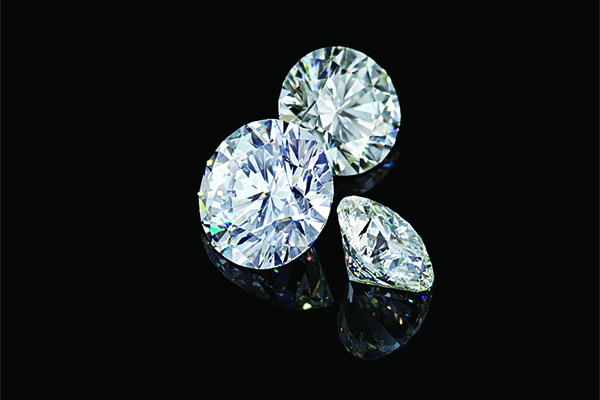

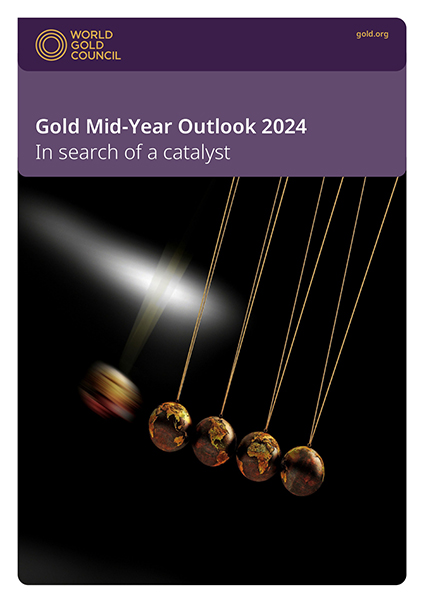

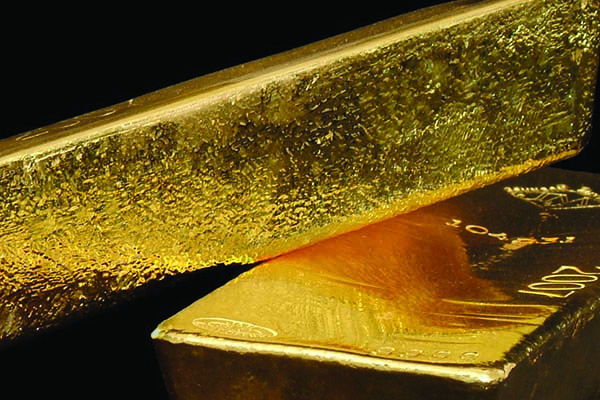

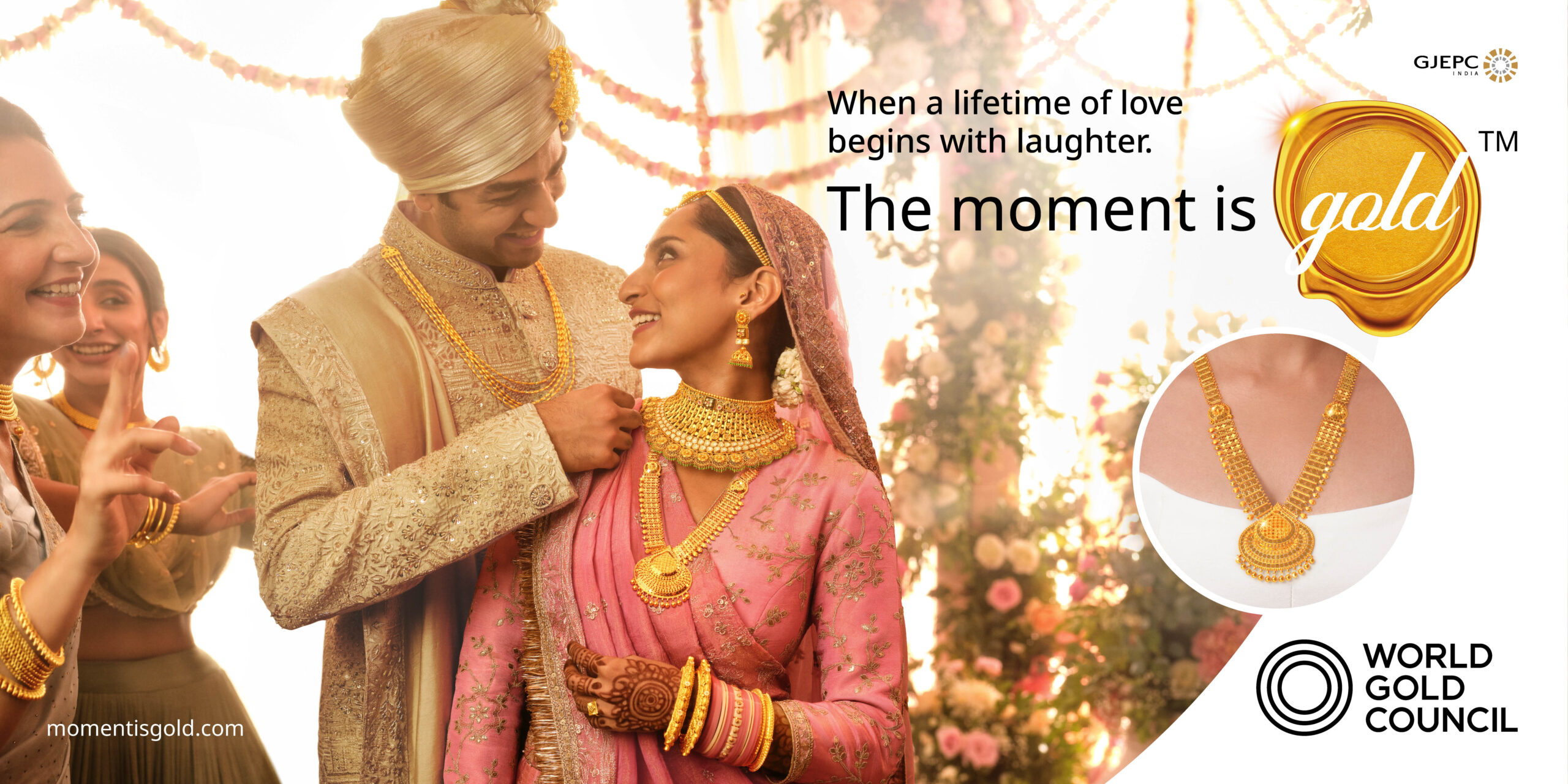

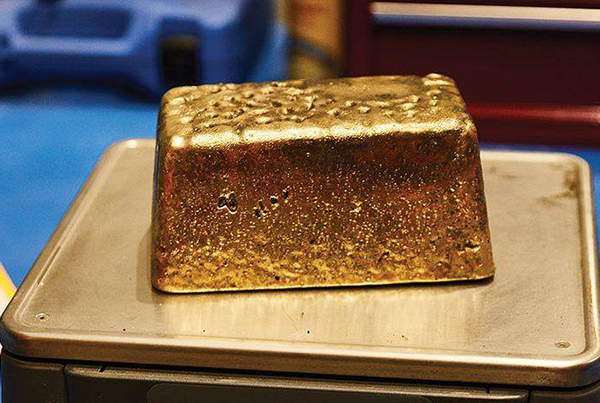

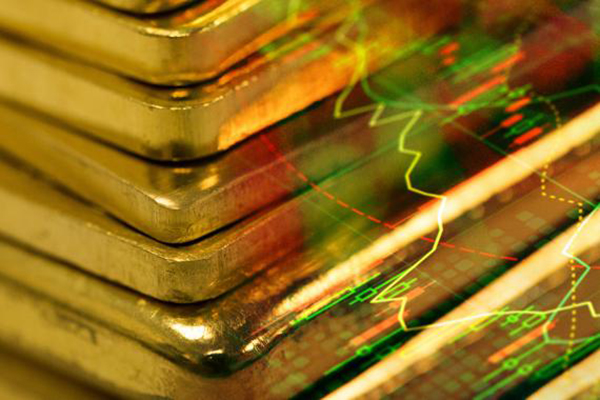

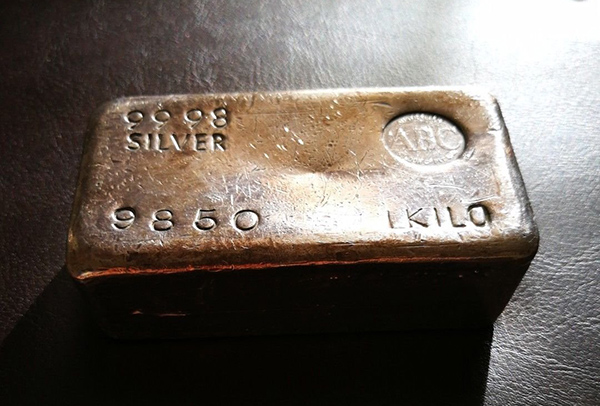

The recently published report by World Gold Council said on gold and credit strategies! Detail said, An alternative asset class of recent interest is private credit, or lending strategies originating outside of traditional banking channels. Private credit strategies span a broad spectrum – from senior secured lending to opportunistic and distressed debt – allowing investors to tailor exposure based on return targets and risk tolerance. The trade-off, however, is illiquidity and less frequent revaluation, which can obscure and dampen volatility in times of stress.

The recently published report by World Gold Council said on gold and credit strategies! Detail said, An alternative asset class of recent interest is private credit, or lending strategies originating outside of traditional banking channels. Private credit strategies span a broad spectrum – from senior secured lending to opportunistic and distressed debt – allowing investors to tailor exposure based on return targets and risk tolerance. The trade-off, however, is illiquidity and less frequent revaluation, which can obscure and dampen volatility in times of stress.

