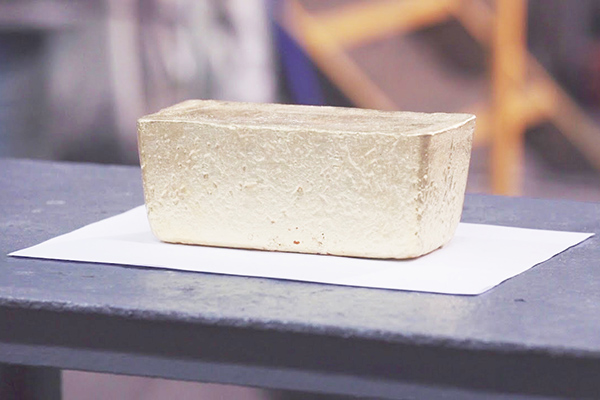

Some themes that have characterised the past couple of years are expected to continue into 2024. Supply is expected to remain subdued in 2024, albeit higher than in 2023. Automotive demand is expected to continue increasing, as platinum for palladium substitution growth offsets a decline in production of vehicles containing an autocatalyst.

Some themes that have characterised the past couple of years are expected to continue into 2024. Supply is expected to remain subdued in 2024, albeit higher than in 2023. Automotive demand is expected to continue increasing, as platinum for palladium substitution growth offsets a decline in production of vehicles containing an autocatalyst.

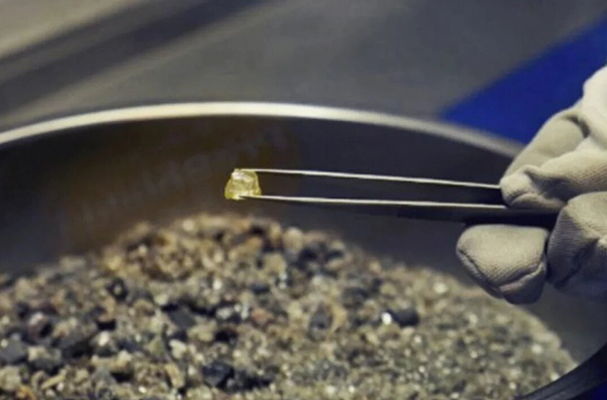

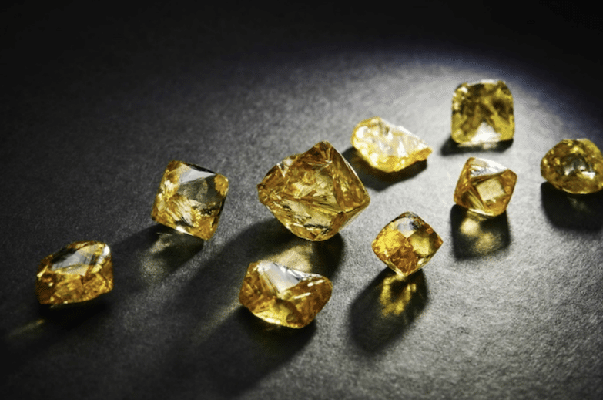

A reduction of industrial demand from record levels and an anticipated challenging investment demand outlook lead to a lower forecast total platinum demand versus 2023. Combining higher supply with weaker demand reduces the market deficit from 1,071 koz in 2023 to 353 koz in 2024, or 5% of demand.

However, there are downside risks to supply and upside potential to investment demand which are not captured in our 2024 forecasts. During 2024, mined platinum supply is expected to increase across all regions except Russia (-50 koz), where smelter maintenance planned for 2023 has been deferred to 2024.

South African production is forecast to be 5% (+194 koz) higher than in 2023 as producers face less smelter maintenance downtime and electricity shortages are expected to reduce with the re-commissioning of generating capacity at the Kusile Power Station. North America (+35 koz) is the second largest contributor to higher mined supply, as operational challenges ease.

