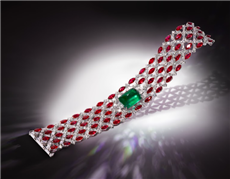

The Budget 2026‑27 does not announce any direct, gems‑and‑jewellery‑specific tax or policy change, but several indirect tax and trade facilitation measures will affect export competitiveness, costs, and business conditions for the sector.

The Budget 2026‑27 does not announce any direct, gems‑and‑jewellery‑specific tax or policy change, but several indirect tax and trade facilitation measures will affect export competitiveness, costs, and business conditions for the sector.

1) Export competitiveness and market access

The budget explicitly aims to “promote export competitiveness” through customs and excise changes, signalling a continued pro‑export stance that indirectly benefits gem and jewellery exporters as a major forex‑earning sector.

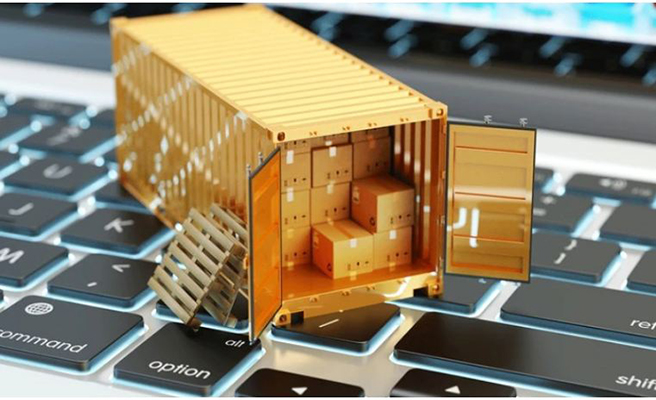

Removal of the value cap of ₹10 lakh per consignment on courier exports will particularly help smaller, design‑driven and online jewellery exporters who rely on frequent small shipments (fine jewellery, studded silver, niche designs). They can now service higher‑value orders through e‑commerce and courier mode without splitting consignments. (Point 175)

E‑commerce and courier rules are proposed to be eased for rejected and returned consignments and to allow “return to origin”, which reduces friction and costs when foreign buyers return jewellery or shipments are refused – important for maintaining global B2C relationships. (Point 175)

2) Customs process reforms and logistics

A unified Customs Integrated System, expansion of non‑intrusive scanning, and risk‑based clearance (especially for “trusted importers” and Authorized Economic Operators) will reduce dwell time and transaction costs for both export and import. (Point 172 and 173)

In line with India’s ambition to significantly expand its role in global trade, the Budget proposes multiple reforms aimed at ensuring minimal intervention and faster movement of goods. The duty deferral period for Tier 2 and Tier 3 Authorised Economic Operators (AEOs) is proposed to be enhanced from 15 days to 30 days, and eligible manufacturer-importers will also be provided similar duty deferral facilities, encouraging greater adoption of trusted trader frameworks.

3) Indirect boost via MSME and services measures

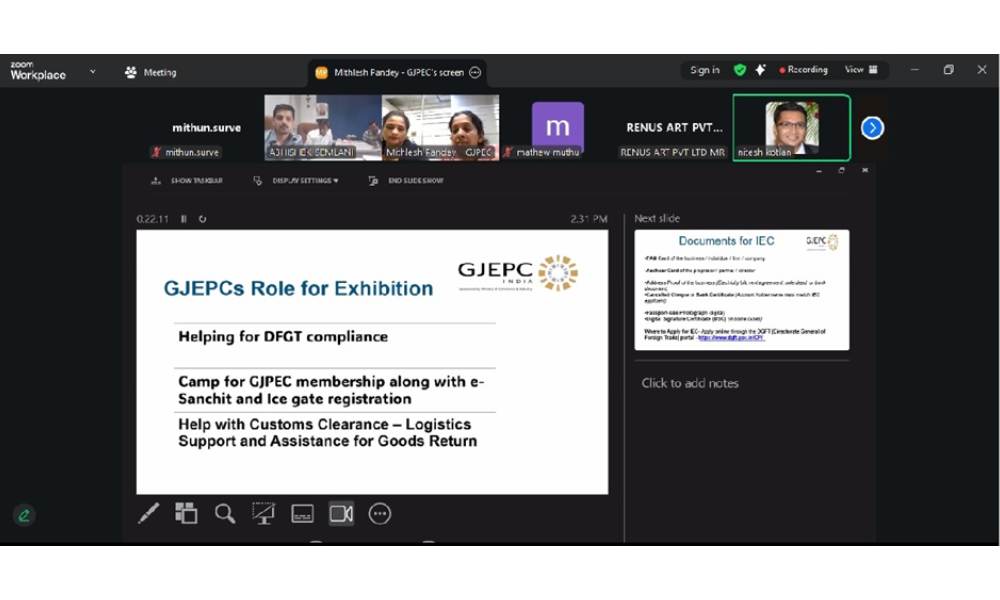

Many jewellery exporters are MSMEs; measures like the SME Growth Fund, TReDS expansion (mandating CPSE purchases through TReDS, secondary market in TReDS receivables), and easier “Corporate Mitras”‑led compliance will support working capital and compliance for export‑oriented small units. (Point 28)

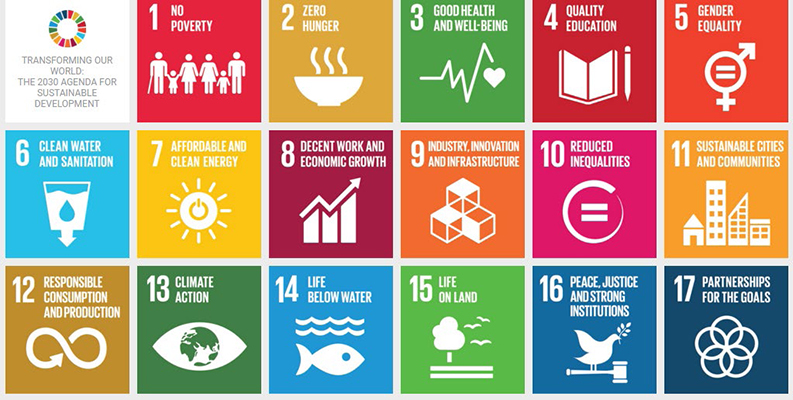

The High‑Powered “Education to Employment and Enterprise” Committee and the push to grow India’s share in global services to 10% by 2047 may indirectly help through better design, branding, and digital marketing services, which are becoming central to jewellery export competitiveness. (Point 51)

