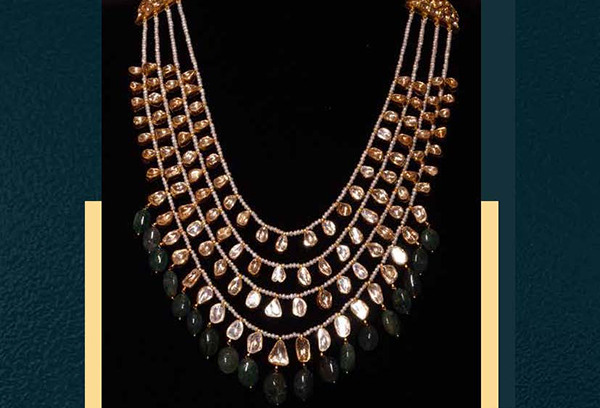

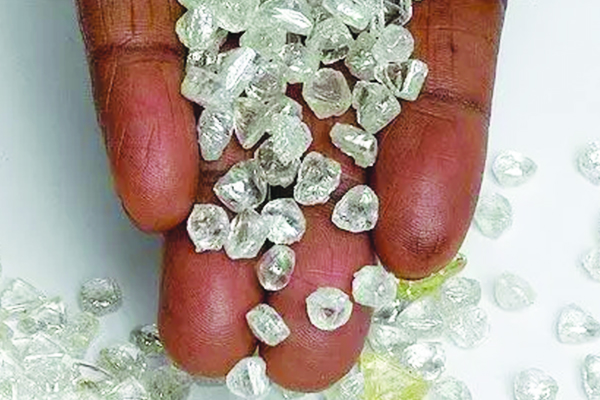

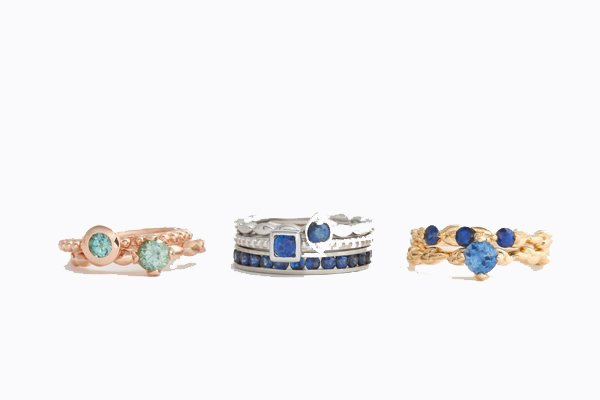

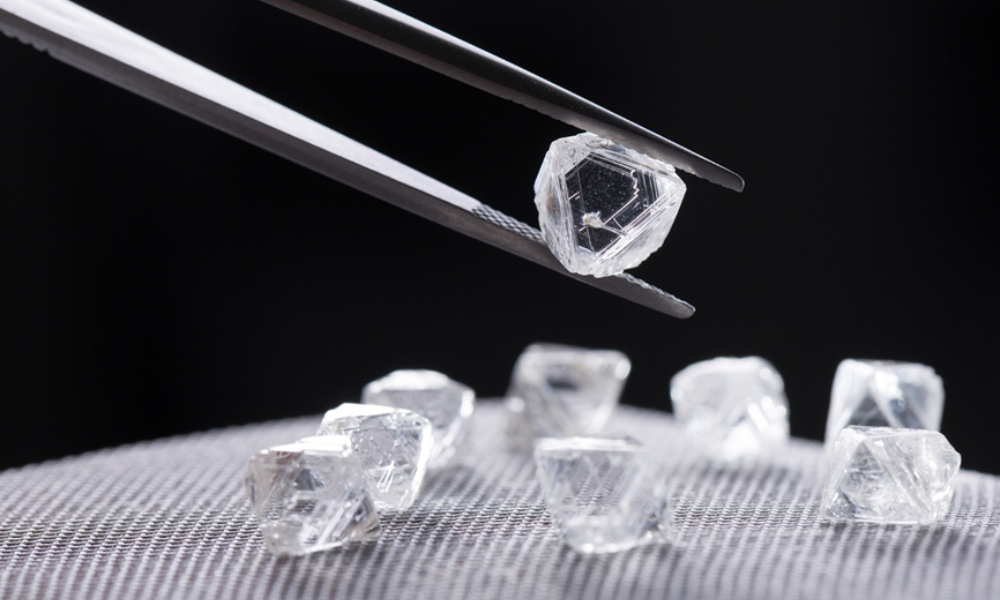

One of the biggest challenges for the Indian gems and jewellery industry has been securing bank credit, which has become even more difficult in the wake of the Nirav Modi, Mehul Choksi scam where the Indian banking system was defrauded of around Rs130bn (US$2bn).