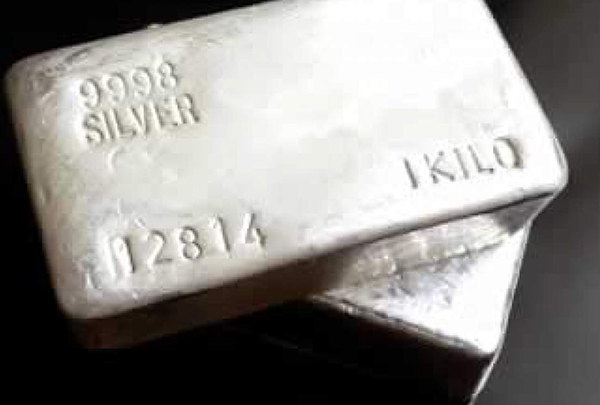

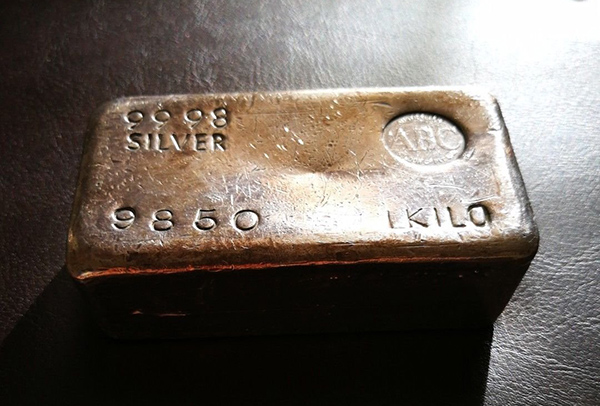

Total 2024 mined platinum supply is forecast to increase by 2% year-on-year to 5,743 koz. Recycling supply is forecast to increase by 7% year-on-year in 2024, on a recovery in end-of-life scrap vehicle availability, but still remaining constrained versus historical recycling rates.

Total platinum supply of 7,310 koz is 9% lower than the average supply of the five years prior to Covid-19, with downside risks to both mined supply and recycling supply from the challenging operating environment in South Africa, as well as a potential for a more prolonged shortage of end-of-life vehicles.

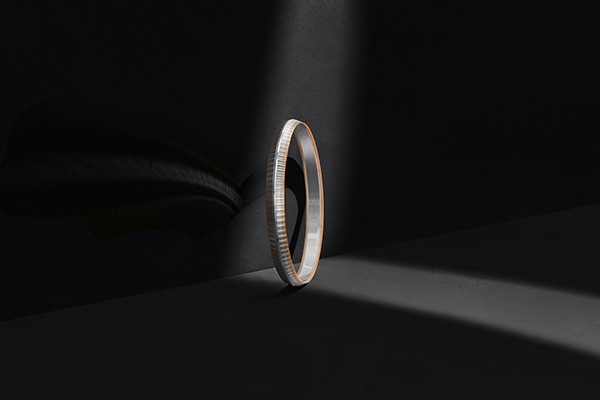

Platinum demand is forecast to decrease by 6% year-on-year in 2024. Growth in demand from the automotive and jewellery markets is expected to be offset by lower industrial and investment demand, albeit industrial demand is still expected to remain at historically strong levels.

In the light-duty automotive market, ICE vehicle production is expected to fall from 78 to 77 million units, reflecting the continued growth of the battery electric vehicle (BEV) market share. Despite this, automotive demand for platinum is expected to grow by 2% (+50 koz) year-on-year, on ongoing platinum for palladium substitution.