4) Custom duty concession extensions

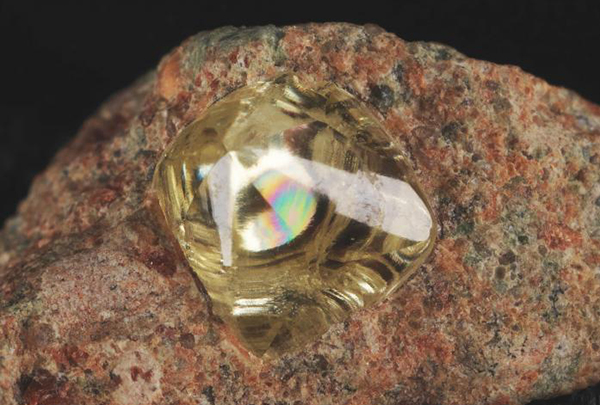

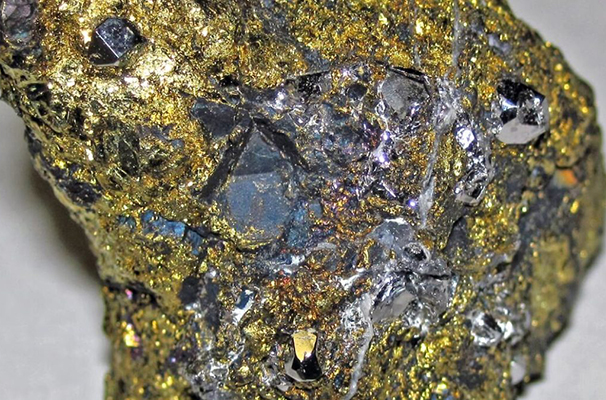

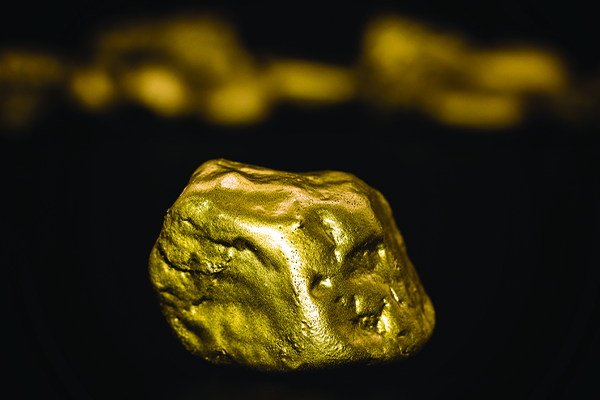

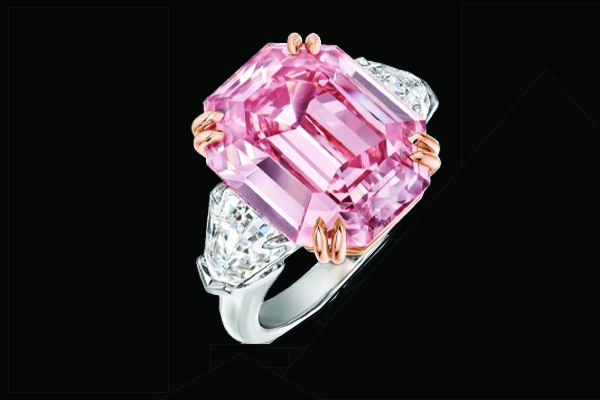

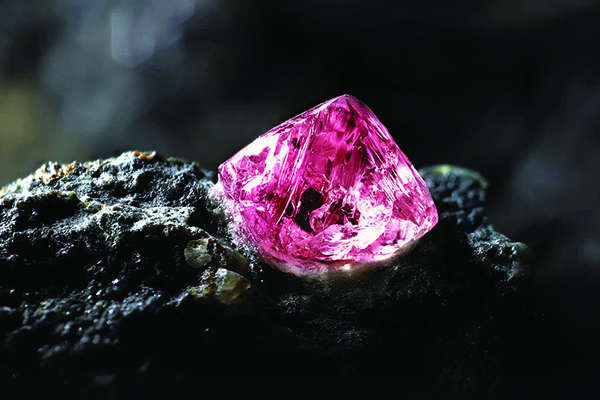

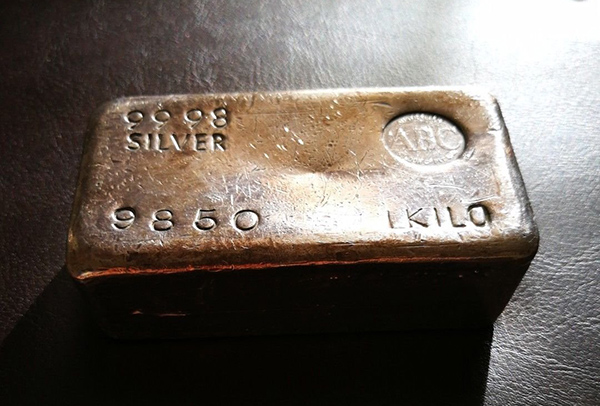

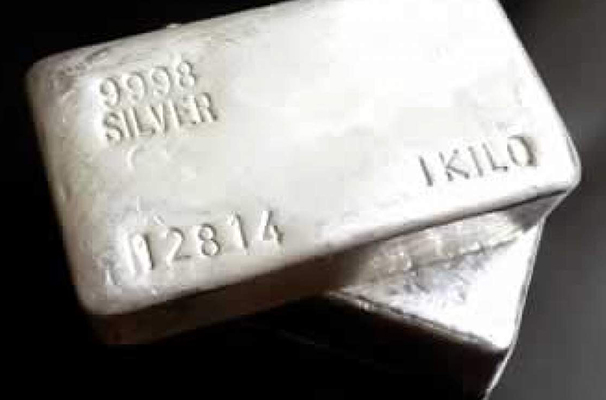

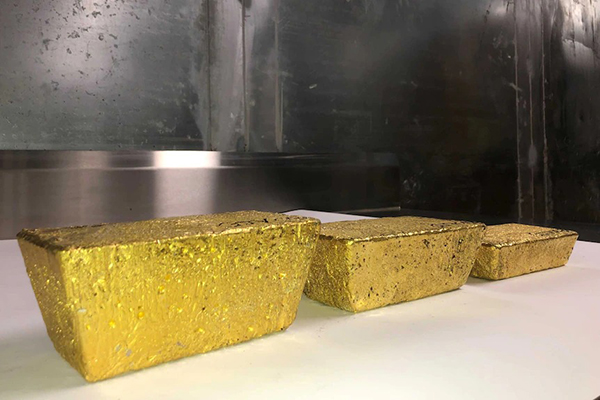

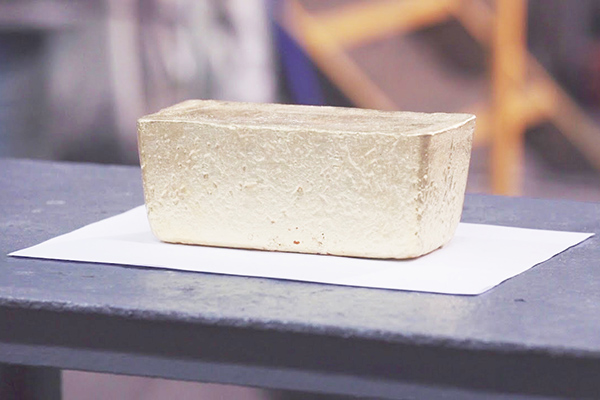

Gold dore bar and Silver dore bar (content ≤ 95%): the concessional Basic Customs Duty (BCD) entry in Notif. 45/2025‑Customs (Sl. No. 192) is being extended up to 31‑03‑2027; only a sunset date is now prescribed, the concessional rate of 5% remains unchanged