One of the biggest challenges for the Indian gems and jewellery industry has been securing bank credit, which has become even more difficult in the wake of the Nirav Modi, Mehul Choksi scam where the Indian banking system was defrauded of around Rs130bn (US$2bn).

According to the latest financial stability report from the RBI, more than 20% of loans given to the sector have become non-performing assets (NPAs), second only to the construction sector. It is therefore not surprising that the gems and jewellery industry only accounts for 2.7% of India’s total credit issuance, which is less than half that of the textile industry, India’s other key export-driven sector.

As a result, it has become difficult for small and medium-sized jewellers to expand their businesses. Even within the industry there is a significant difference between how a large or medium-sized jeweller obtains funding vis-à-vis smaller operations. Securing cash credit from banks is much easier for large and medium-sized businesses.

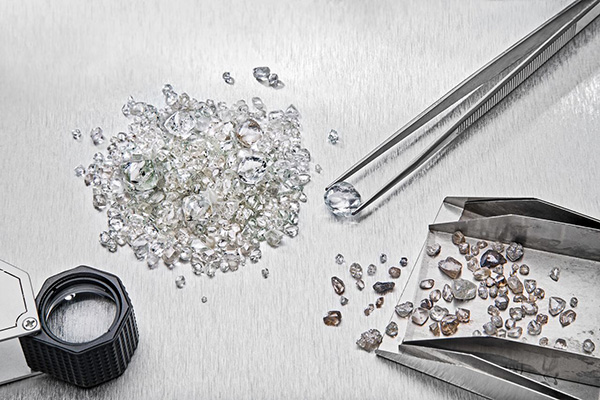

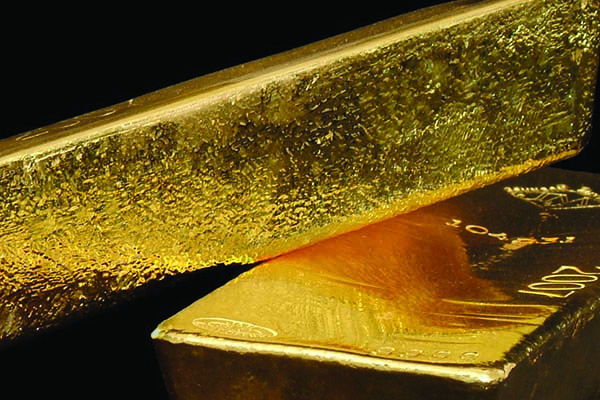

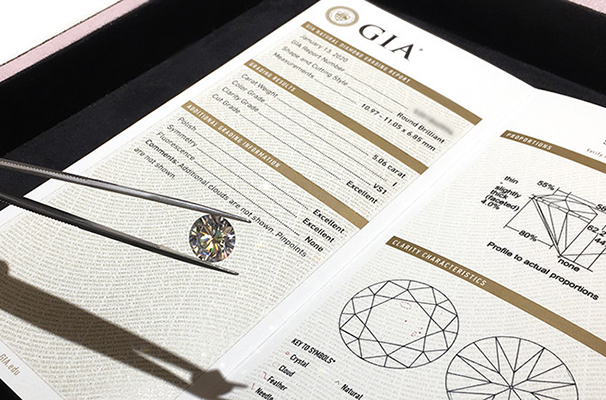

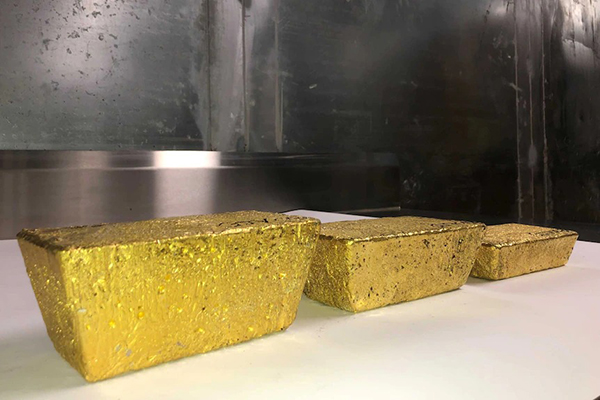

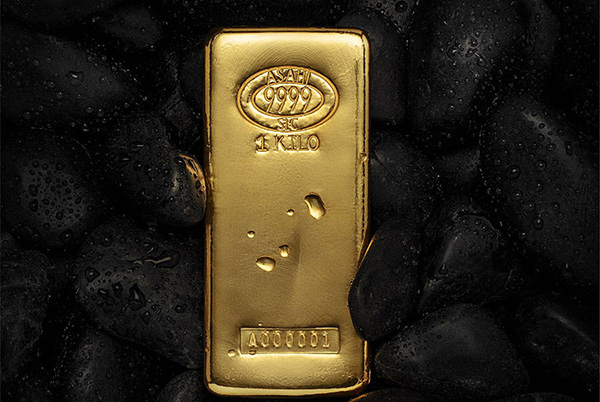

This is because many of these jewellers have much more transparent accounts, making it easier for the bank to judge past and future performance. It is also possible for organised jewellers to avail themselves of gold metal loans from banks. Metals Focus estimates that outstanding gold metal loans were around 65t at the end of 2021.

The other advantage that large, organised jewellers enjoy is credit from manufacturers. For many of the large jewellers, obtaining credit is essential to their operations. For example, discussions between Metals Focus and the trade revealed that jewellery retailers often enjoy between one and three months of credit from a fabricator, which helps them with inventory management and allows them to expand their operations by offering more products.

