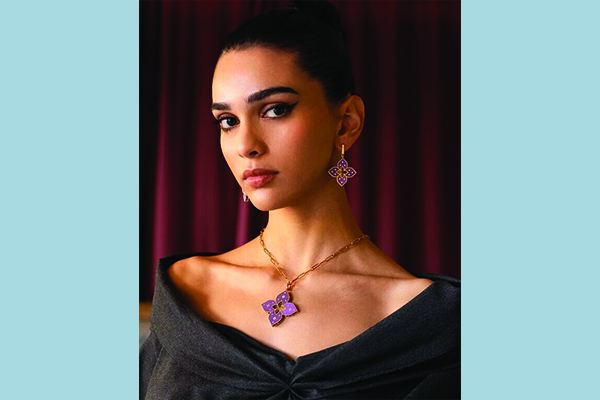

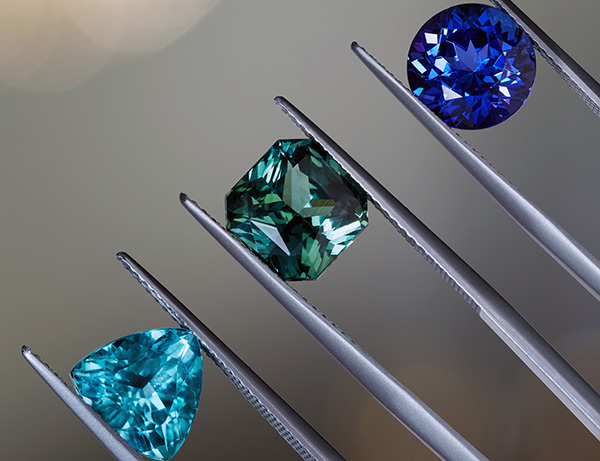

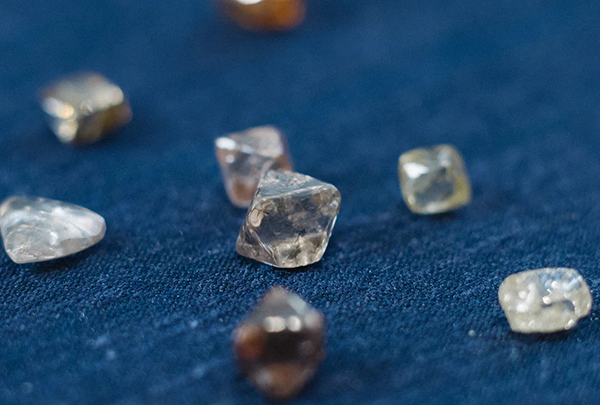

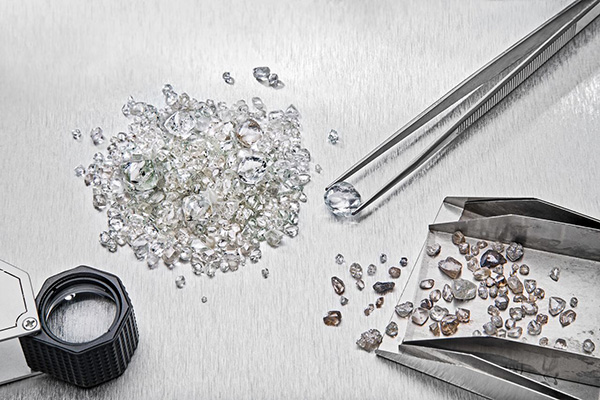

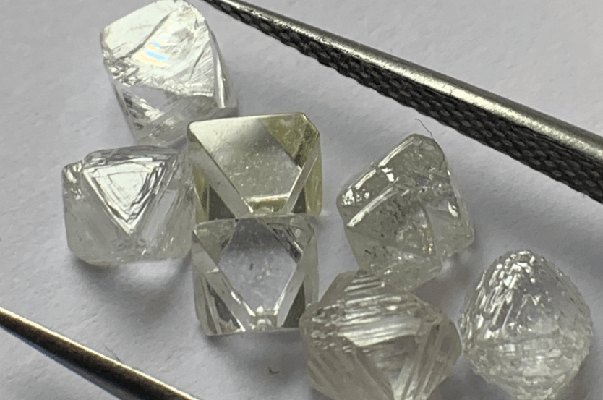