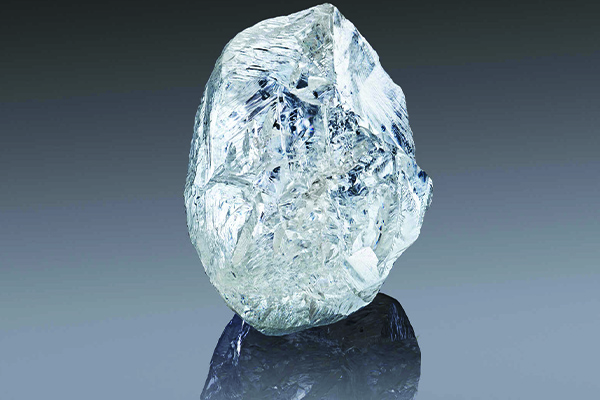

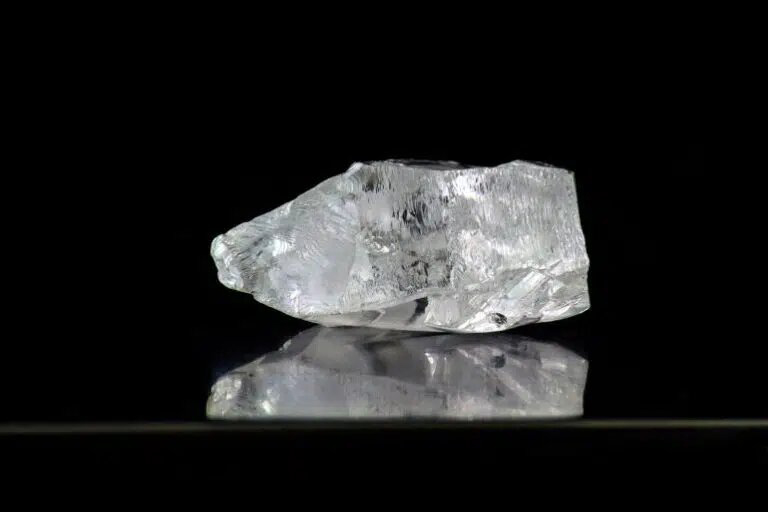

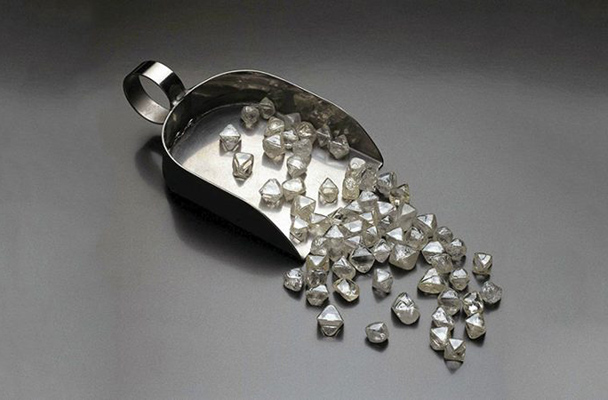

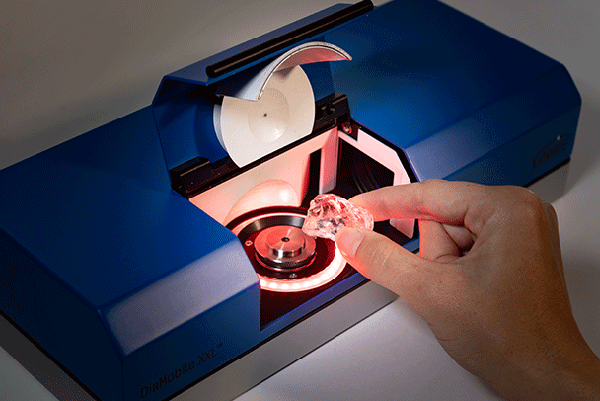

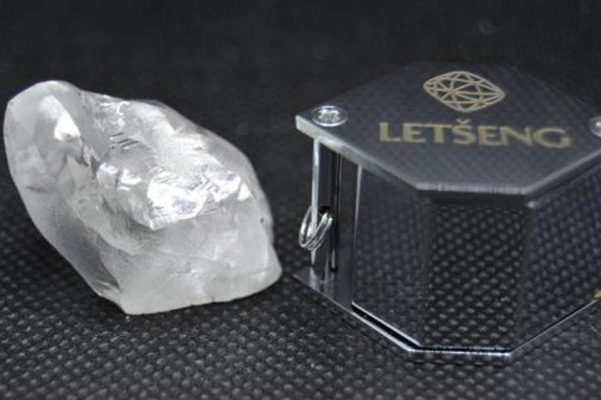

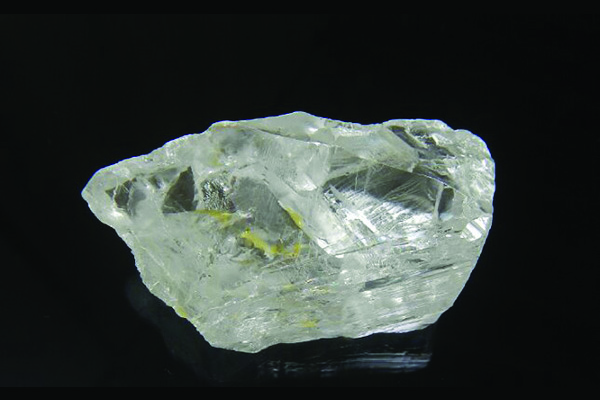

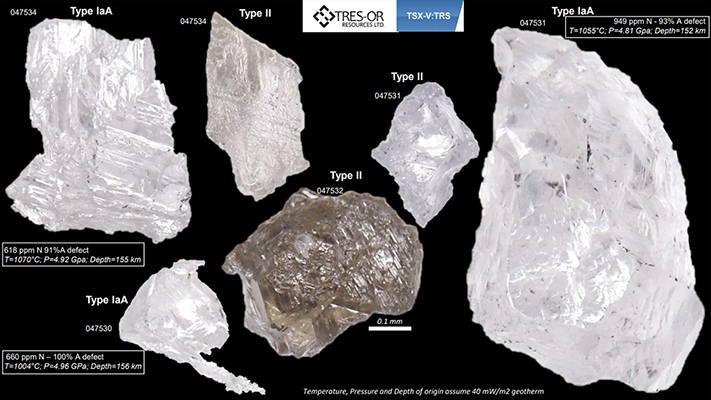

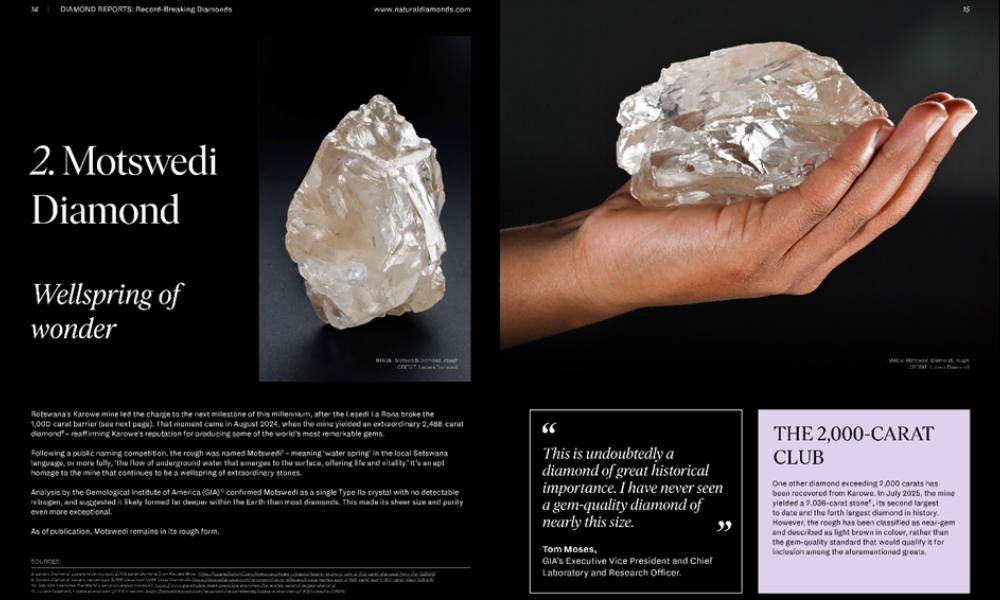

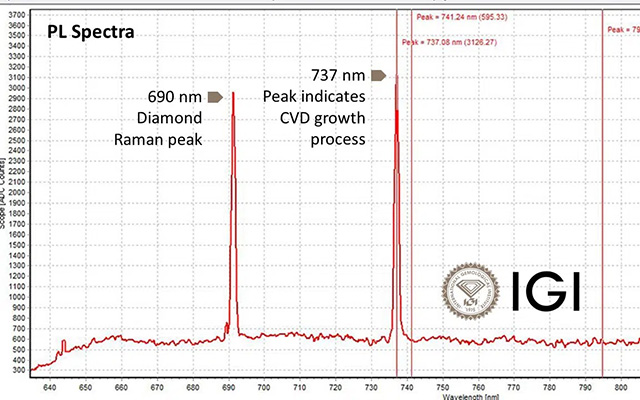

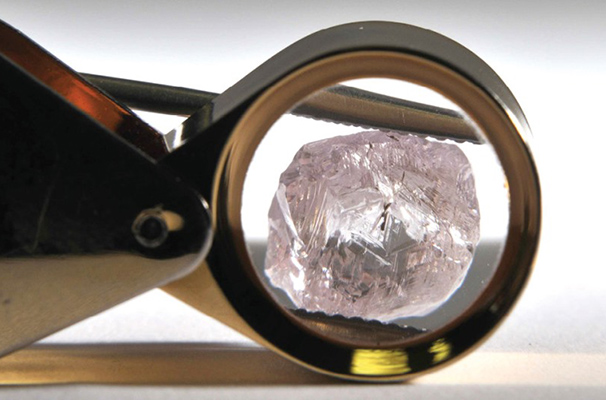

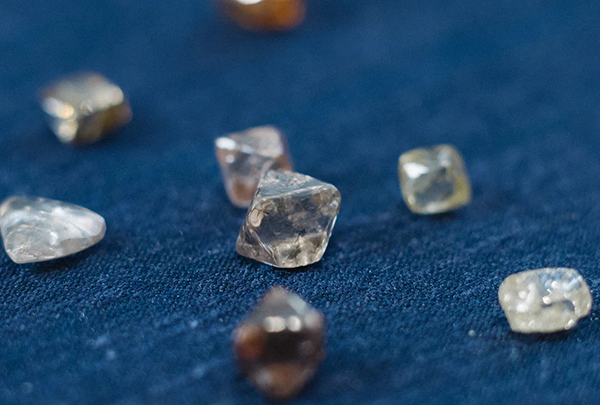

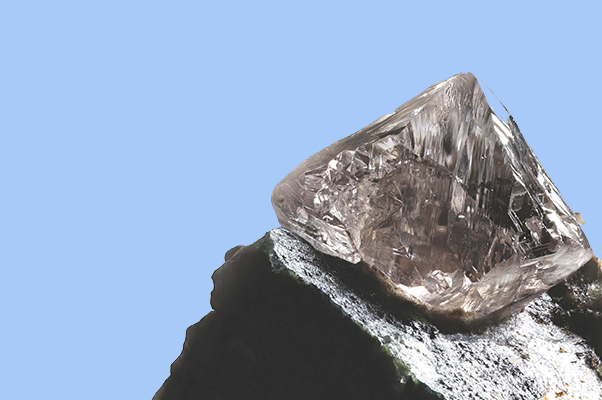

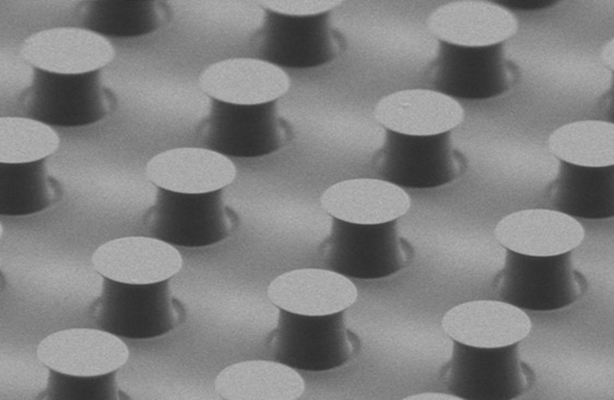

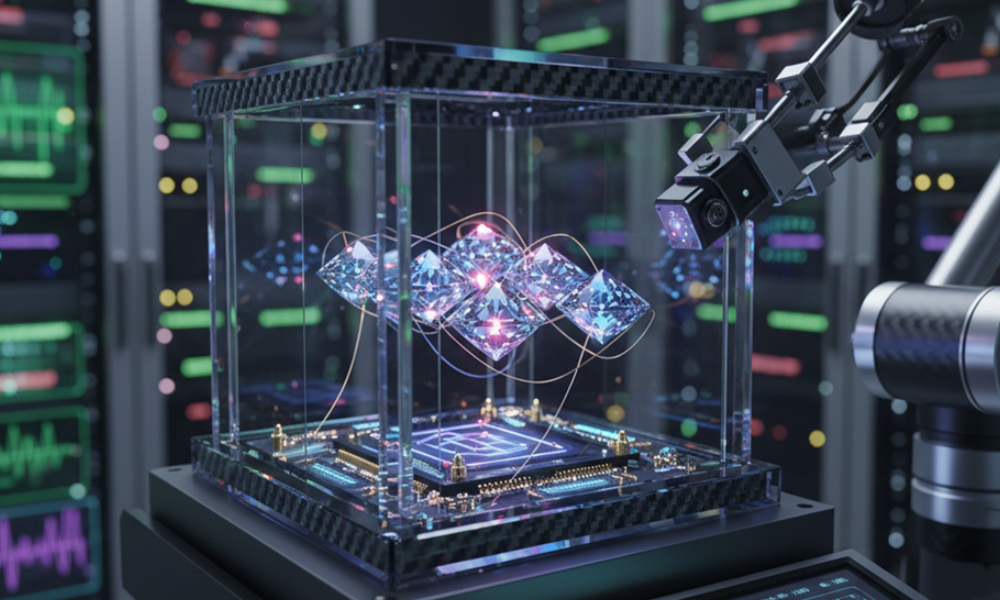

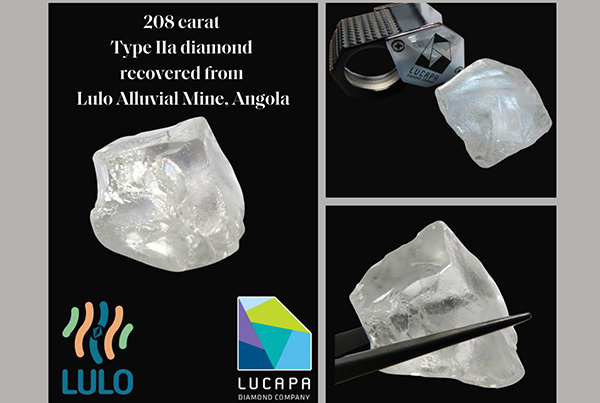

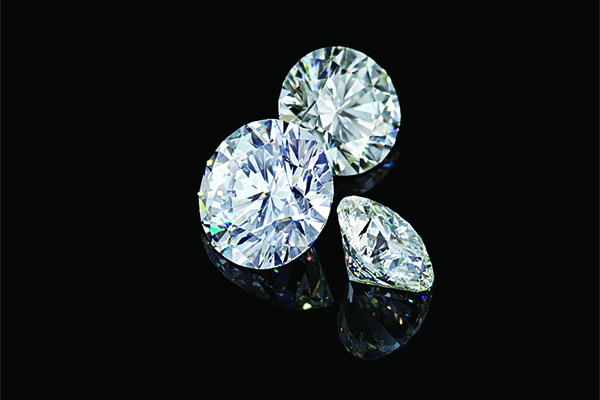

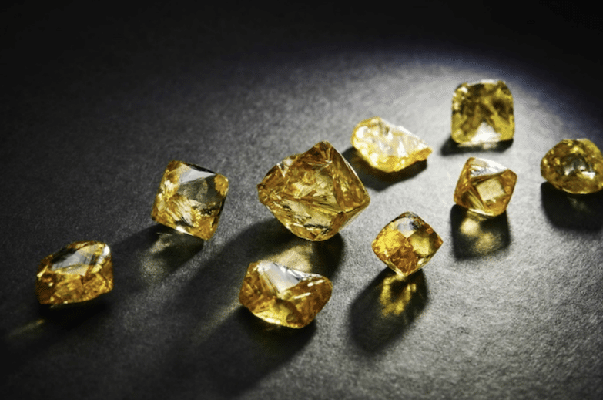

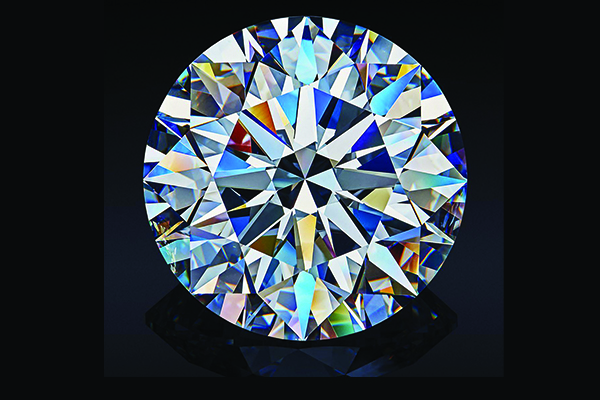

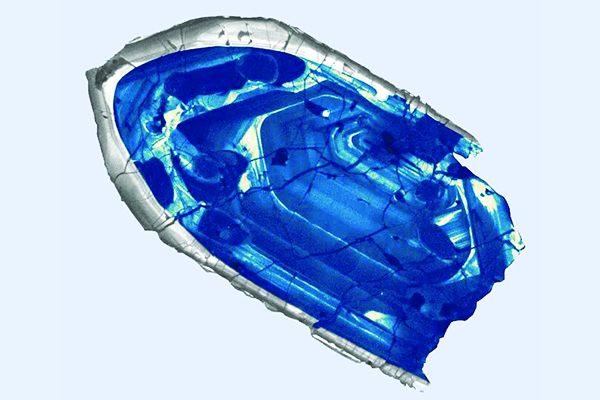

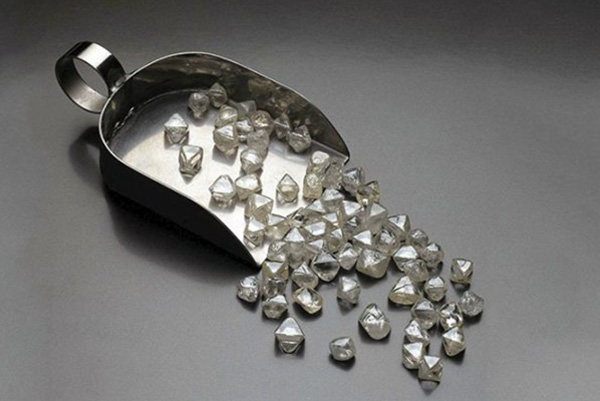

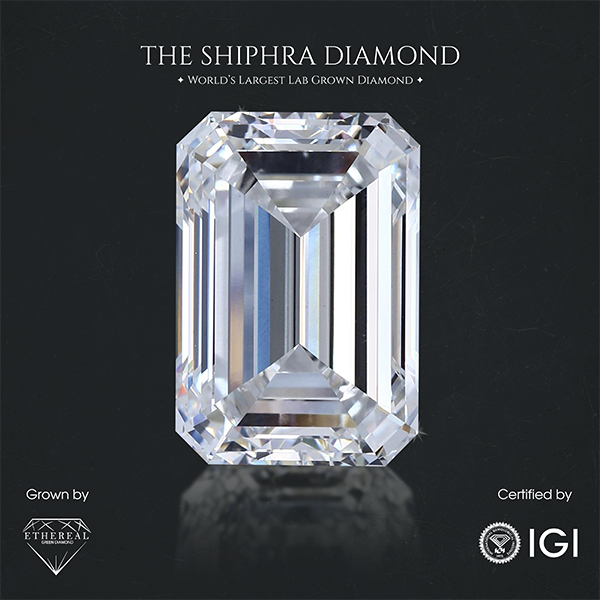