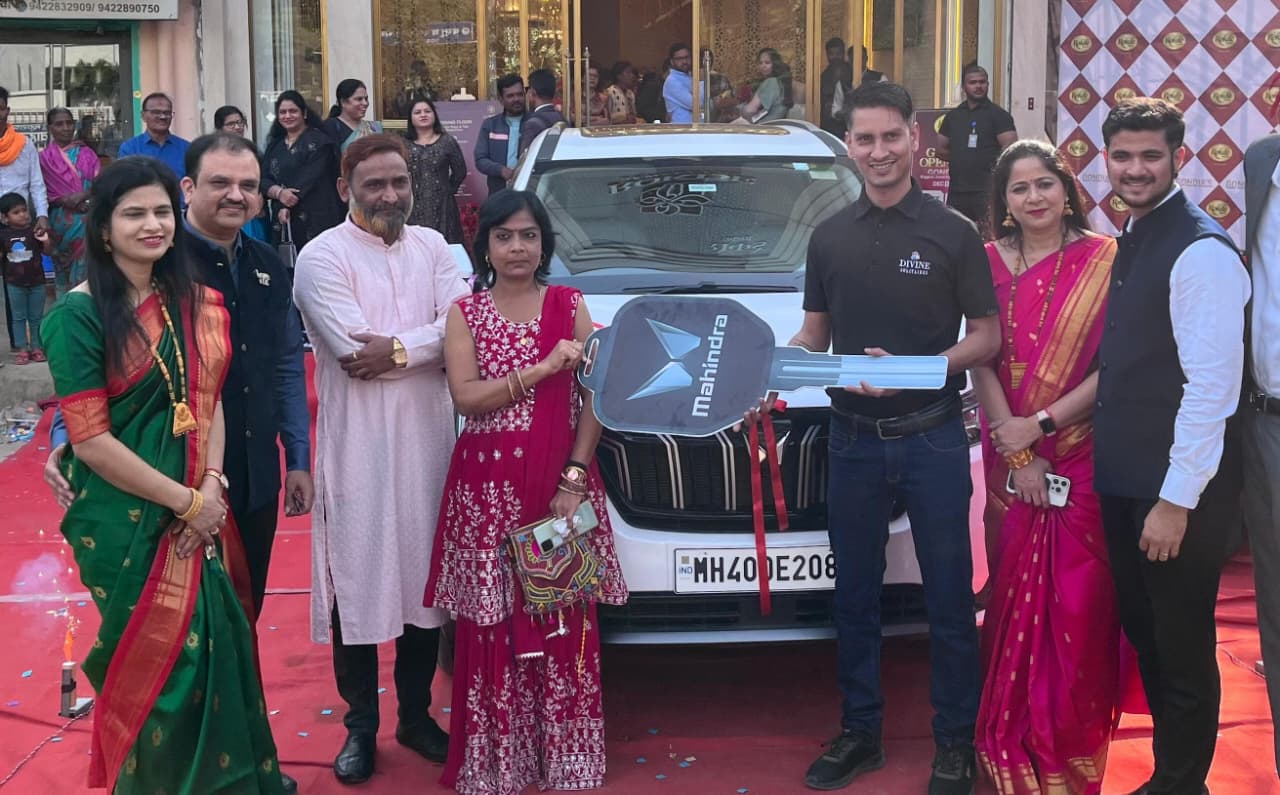

The other important means of funding, which we believe is unique to India, is the monthly investment scheme run by jewellers, which Metals Focus estimates accounts for 20-30% of their funding. This works as a monthly gold saving scheme where consumers deposit a specific amount of money with the jeweller for 11 months, with the jeweller then paying the consumer one month’s equivalent of their deposit as interest. At the end of the year the consumer chooses to buy gold jewellery or minted products with accumulated savings and interest.

In contrast to large and medium-sized jewellers, it is extremely difficult for small and independent jewellers to secure cash credit from banks; they either tend to rely on the monthly gold scheme for funding or they lend money. Most act as money lenders, offering loans against gold jewellery and charging customers annual interest of 18-30%.

This forms a large part of their business and if a consumer misses a couple of payments the interest rate can increase further, or the jewellery is retained. Unlike banks and non-banking financial corporations (NBFCs) where loan-to-value (LTV) is 90% as stipulated by the RBI, the LTV for jewellers is about 60-70%, offering them a better margin of safety and profitability.