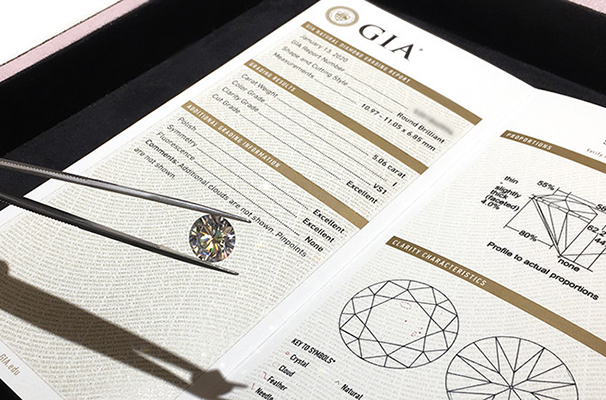

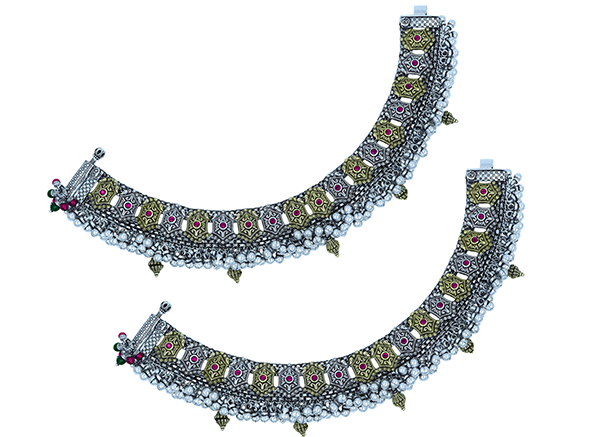

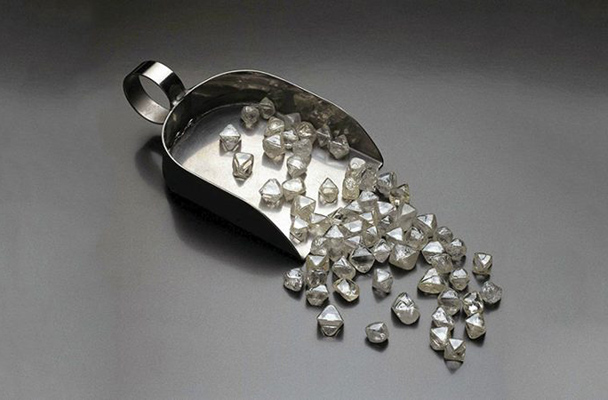

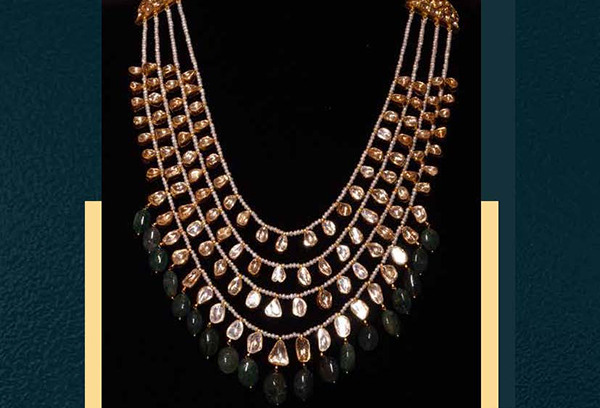

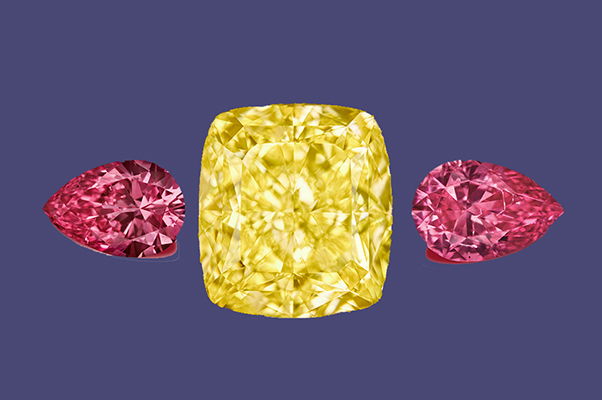

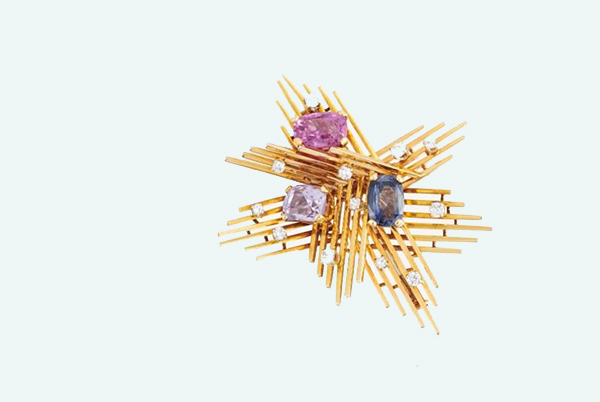