The asset class has gained prominence—initially in the low-interest rate environment as investors searched for yield, and more recently amid ongoing regulatory shifts, as banks deleverage their balance sheets in response to Basel IV.5 What this means for private credit is the potential expansion of certain types of loans, which were previously parked under the banks’ balance sheets; for instance, speciality finance, agriculture, and small-to-medium enterprise loans.

As banks deleverage, private credit investors could scoop up these loans and negotiate favourable terms. And while this regulation may impact Europe in the mid-term, investors with global private credit mandates should continue to look at this asset class with interest.

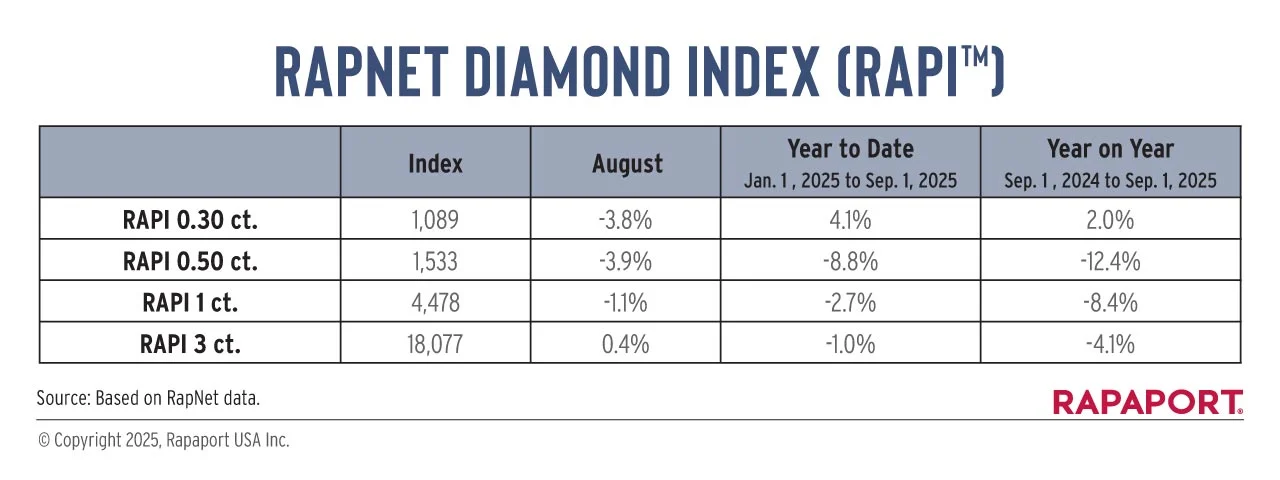

Understanding underlying credit markets is essential, as private credit is fundamentally exposed to the same credit cycle dynamics6 – just with more opacity and lag. The ICE BofA US High Yield Bond Index returned 8% in 2024 while the LSTA Leveraged Loans Index returned 9% in the same year. Both are useful distant proxies

for understanding private credit’s risk-return dynamics. These indices reflect similar underlying borrower profiles – sub-investment grade corporates –and comparable exposure to credit and macro conditions, albeit in the public markets.