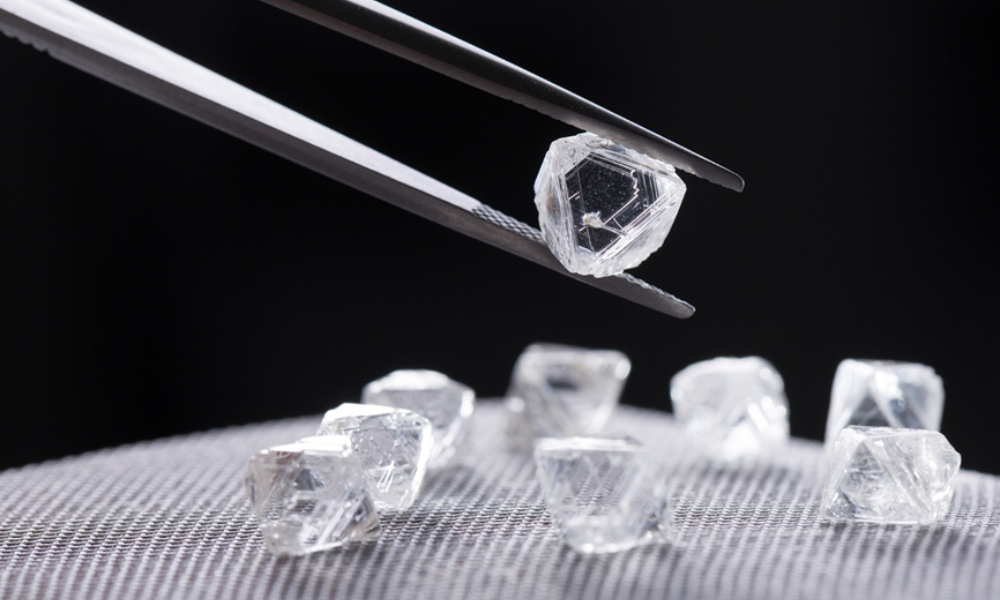

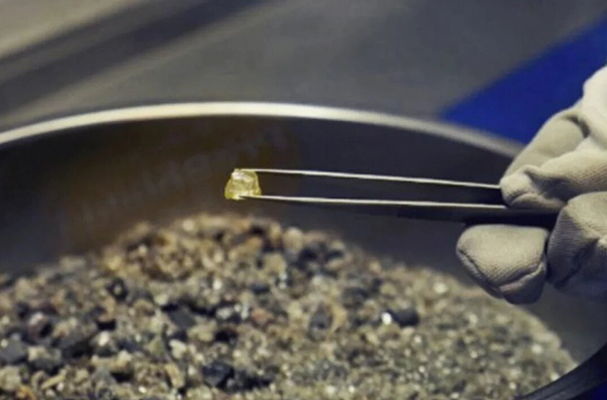

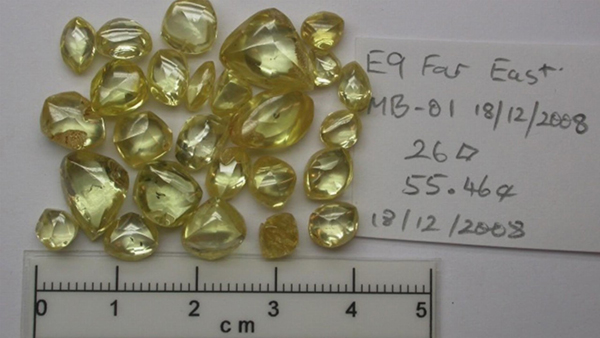

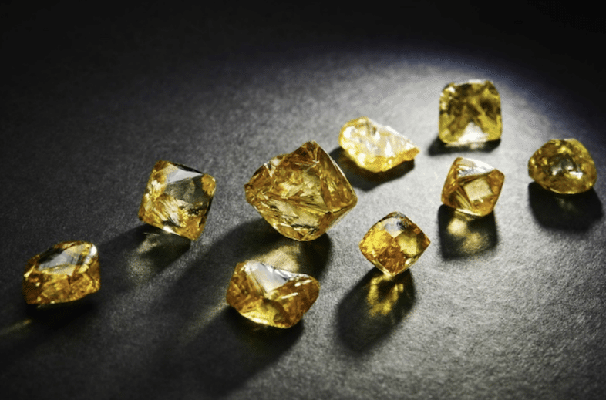

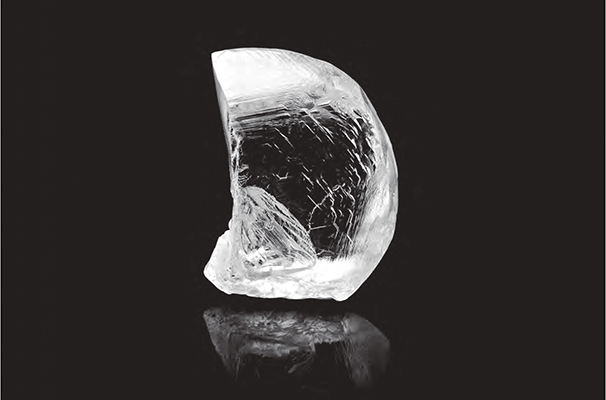

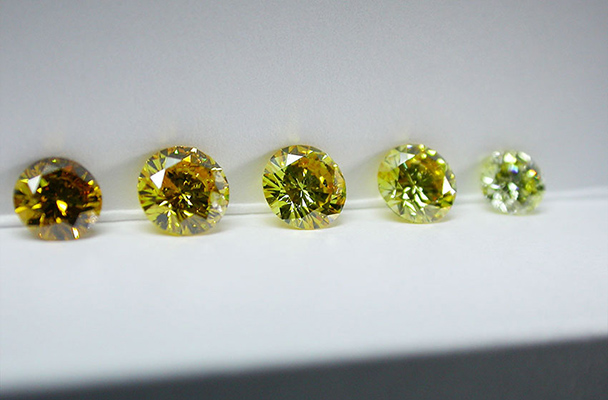

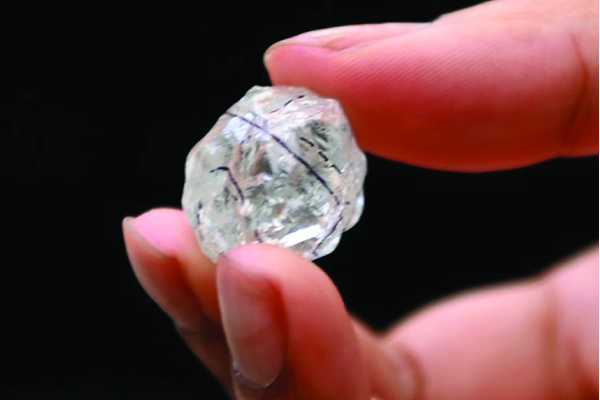

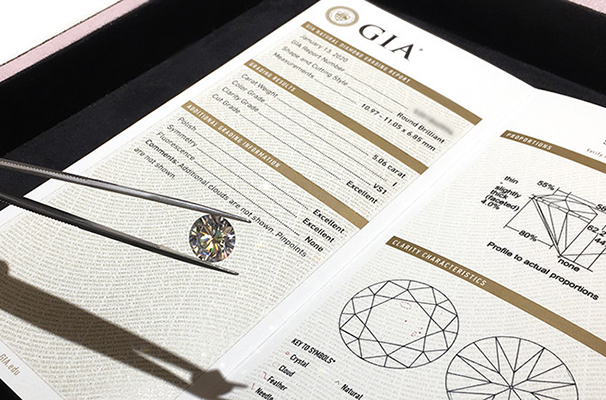

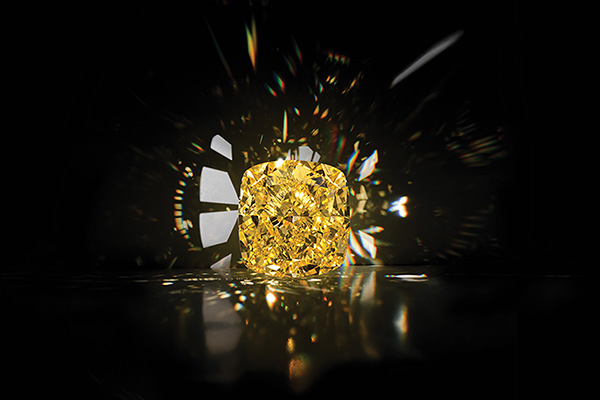

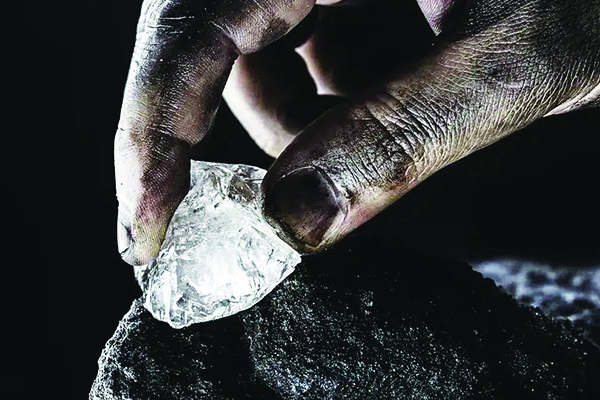

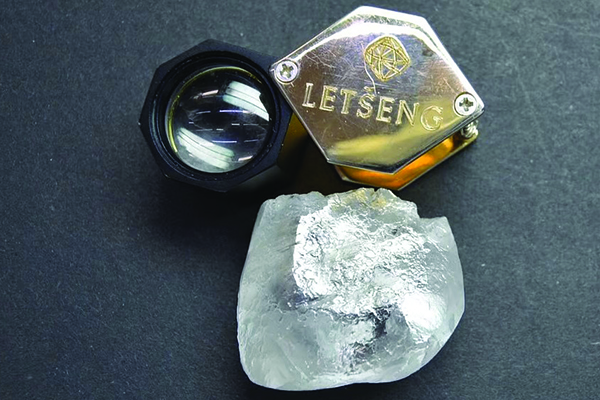

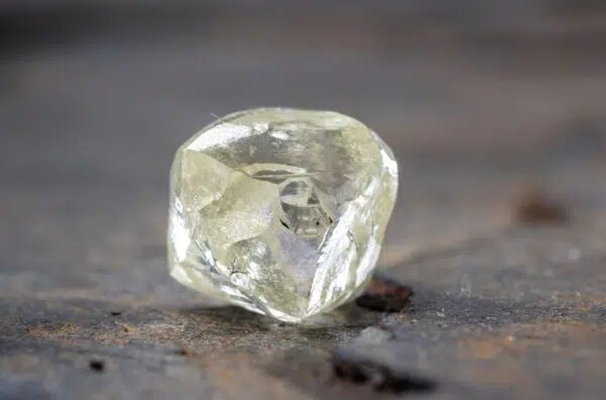

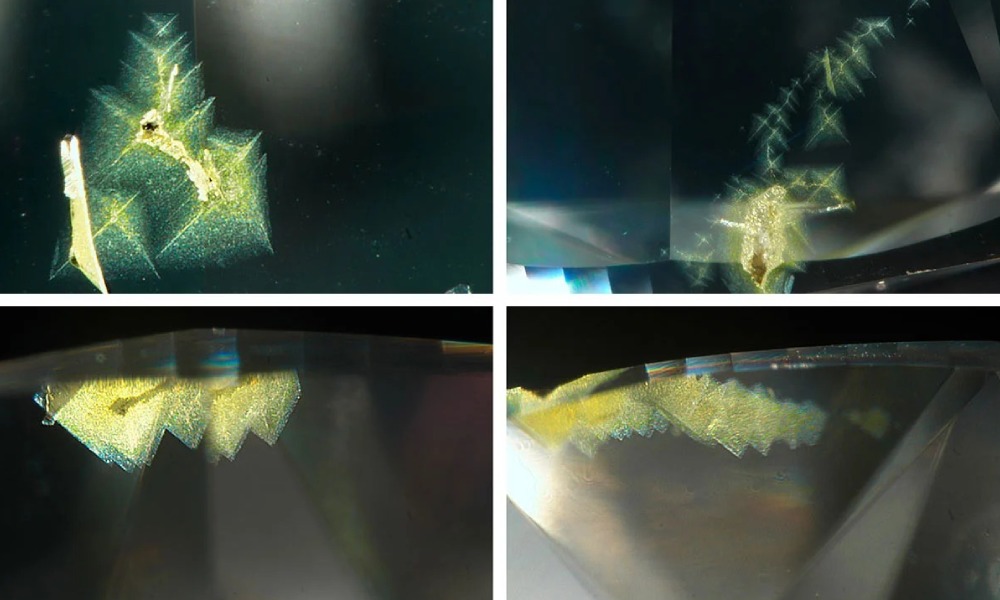

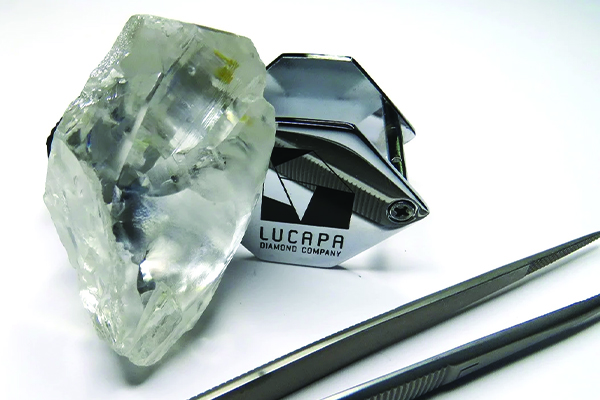

Simply Sawn diamonds and Seeds for use in manufacturing of rough labgrown diamonds: the concessional Basic Customs Duty (BCD) entry in Notif. 45/2025‑Customs (Sl. No. 192) is being extended up to 31‑03‑2028; only a sunset date is now prescribed, the concessional rate of 0% remains unchanged