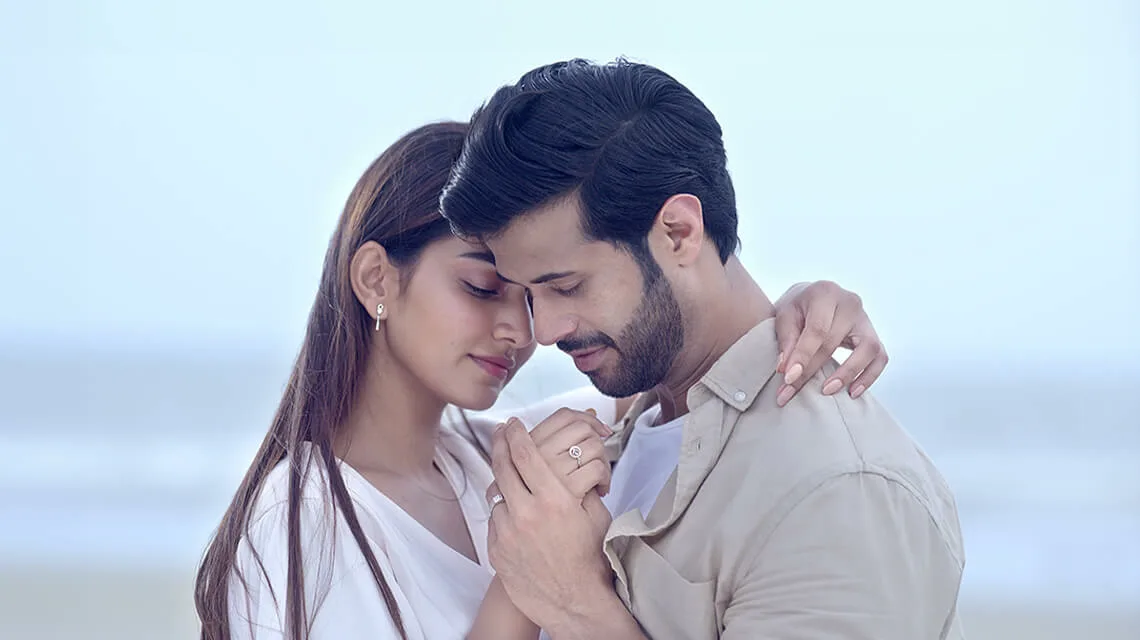

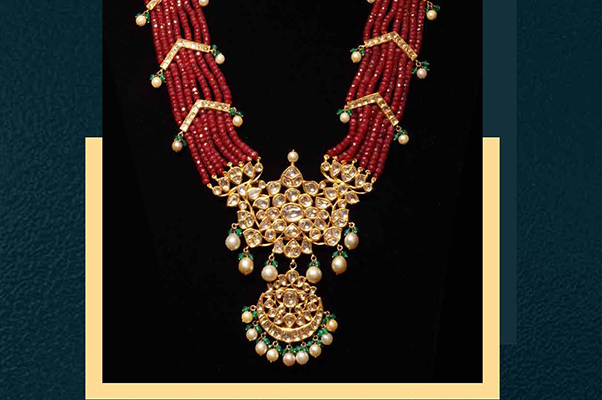

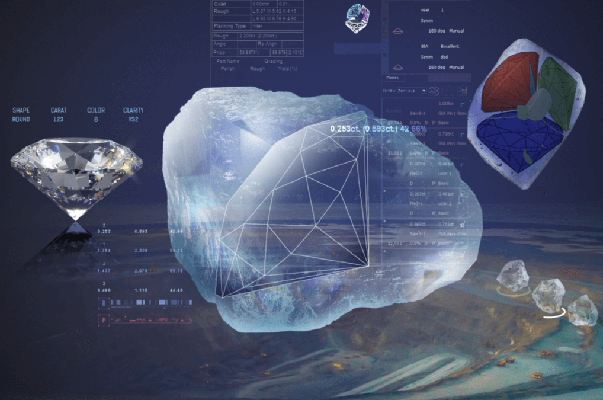

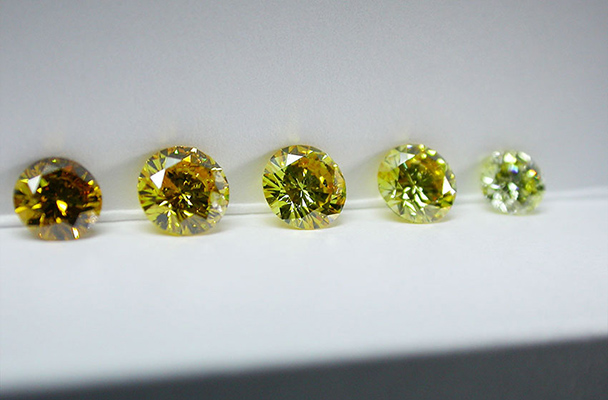

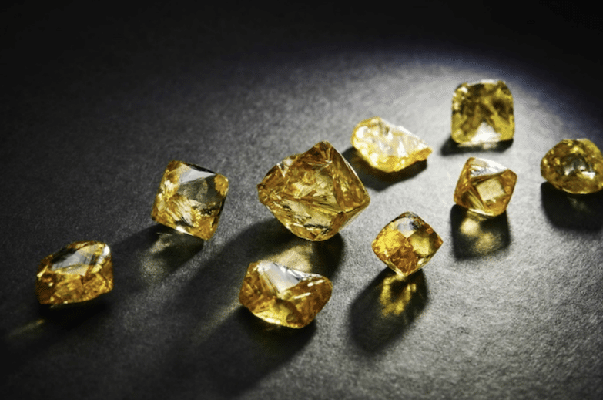