A typical private credit portfolio combines elements of capital preservation and yield enhancement—often through a mix of senior secured lending and opportunistic strategies. When gold is added to such a portfolio, risk-adjusted returns improve. Gold acts as a liquidity buffer and risk management tool, especially valuable during credit market dislocations when traditional hedges, like government bonds, may be less reliable.

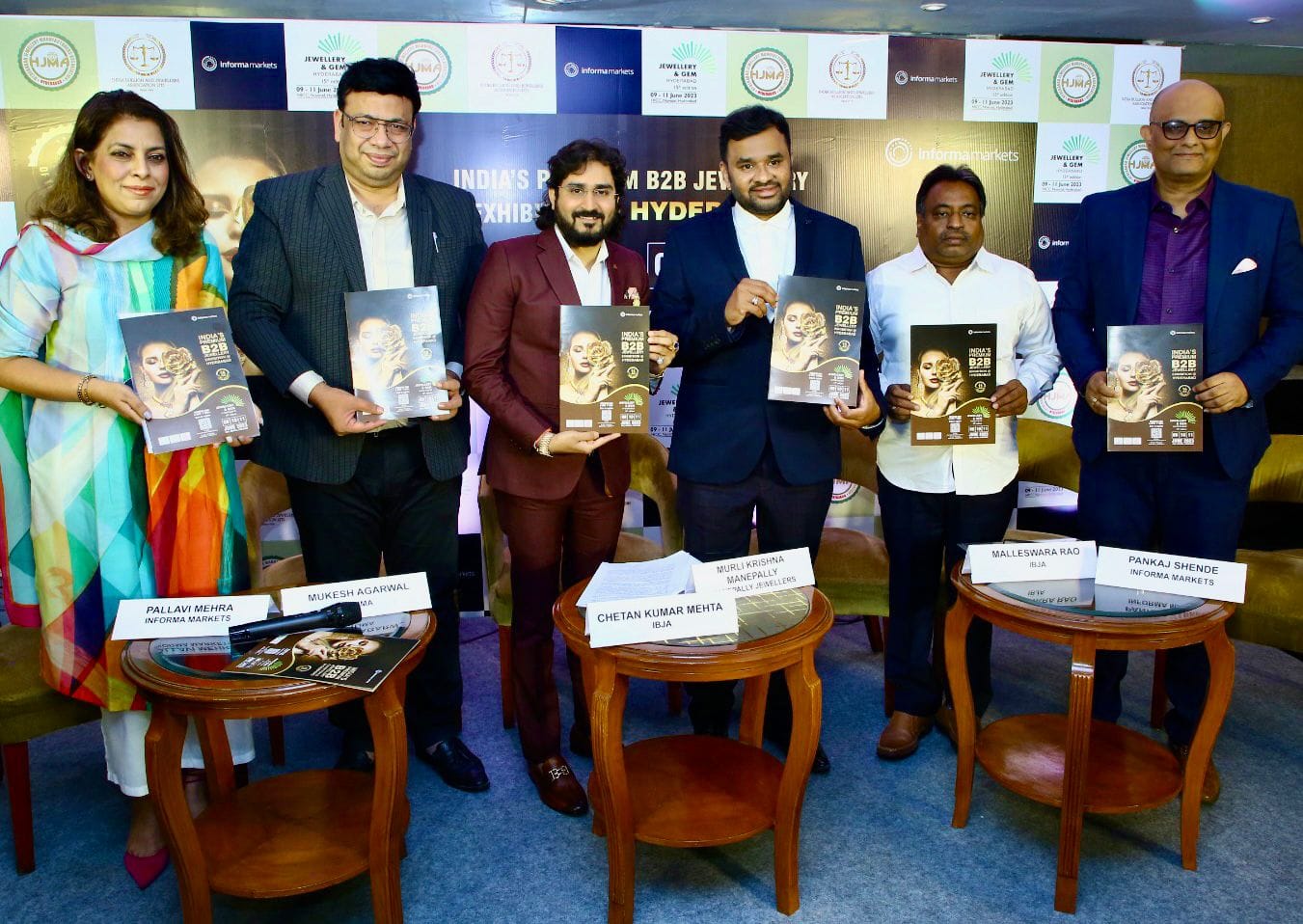

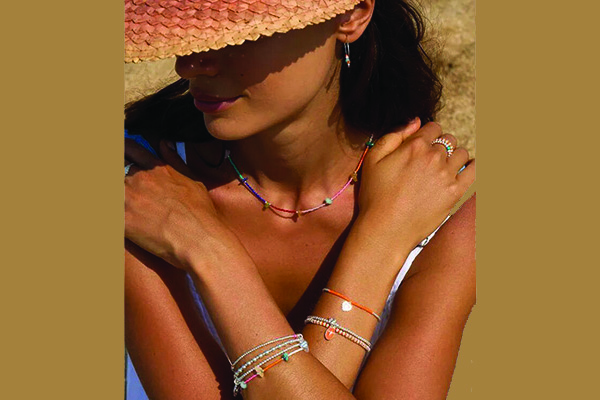

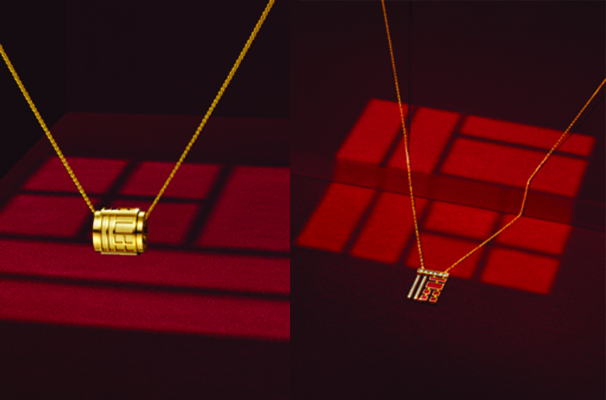

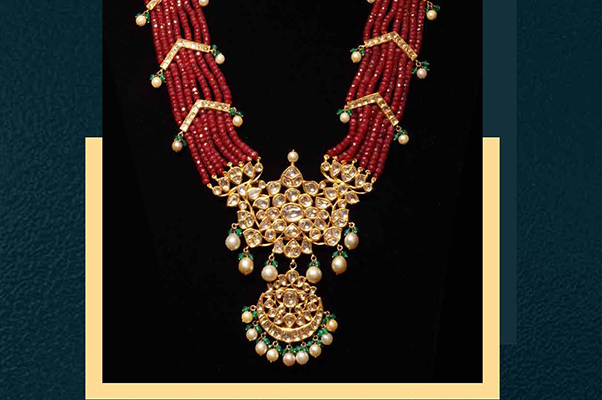

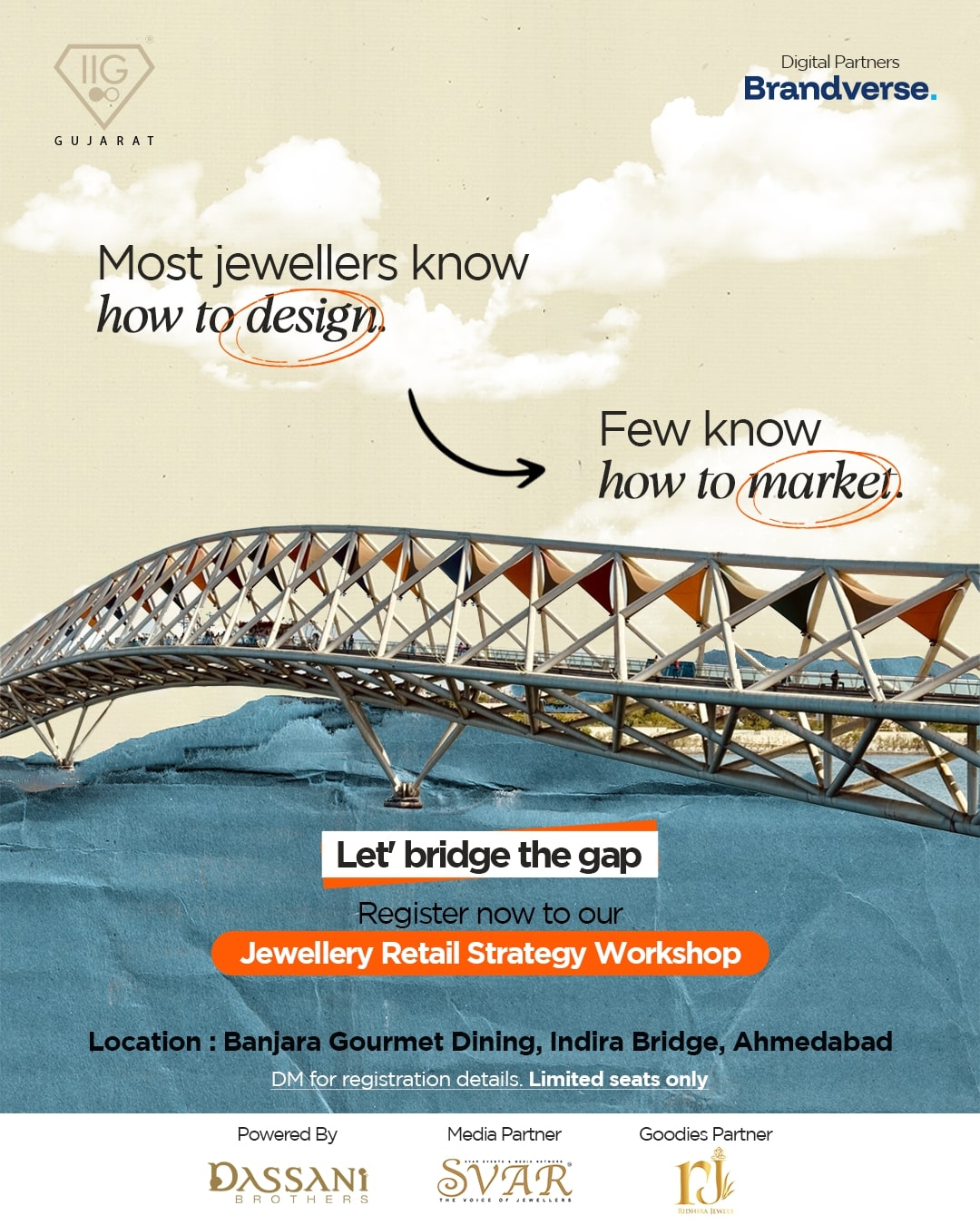

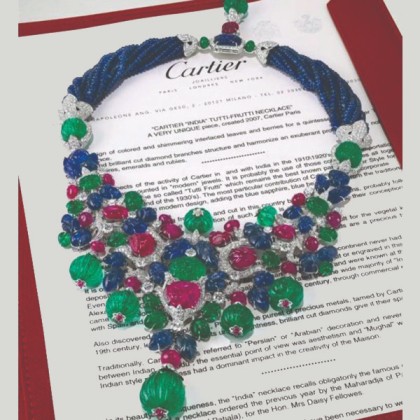