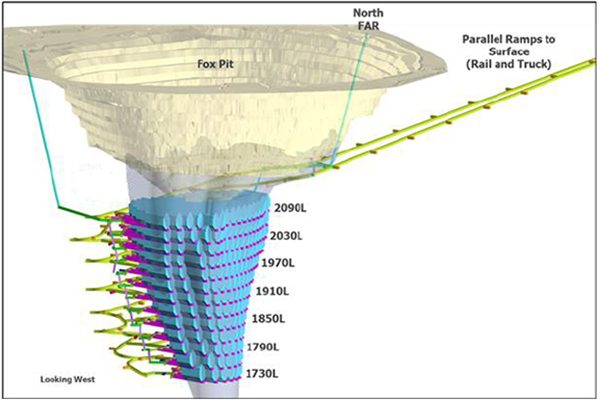

5) One-Time Support for SEZ Manufacturing Units Selling into Domestic Market

To address concerns relating to under-utilisation of capacity in Special Economic Zones due to global trade disruptions, the Government has proposed a special facilitative measure to enable eligible SEZ manufacturing units to undertake limited sales into the Domestic Tariff Area (DTA) at concessional duty rates, subject to a prescribed proportion linked to their export performance. GJEPC notes that the detailed regulatory framework and operational guidelines for implementation are yet to be notified, and the Council will engage with the Government to ensure that the gems and jewellery sector, including SEZ-based manufacturing units, is appropriately covered within the scope of this measure.