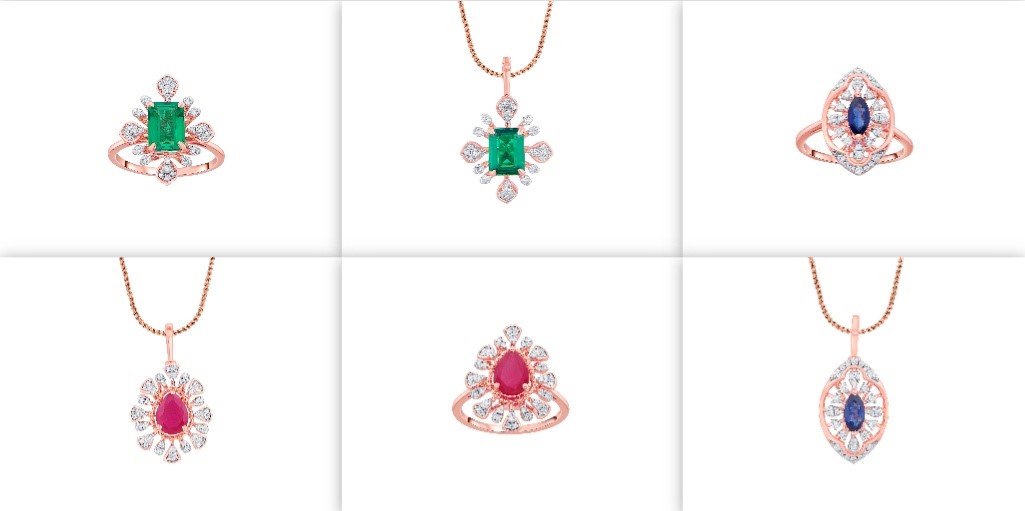

2: Jewellery makes up almost half of these above ground stocks, while gold in investment form (bars, coins and physically backed gold ETFs) accounts for almost a quarter,