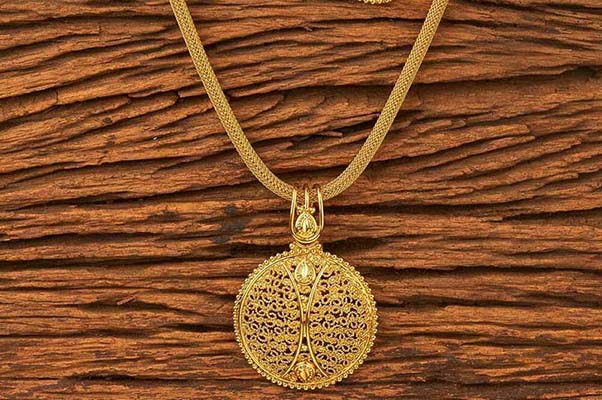

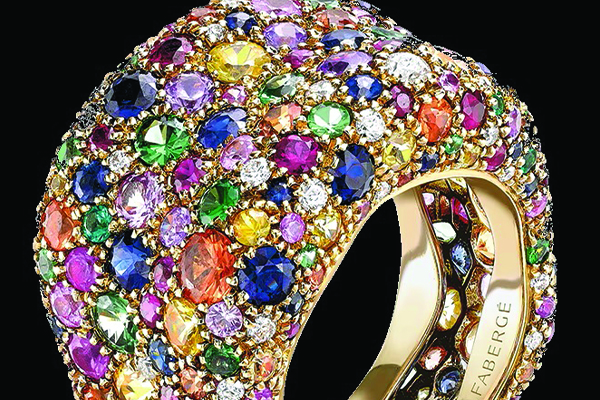

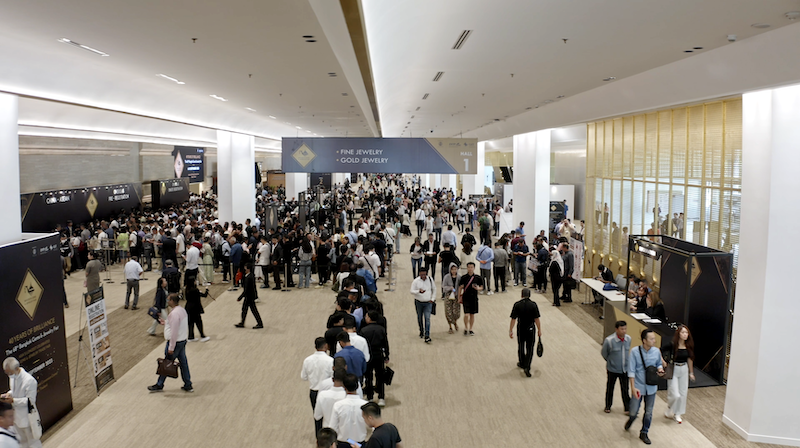

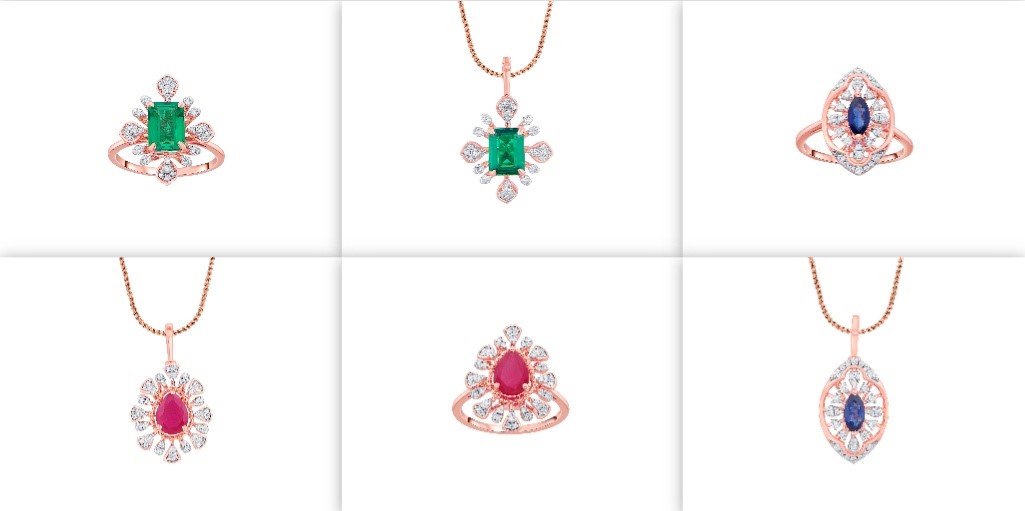

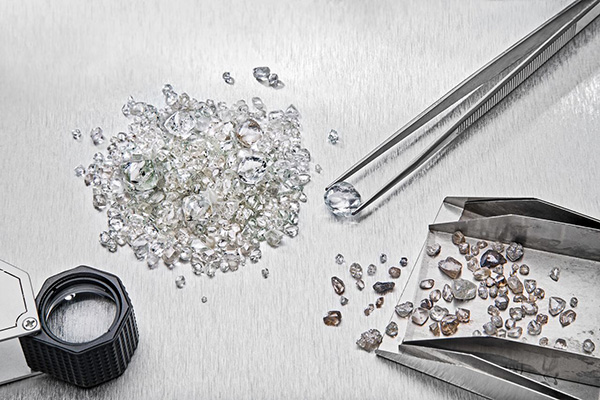

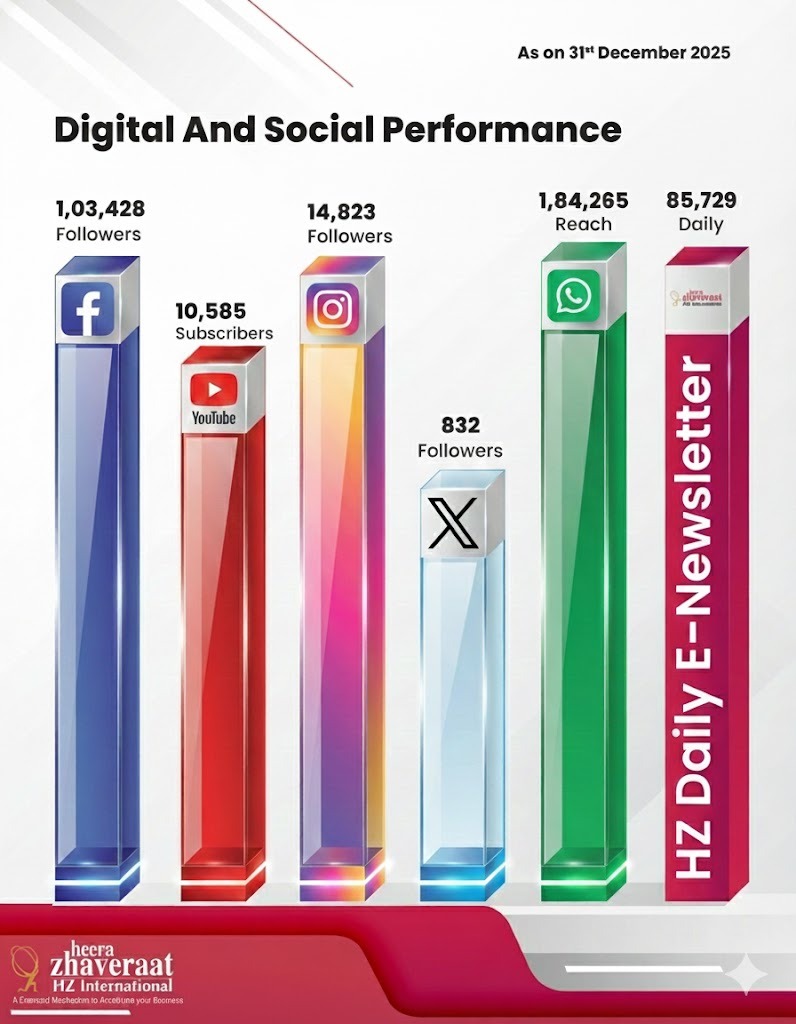

Offical Facebook account of heerazhaveraat.com, homepage for Trade News, Articles and Promotion of D