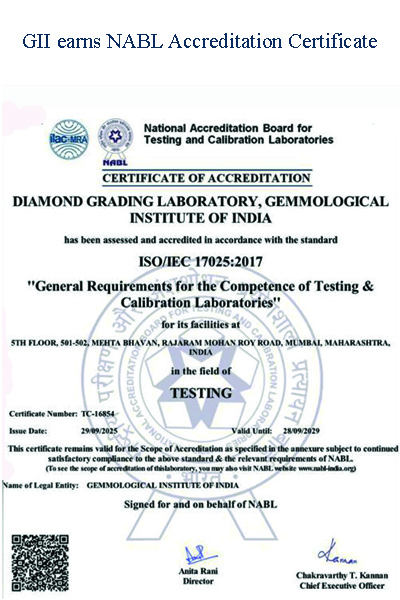

6) Continued Policy Support for Diamonds and Lab-Grown Diamond Ecosystem

The Government has also extended the validity of key Customs notifications till 31 March 2028, including entries relevant to the gem and jewellery sector such as simply sawn diamonds and seeds used in manufacturing of rough lab-grown diamonds. This provides stability and long-term policy support to India’s diamond and lab-grown diamond industry.

7) Sovereign Gold Bond Scheme under Rationalisation of Capital Gains Tax

The Budget has proposed a rationalisation of the capital gains tax exemption for Sovereign Gold Bonds, providing that such exemption will be available only in cases where the bonds are originally subscribed by individuals at the time of issuance and are held continuously until redemption on maturity. While this ensures uniform treatment across all RBI issuances, the narrower eligibility framework may reduce flexibility and could impact the secondary market attractiveness of Sovereign Gold Bonds as a gold investment avenue.

8) Banking Reforms introduced

Setting up a “High Level Committee on Banking for Viksit Bharat”, to comprehensively review the sector and align it with India’s next phase of growth, while safeguarding financial stability, inclusion and consumer protection.

9) Industrial Clusters:

Introduction of a scheme to revive 200 legacy industrial clusters to improve their cost competitiveness and efficiency through infrastructure and technology upgradation.

10) MSME Segment:

Equity Support:

Introduction of a dedicated ₹10,000 crore SME Growth Fund, to create future Champions, incentivizing enterprises based on select criteria.

Top up the Self-Reliant India Fund set up in 2021, with ₹2,000 crore to continue support to micro enterprises and maintain their access to risk capital.

Liquidity Support

With TReDS, more than ₹7 lakh crore has been made available to MSMEs. To leverage its full potential:, following has been announced:

(i) mandate TReDS as the transaction settlement platform for all purchases from MSMEs by CPSEs, serving as a benchmark for other corporates;

(ii) introduce a credit guarantee support mechanism through CGTMSE for invoice discounting on TReDS platform;

(iii) link GeM with TReDS for sharing information with financiers about government purchases from MSMEs, encouraging cheaper and quicker financing;

(iv) introduce TReDS receivables as asset-backed securities, helping develop a secondary market, enhancing liquidity and settlement of transactions.

Professional Support:

Facilitation of Professional Institutions such as ICAI, ICSI, ICMAI to design short-term, modular courses and practical tools to develop a cadre of ‘Corporate Mitras’, especially in Tier-II and Tier-III towns. These accredited para-professionals will help MSMEs meet compliance requirements at affordable costs.

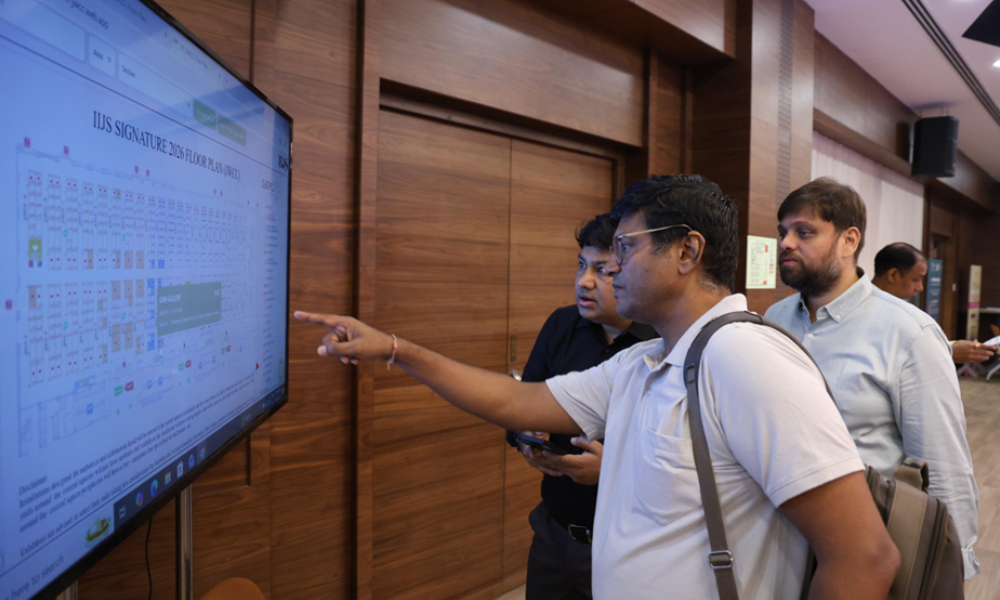

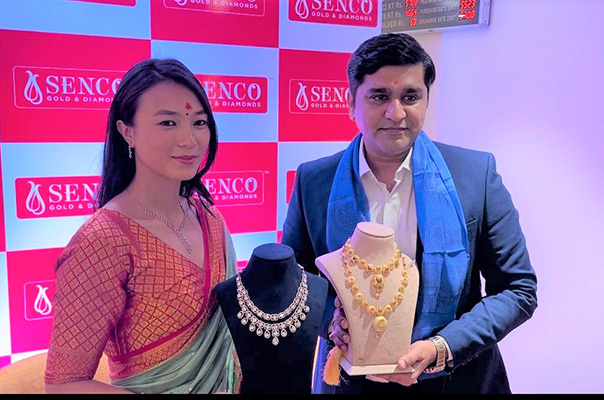

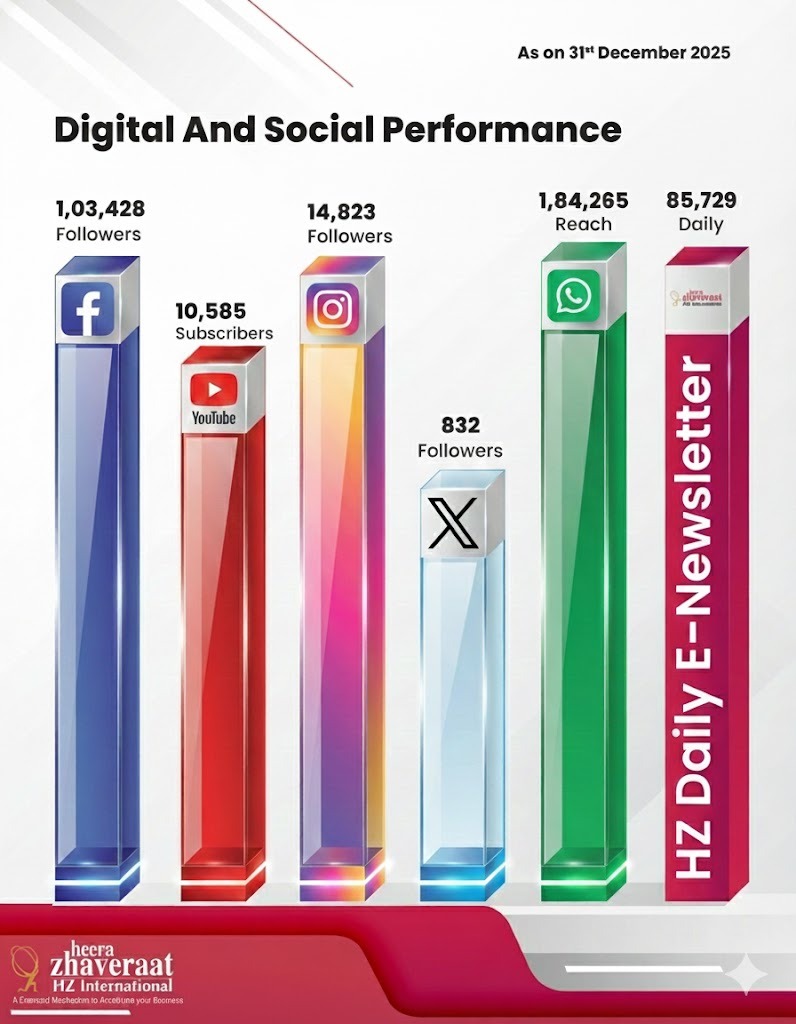

Offical Facebook account of heerazhaveraat.com, homepage for Trade News, Articles and Promotion of D