3: The physical financial gold market – made up of bars, coins, gold ETFs and central bank reserves – is worth nearly US$5tn, almost 40% of the total.

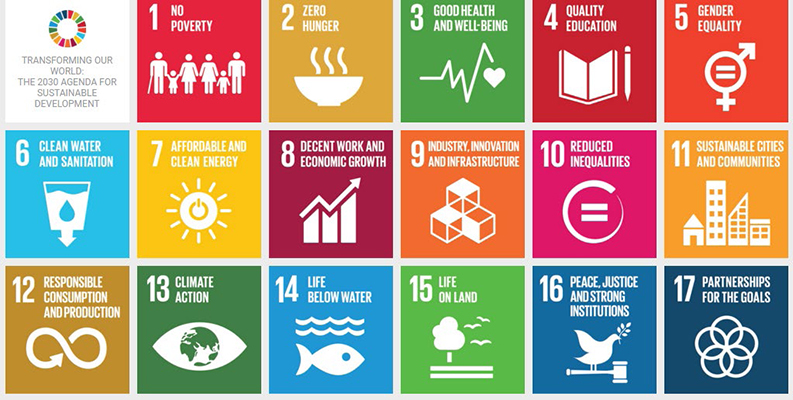

4: The size of the market means it can absorb large purchases by, and sales from, institutional investors and central banks without resulting in price distortions & 5: In addition, diversity underpins the stability of the gold market. Over the last three decades alone, dramatic shifts in the sources of demand and supply-both sectoral and geographic, have created a more diverse market.