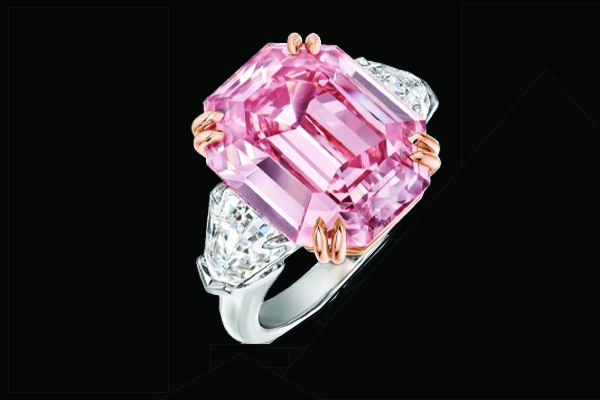

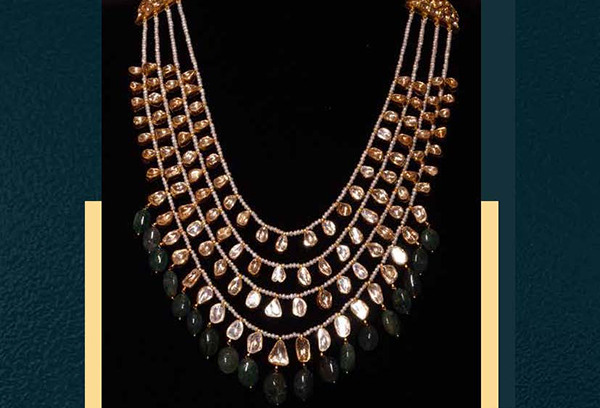

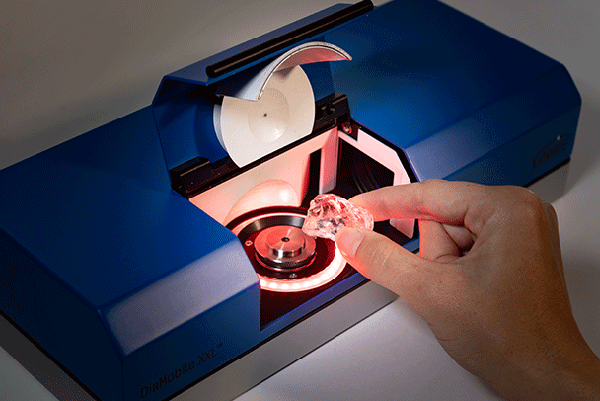

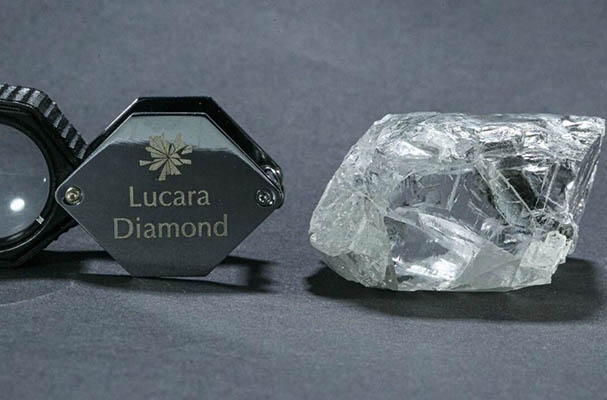

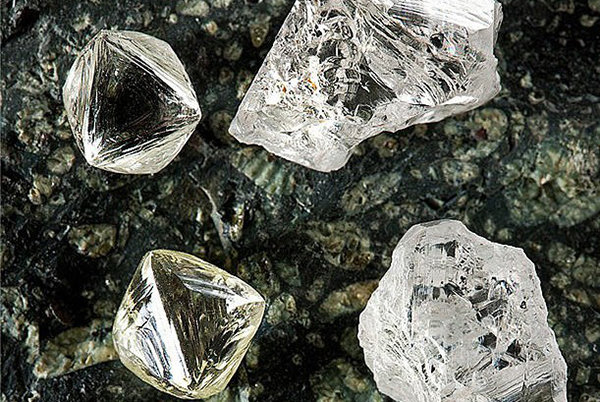

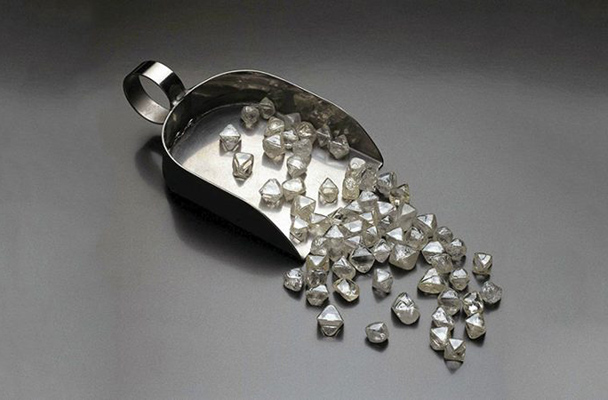

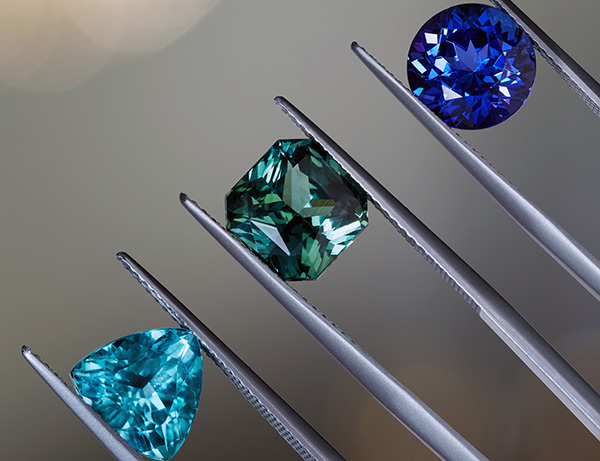

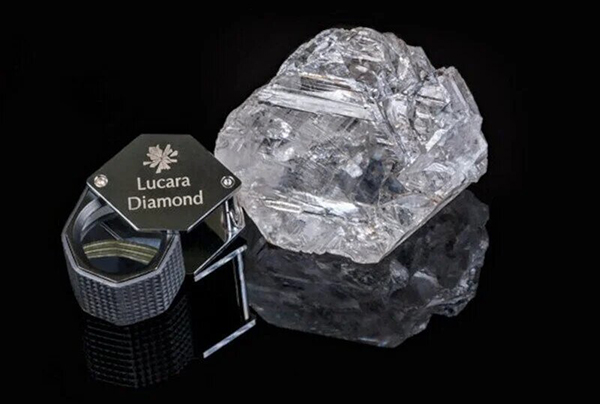

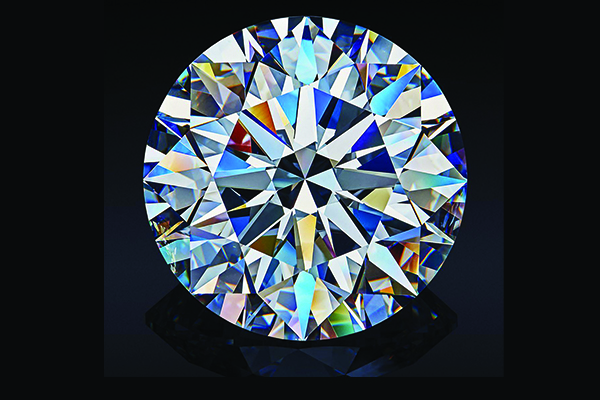