Many small jewellers have been in business for generations, during which time they have converted part of their profits into gold and re-routed that back into the business to help fund operations. However, this can restrict growth as there is only limited capital available to plough back into the business.

One of the key reasons smaller jewellers find it hard to access capital is that most deal in cash and do not report total turnover in their accounts; this helps to explain why only a fraction of these jewellers are registered under GST.

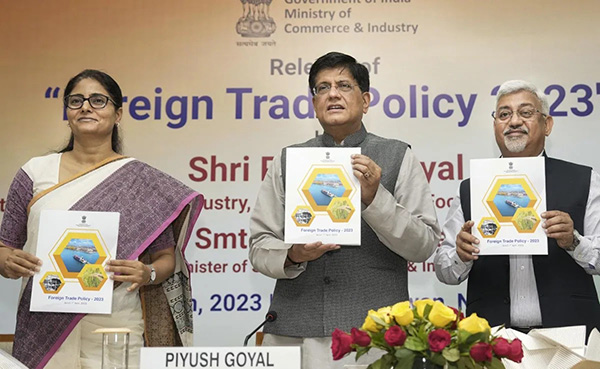

All the regulatory changes that have taken place over the last decade – including the requirement of a PAN card for transactions above Rs200,000 (US$2,500), restrictions on cash transactions and, more importantly, demonetisation and the introduction of GST – have made it difficult for many smaller jewellers to remain in business. It is not surprising that many have closed their shops, especially those in large cities and towns.