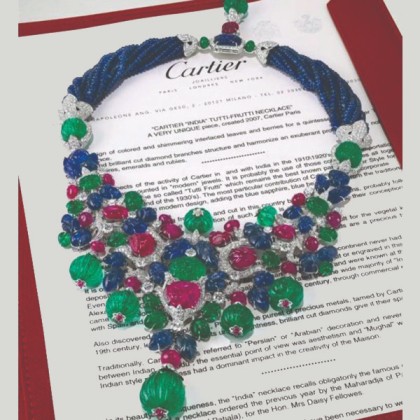

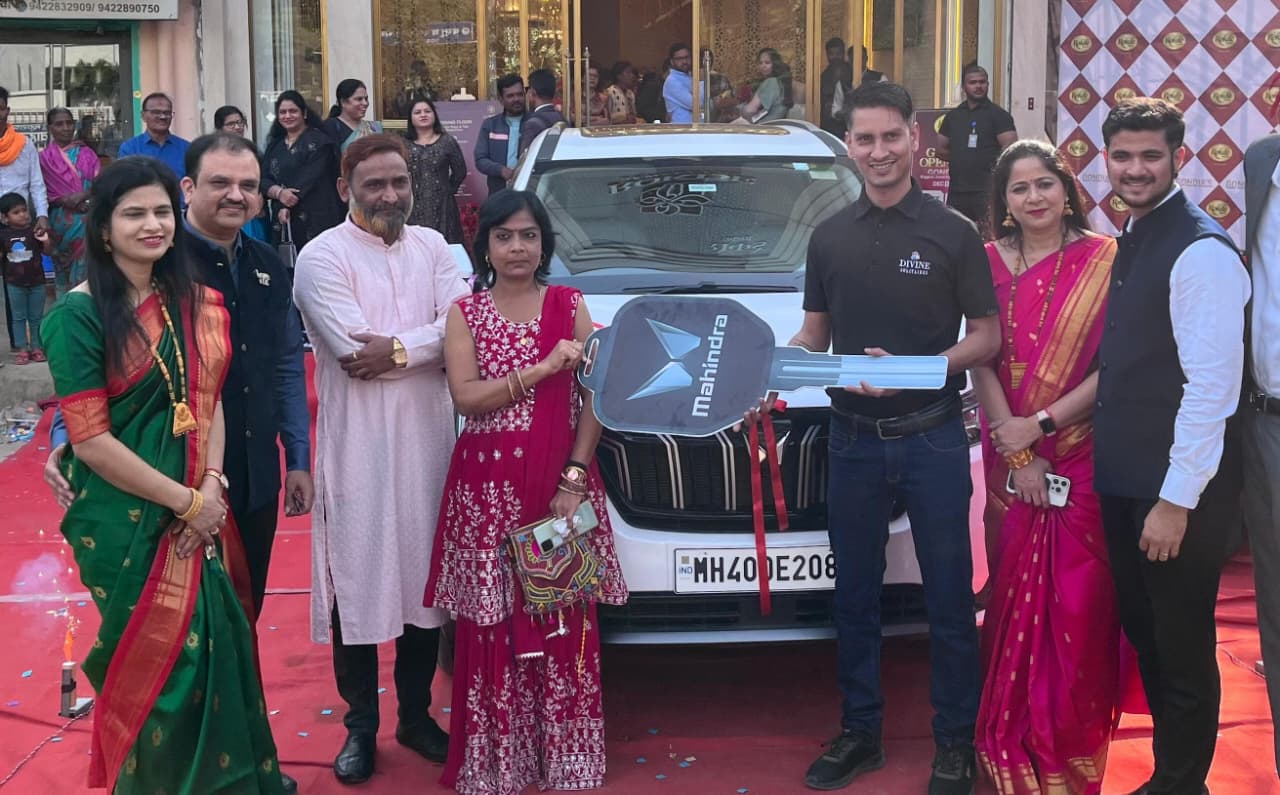

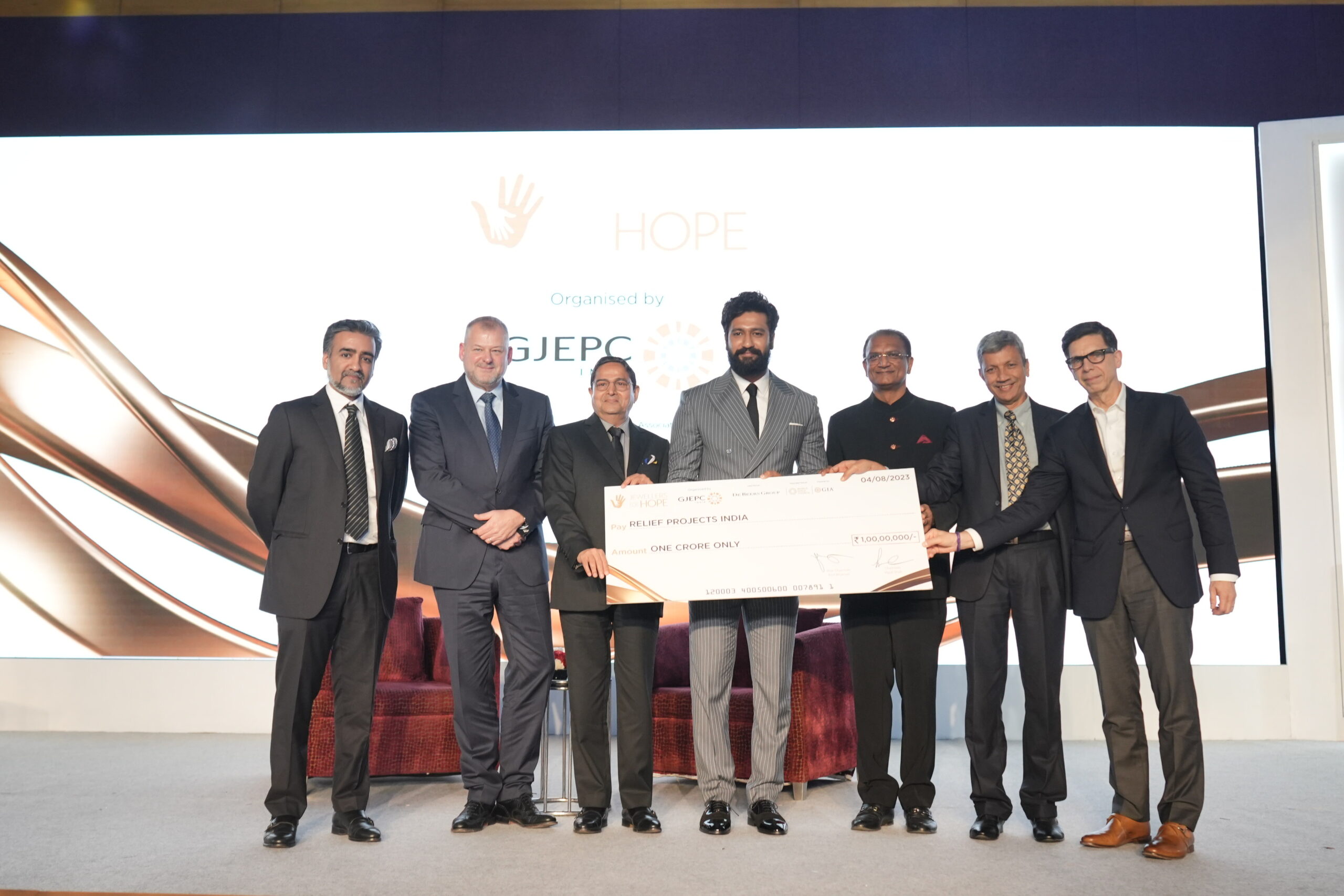

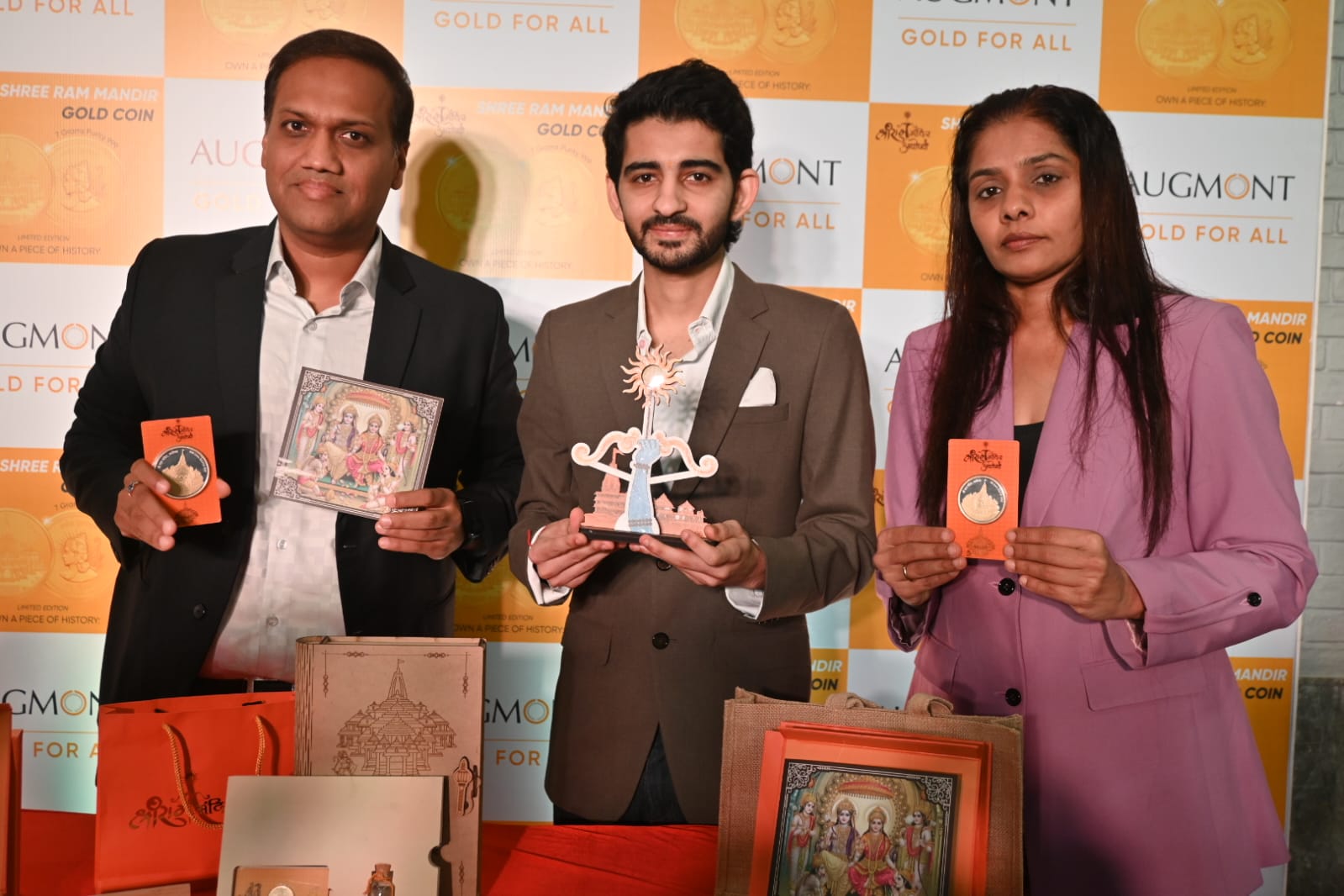

Flashback ✨

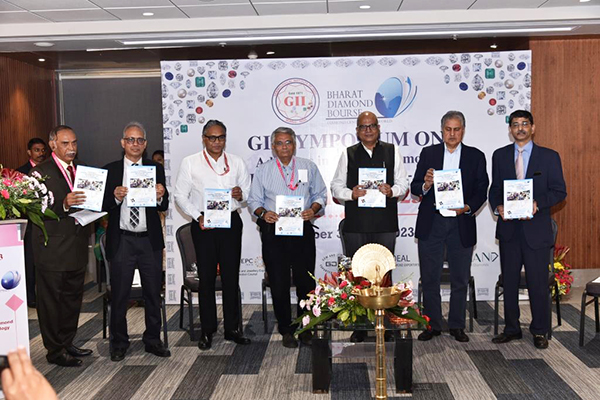

At Golden Girls Awards 2025, Bengaluru, Ms. Reena Shukla (Director – Bajaj Overseas Ltd, Heera Zhaveraat) was honoured by The Jewellers’ Association, Bengaluru (JAB) for 20+ years of contribution to the Gem & Jewellery industry.

Grateful to JAB for the recognition 🙏