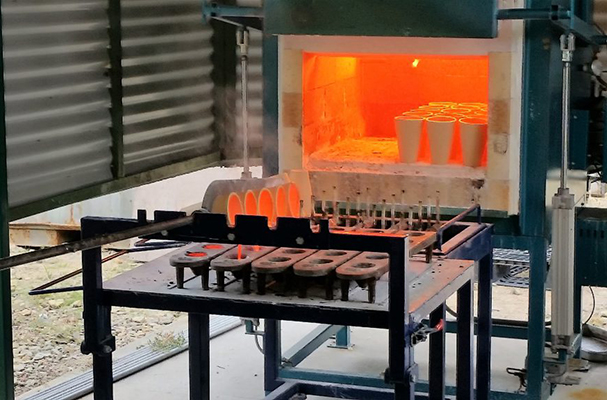

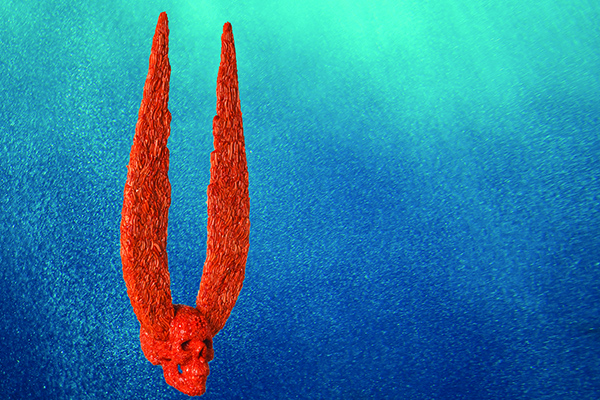

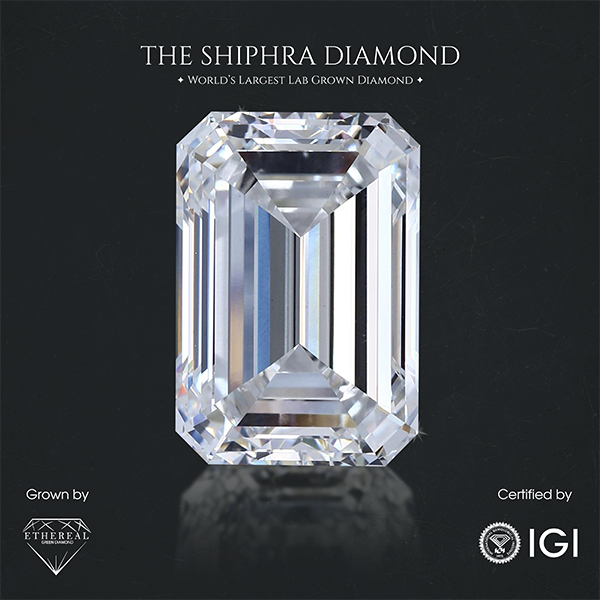

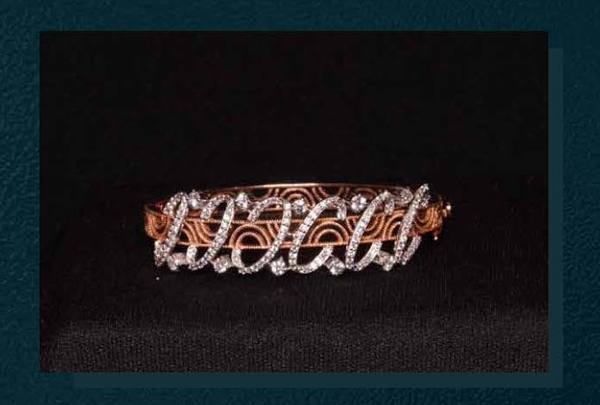

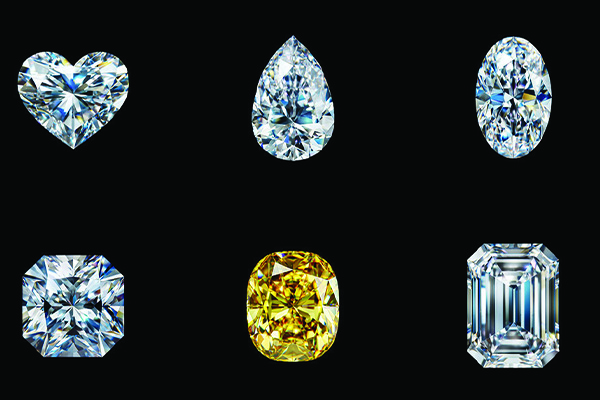

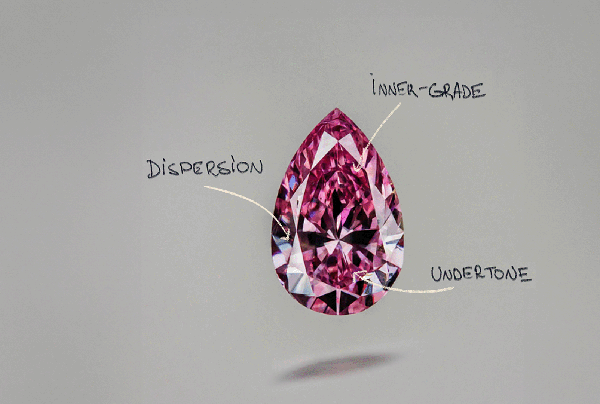

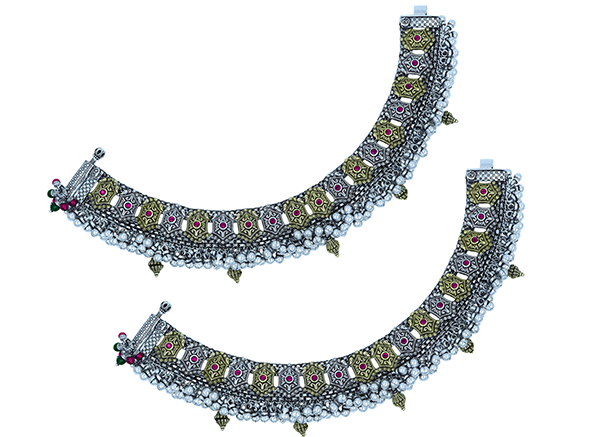

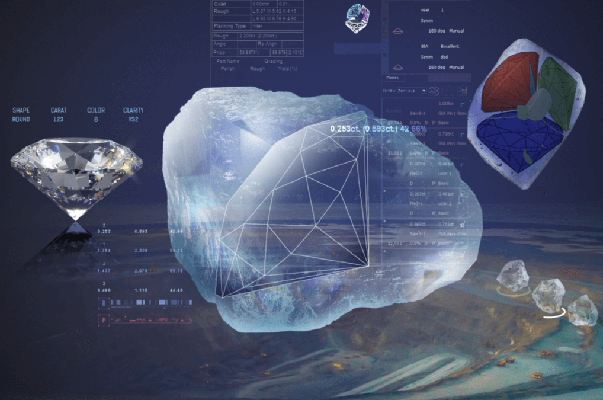

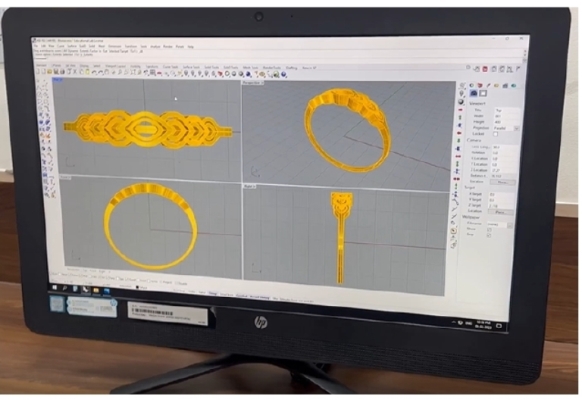

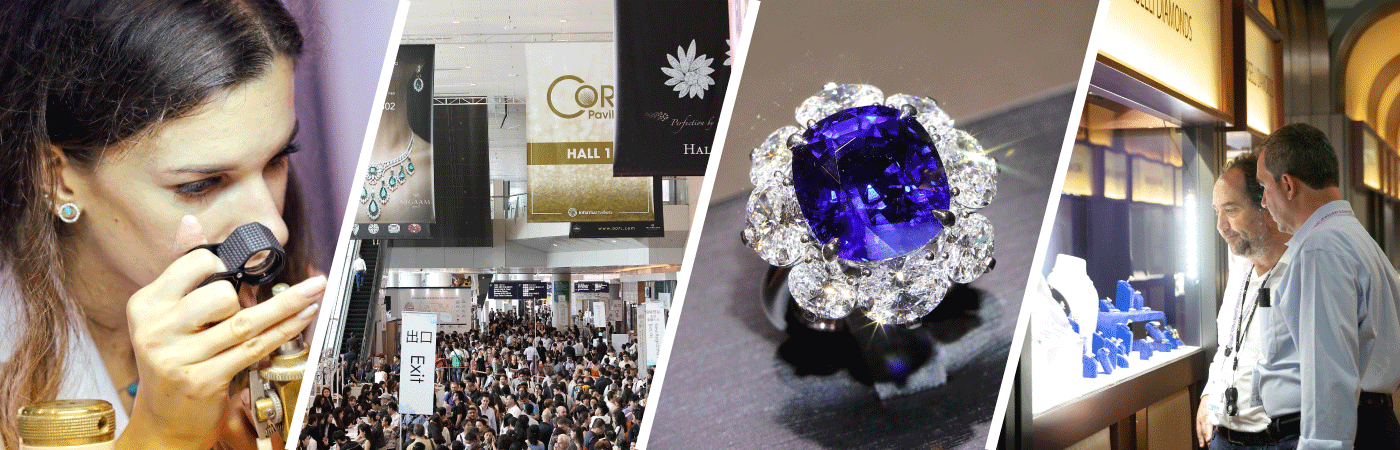

Heera Zhaveraat (HZ International) A Diamond, Watch and Jewellery Trade Promotion Magazine provide dealers and manufactures with the key analytical information they need to succeed in the luxury industry. Pricing, availability and market information in the Magazine provides a critical edge.

All right reserved @HeeraZhaveraat.com

Design and developed by 24x7online.in