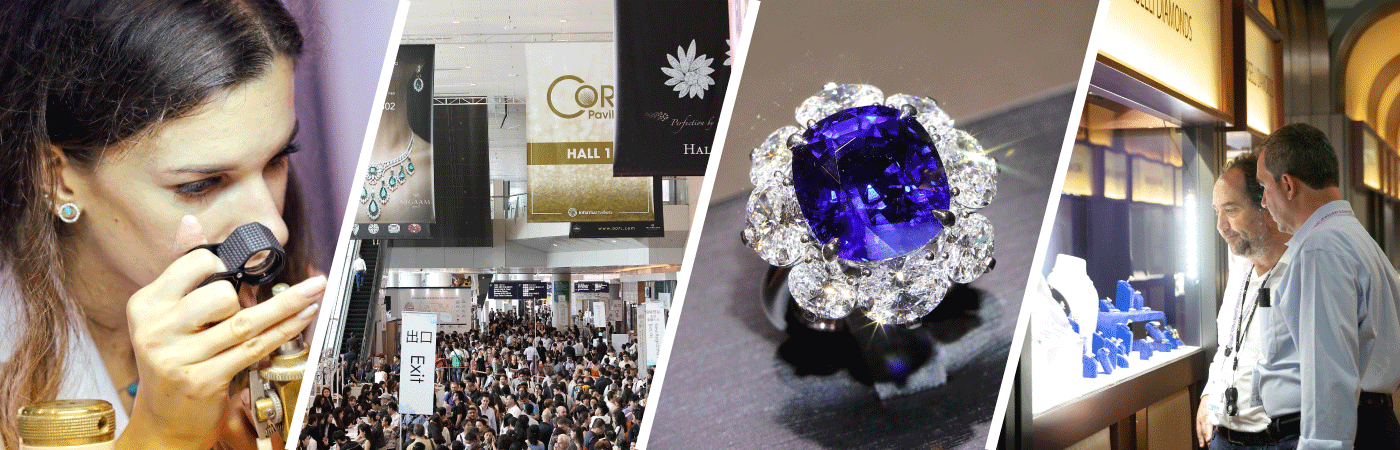

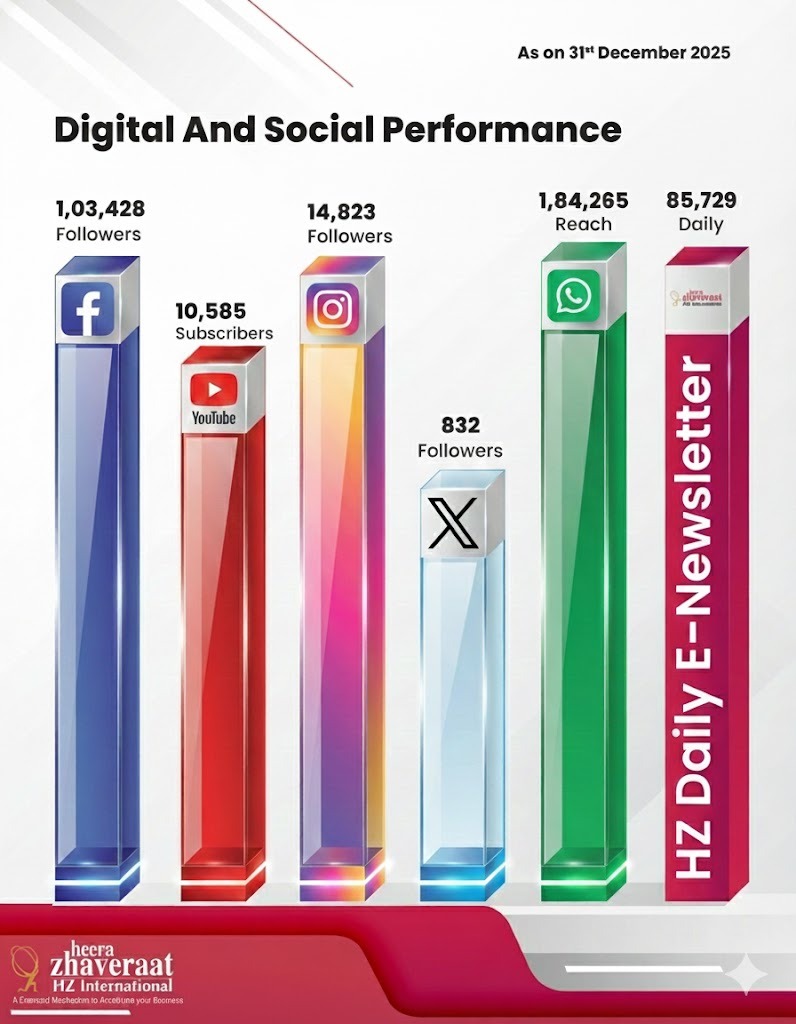

Offical Facebook account of heerazhaveraat.com, homepage for Trade News, Articles and Promotion of D

Heera Zhaveraat (HZ International) A Diamond, Watch and Jewellery Trade Promotion Magazine provide dealers and manufactures with the key analytical information they need to succeed in the luxury industry. Pricing, availability and market information in the Magazine provides a critical edge.

All right reserved @HeeraZhaveraat.com

Design and developed by 24x7online.in