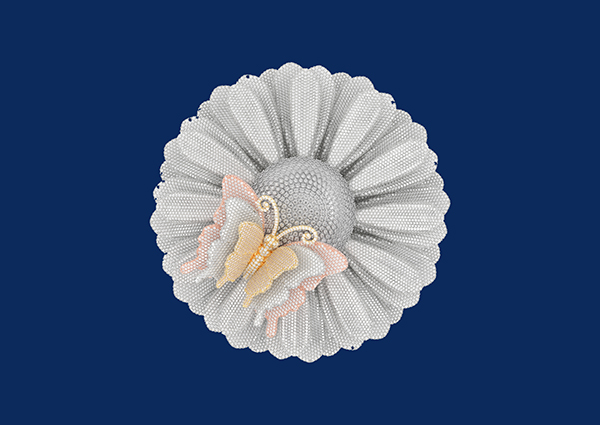

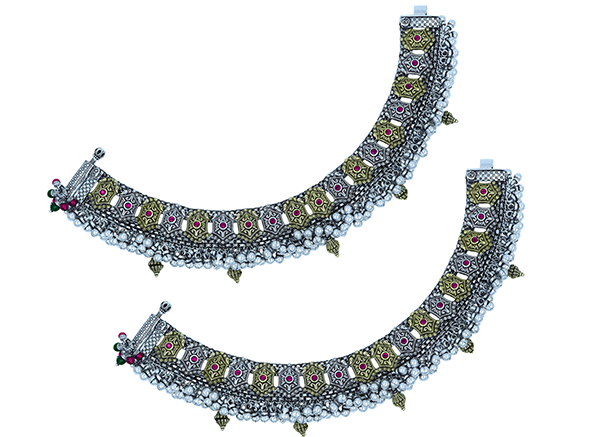

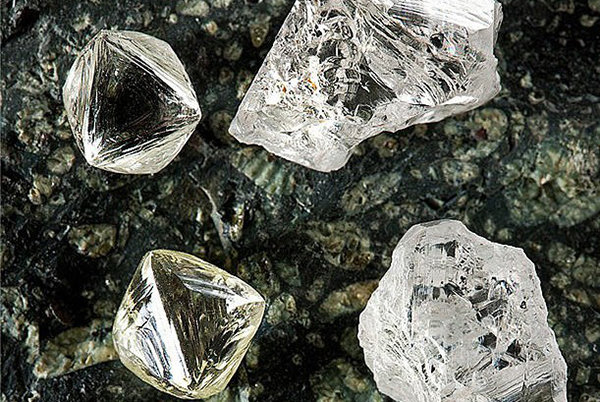

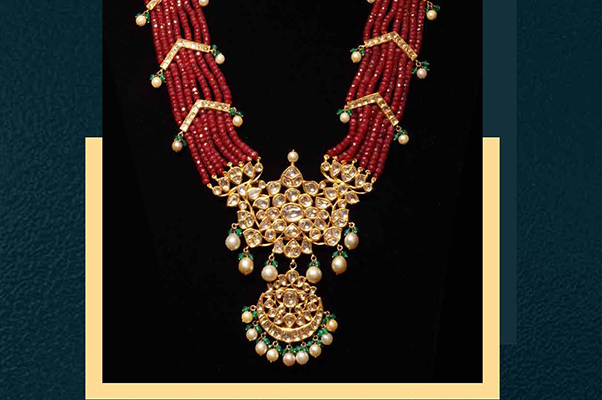

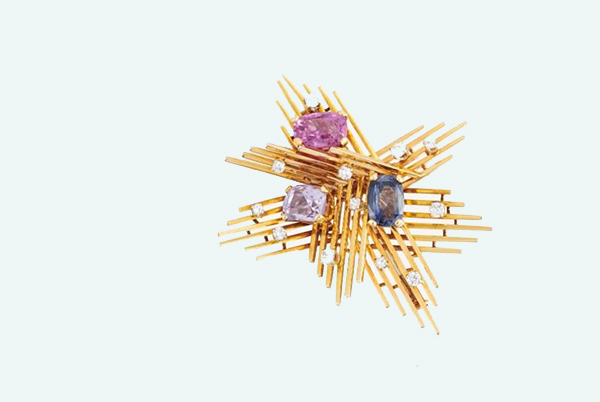

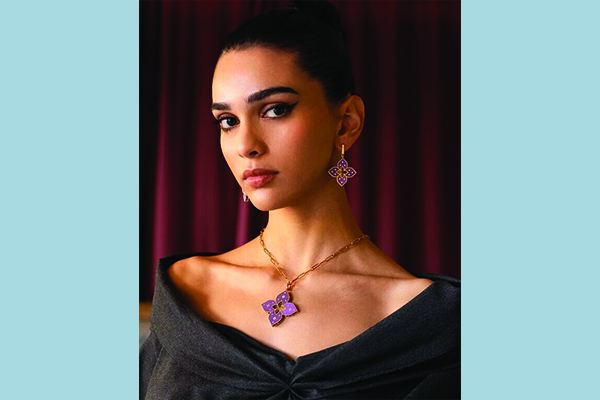

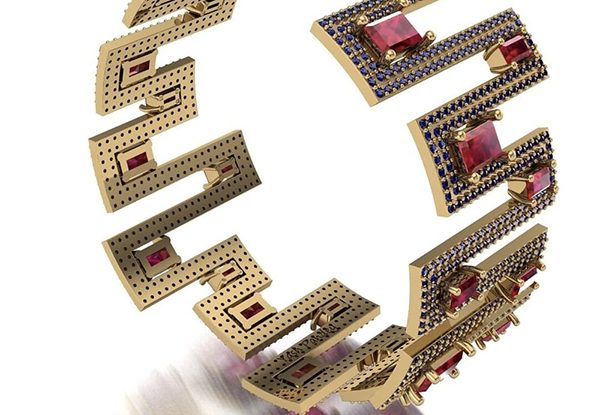

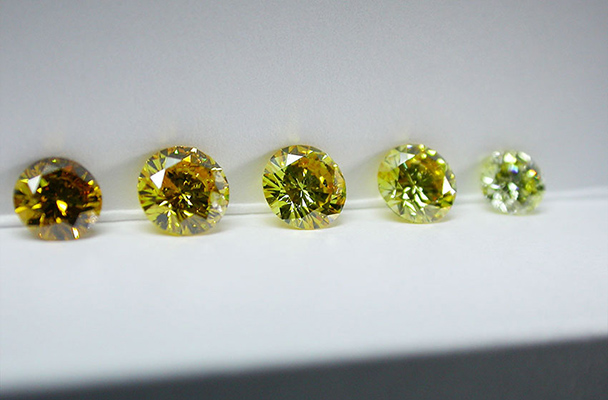

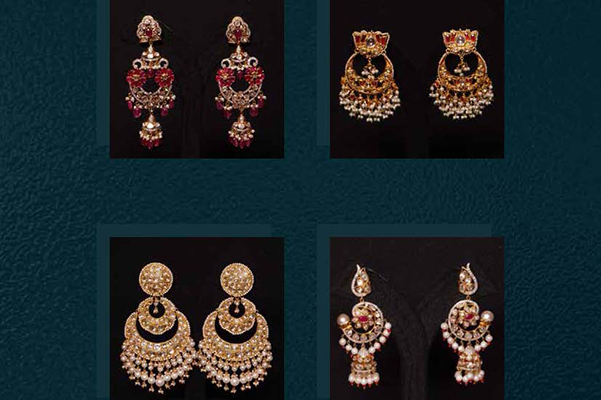

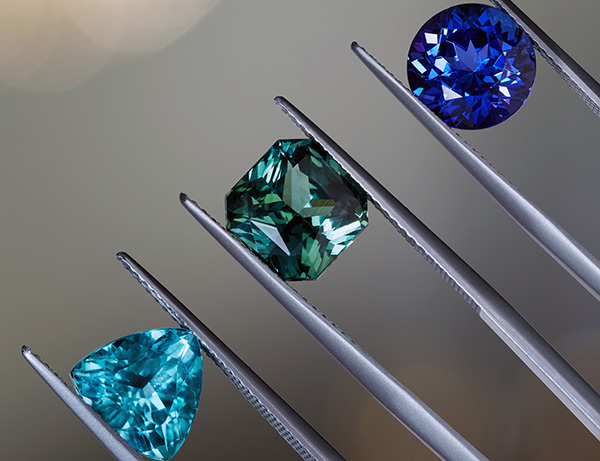

The jewellery market will benefit from demand growth in India and Japan and a modest recovery in China. While industrial platinum demand is forecast to decrease 285 koz versus 2023, demand is coming off record levels in 2023, and the 2024 forecast of 2,367 koz still represents annualised demand growth of 3.7% CAGR since 2013.

Investment demand of 82 koz in 2024 is negatively impacted by a 170 koz swing in ETF demand to negative 120 koz in 2024, as well as a weaker outlook for bar and coin, partially offset by inflows of 30 koz into exchange stocks. The global platinum market will record a second year of deficits at 353 koz representing a continuation of tight fundamentals.