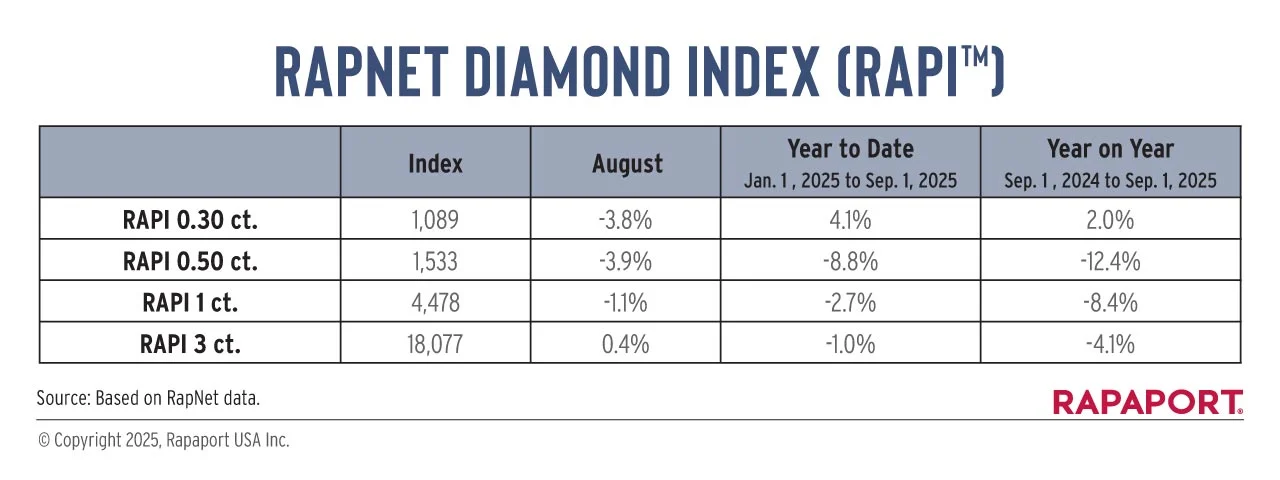

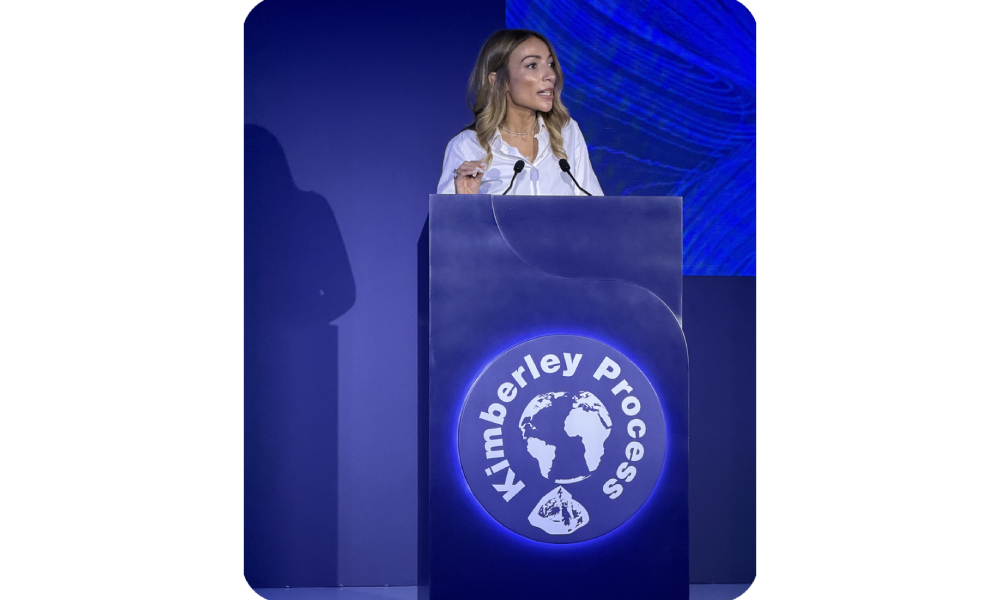

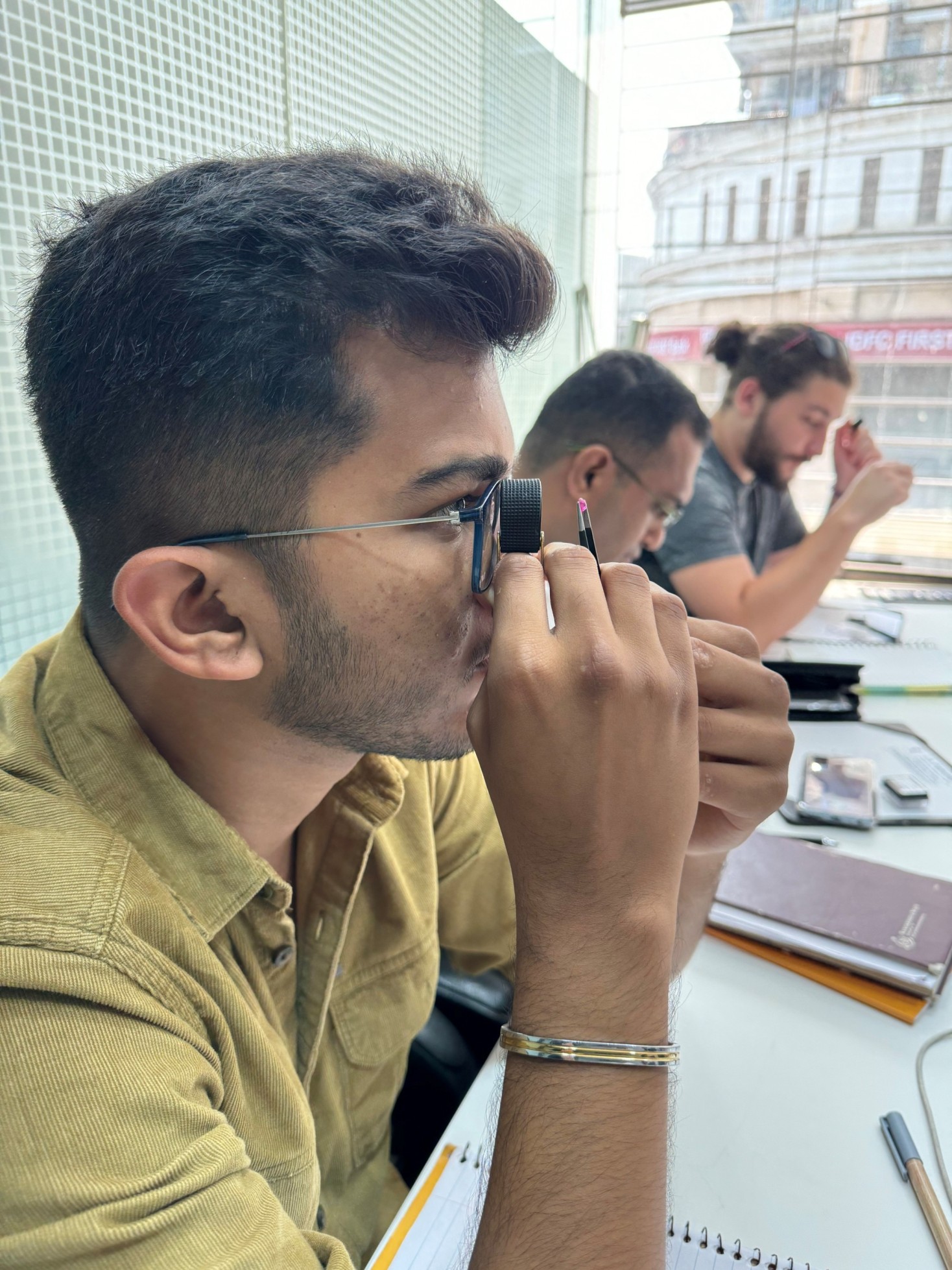

Heera Zhaveraat (HZ International) A Diamond, Watch and Jewellery Trade Promotion Magazine provide dealers and manufactures with the key analytical information they need to succeed in the luxury industry. Pricing, availability and market information in the Magazine provides a critical edge.

All right reserved @HeeraZhaveraat.com

Design and developed by 24x7online.in