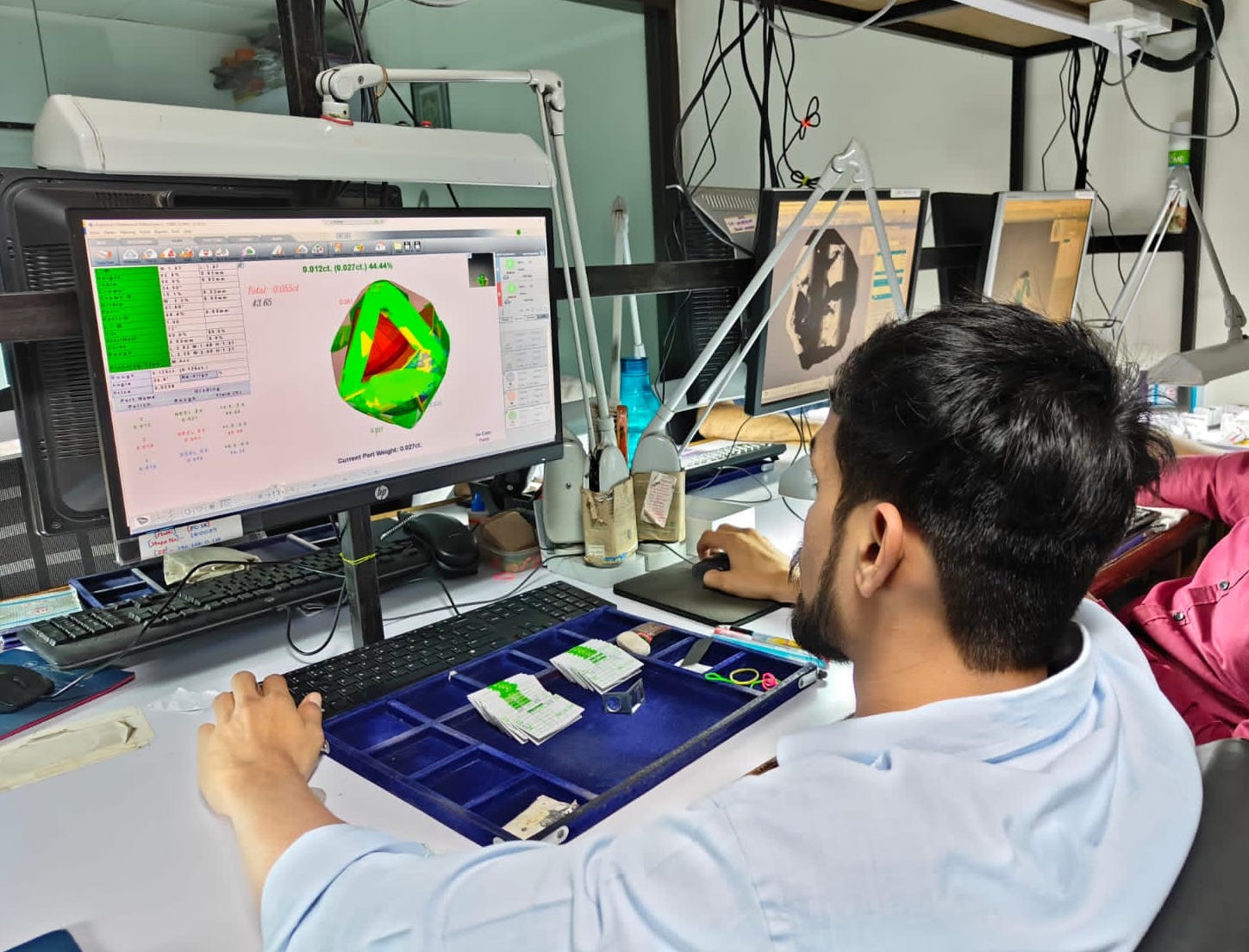

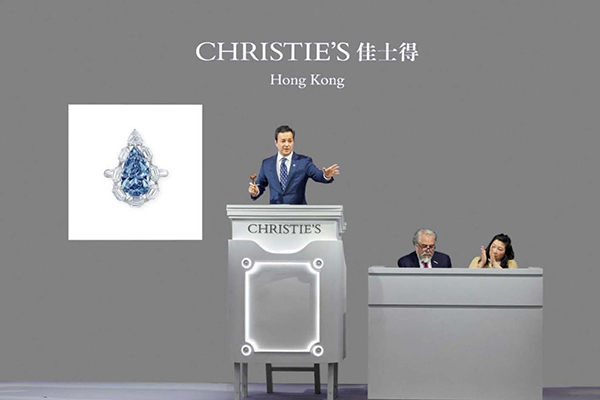

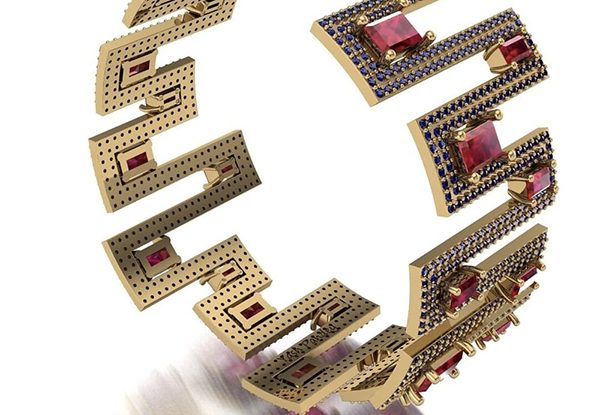

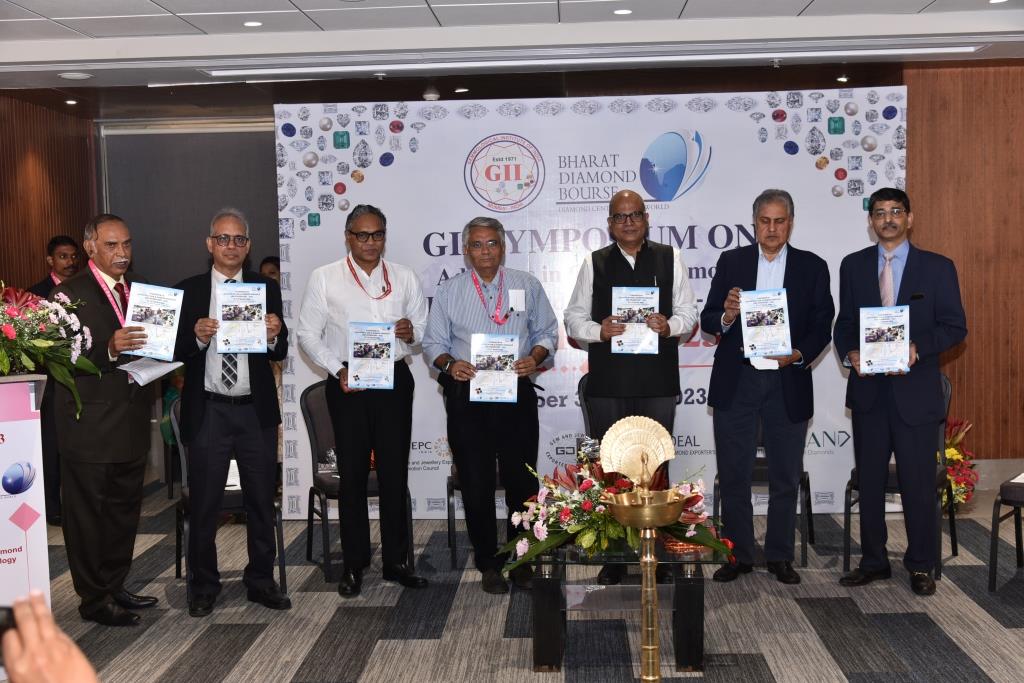

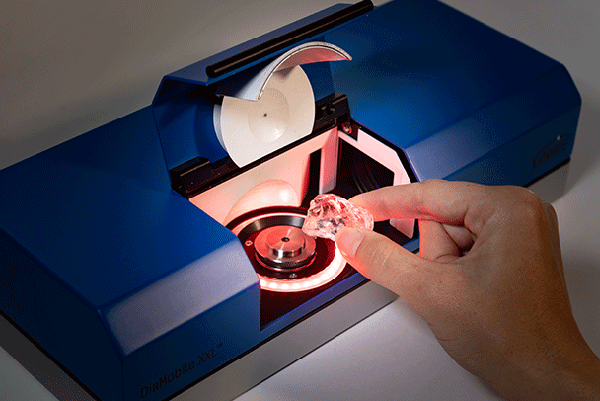

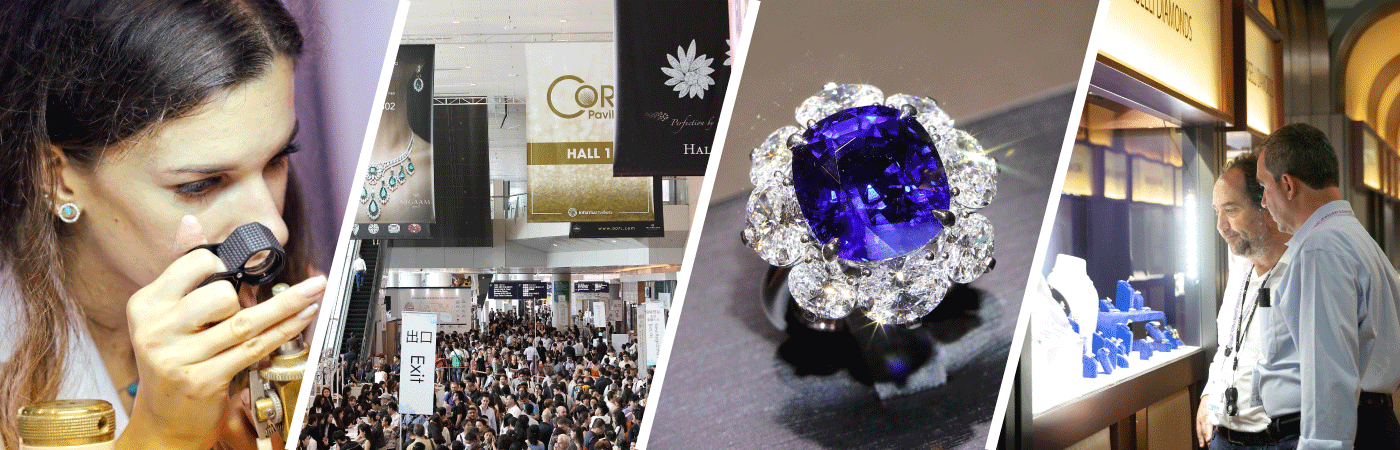