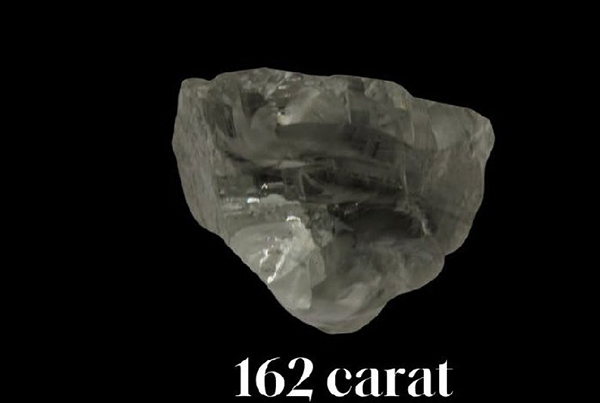

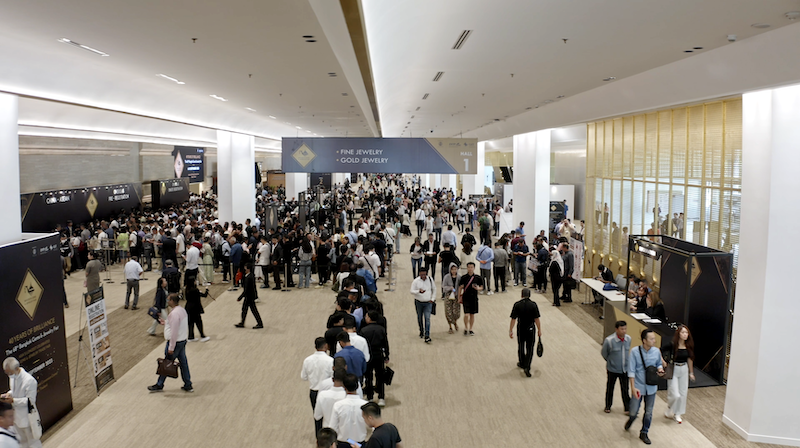

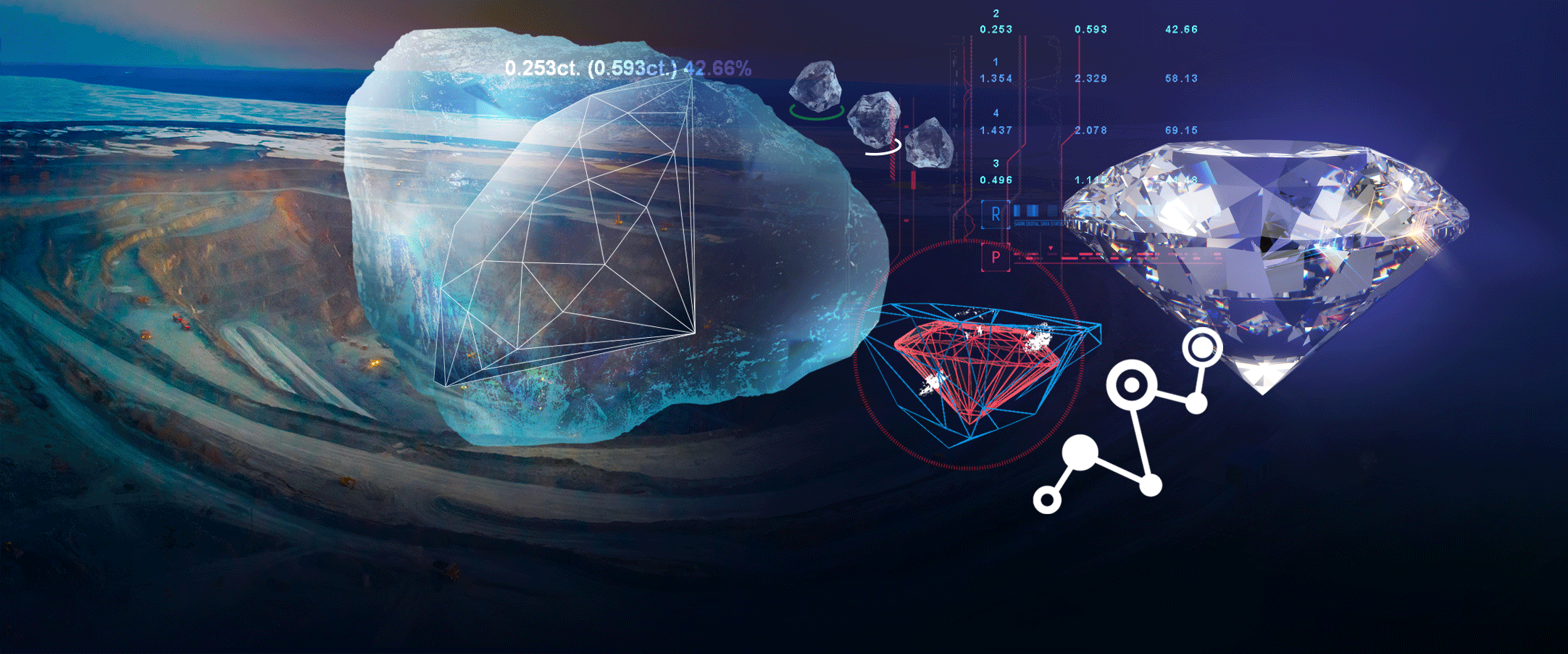

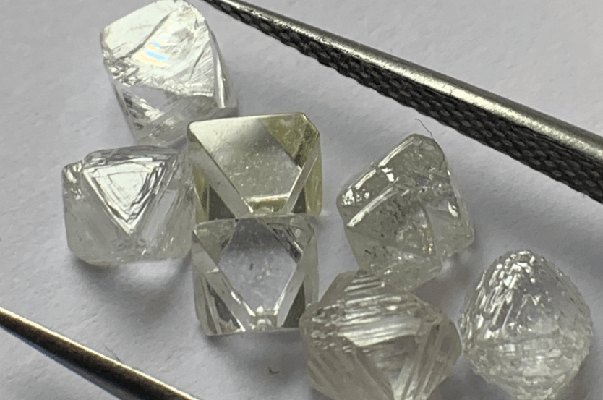

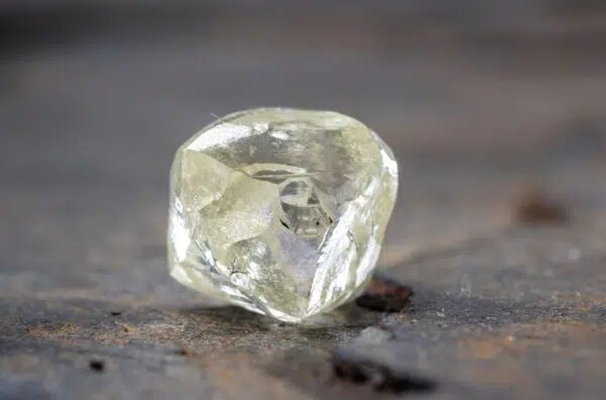

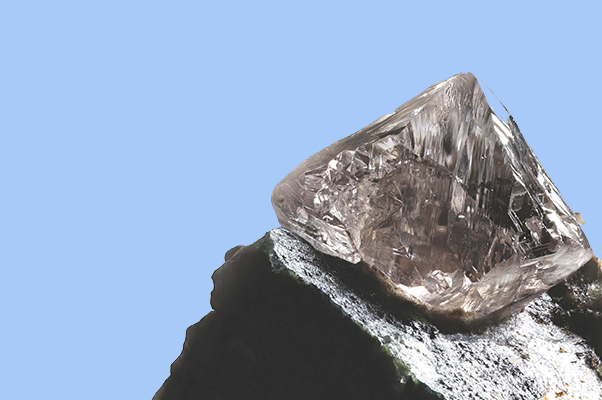

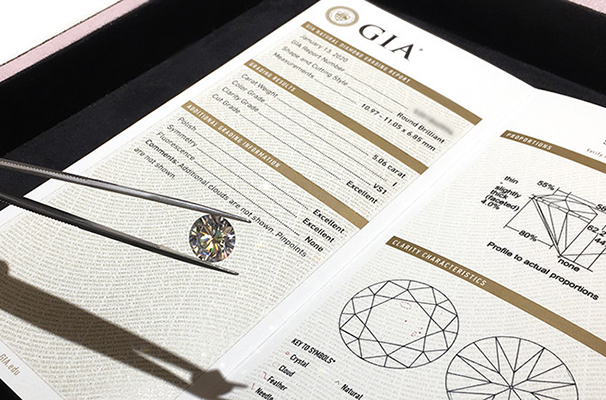

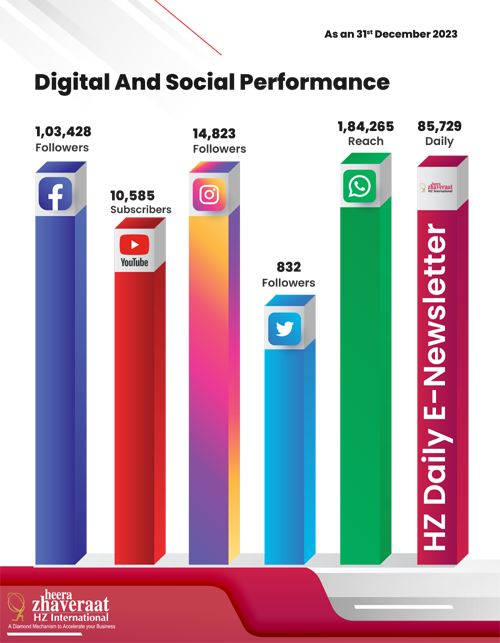

Heera Zhaveraat (HZ International) A Diamond, Watch and Jewellery Trade Promotion Magazine provide dealers and manufactures with the key analytical information they need to succeed in the luxury industry. Pricing, availability and market information in the Magazine provides a critical edge.

All right reserved @HeeraZhaveraat.com

Design and developed by 24x7online.in