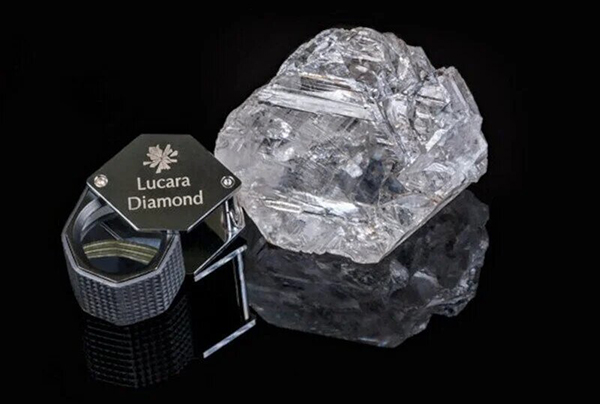

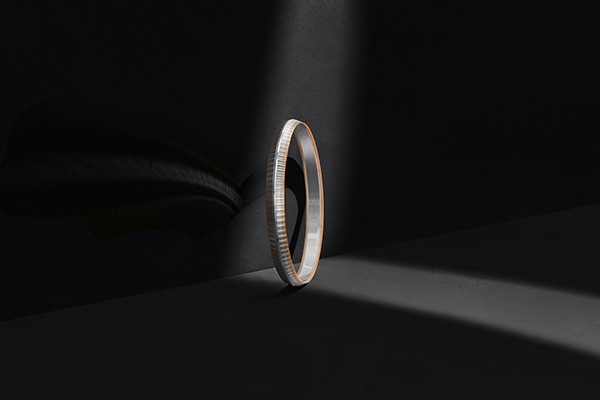

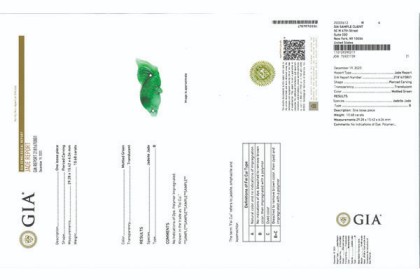

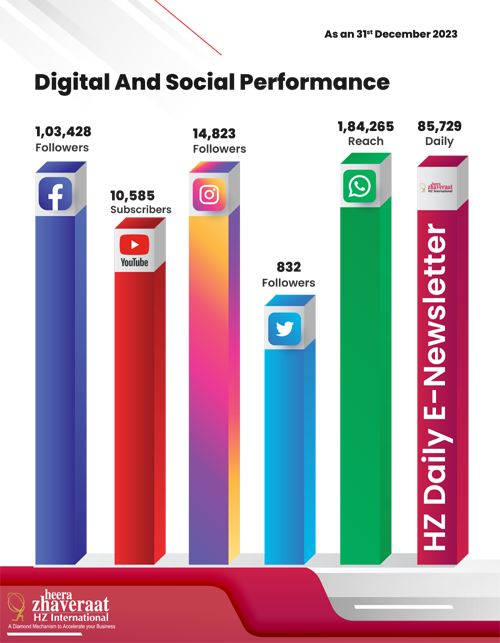

Heera Zhaveraat (HZ International) A Diamond, Watch and Jewellery Trade Promotion Magazine provide dealers and manufactures with the key analytical information they need to succeed in the luxury industry. Pricing, availability and market information in the Magazine provides a critical edge.

All right reserved @HeeraZhaveraat.com

Design and developed by 24x7online.in